III.1. Ecopetrol advances in its 2040 Strategy:

Energy that Transforms

Since the publication of the 2040 Strategy “Energy that Transforms”, the Ecopetrol Group has been advancing steadily in its implementation and has consequently positioned itself as an energy group that transitions towards new forms of energy, without neglecting its competitiveness in the hydrocarbon business, increasingly decarbonizing its operations, and strengthening the TESG pathway.

The following aspects stand out from the three (3) business lines of the Ecopetrol Group:

- i) Hydrocarbons currently accounting for roughly 88% of the Group’s EBITDA.

- ii) Low emission solutions, where the challenge is for it to represent at least 14% of EBITDA by 2040.

- iii) Transmission and toll roads contributing approximately 12% of the Group’s EBITDA (2022) but with the aspiration that it generates close to 26% of EBITDA by 2040.

By 2040, the low emissions and transmission and toll roads businesses are expected to jointly contribute between 30% and 50% of EBITDA.

Growing with the energy transition

The hydrocarbon business is vital for the growth of the Group and, in this sense, the commitment to sustain a production of 800 to 850 KBPED in 2030 remains, focusing on the proper management of basic production, consolidation of the enhanced recovery program, profitable production in the Permian in the United States, offshore exploration in the Colombian Caribe region, as well as the fields in the Piedemonte and the Eastern Plains. Ecopetrol has set out to diversify the production of hydrocarbons until reaching a sustained 30% market share in the gas sector by 2040.

The long-term aspiration in the midstream segment is to increase resilience to maintain the value at around 2.2 TRILLION USD in EBITDA for this segment. Along this path, the strategic lines to secure the business are as follows: maintain the competitiveness of the oil pipelines, grow in multiple pipelines, port optimization, diversification towards gas infrastructure, and internationalization.

In order to ensure cleaner and more profitable fuels, as well as protect the country’s energy sovereignty, Ecopetrol continues on the path towards maximizing the margin of its refineries, as well as enhancing the value of virgin naphtha in Cartagena and continue reducing the sulfur content in the fuels produced (less than 10 ppm sulfur in diesel by 2025 and less than 10 ppm sulfur in gasoline by 2030).

With regard to the commercial segment of the hydrocarbon line, we inaugurated our trading subsidiary in Singapore (Ecopetrol Trading Asia) in September 2022, which will help us increase the commercial value of our products and strengthen geographical position worldwide.

From the diversification perspective, ISA, an Ecopetrol Group subsidiary, was integrated successfully. For the reported period, the company represented 12% of the Group’s EBITDA, thus consolidating its entry into the electric chain transmission segment. The long-term objective is to continue growing organically and inorganically in the transmission business and venture into large-scale energy storage projects. For this strategy, the purpose is to invest roughly 36 TRILLION USD by 2030.

On the other hand, we launched the roadmap for the production of at least 1 million tons of low-carbon hydrogen (H2) by 2040, which implies an investment of 2.5 TRILLION USD and an expected long-term return of +400 MUSD in EBITDA. The first goal for 2030 is to produce 47 thousand tons of H2 for our own consumption and for export. Similarly, Ecopetrol is structuring the roadmap towards the capture, use, and storage of carbon dioxide CO2 (CCUS).

In terms of self-generation of non-conventional renewable energy, the aspiration by 2030, is that at least 30% – 40% of our own energy consumption comes from green sources. In 2022, Ecopetrol produced 208 MW from solar energy, among other sources, which paves the way for the goal of 900 MW by 2025 (solar, wind, biomass, and geothermal).

Generating value with TESG

TESG at Ecopetrol refers to performing responsible, safe, and efficient operations, in a harmonious relationship between the Stakeholders Groups and the environment; under a transparent and ethical governance framework, and making use of technology to develop innovative solutions to address current and future challenges.

In this sense, the Ecopetrol Group is committed to the goal of net zero emissions by 2050 in Scopes 1 and 2 (own operations and those related to the operation). To this end, the Group has focused on the reduction of fugitive emissions, an energy efficiency of up to 10%, and the incursion into natural climate solutions in the short and medium term, as well as H2, CCUS, and energy storage in the long term.

Moreover, Ecopetrol is geared towards integrated water management to minimize water catchment, thus avoiding dumping into bodies of fresh water and compensating until reaching an adequate balance. Ecopetrol currently reuses 77.5% of the water produced by its operations, and it aspires to raise this number to 90%, which will ensure the use of neutral water by 2045.

Finally, the 2040 Strategy accounts for the sustainable development of the territories through social investment; for which we expect to invest some 472 billion COP in 2023, benefiting communities with education, roads, and access to public services. In terms of social gas, Ecopetrol was able to connect 7,683 new users in 2022, with the goal of servicing 75,000 by 2030. And on the matter of labor force, the Ecopetrol Group generated close to 73,000 unskilled labor jobs hired locally through contractors, with a 28% increase in the employment of people facing difficult labor placement.

Cutting-edge knowledge

The science, technology, and innovation (CT+i) strategy is at the heart of TESG and will enable between 20 and 30 TRILLION USD of accumulated EBITDA by 2040. To take on this challenge, Ecopetrol has set itself out be an orchestrator of ecosystems focused on technology clusters to solve the challenges posed by the 2040 Strategy:

Decarbonization

Energy transition

TESG

Resilient assets

Circular economy

The 5.0 industrial revolution

With this strategy, Ecopetrol expects to execute roughly

400 MUSD

per year in CT+i investments.

Furthermore, Ecopetrol is committed to equipping its human talent with the necessary skills to face the challenges of growing with the energy transition. To this end, it hopes to instill 70% of the required cutting-edge skills in its employees to strengthen the 2040 Strategy, with levers such as training programs, the appropriation of culture, emotional connections with people, and talent and leadership redevelopment.

Competitive Returns

The Ecopetrol Group’s 2040 vision seeks to generate competitive and sustainable financial returns for shareholders and investors, by strengthening EBITDA through 30% – 50% gradual diversification from low emission businesses by 2040, maintaining a ROACE between 8% and 10%, maintaining the capital structure at a gross debt/EBITDA ratio consistent with investment grade (<2.5x), and ensuring contributions to the Nation in the range of 13 TRILLION COP to 20 TRILLION COP (royalties, taxes, and dividends).

The Company has strengthened the efficiencies program as a strategic line to ensure cost optimization in a structural way, thus mitigating the inflationary effects on OPEX and amassing 20 TRILLION COP since 2015.

It has similarly been increasing the level of investments, maintaining capital discipline with a ROACE greater than 13% in the last two (2) years and an investment record close to 5.4 TRILLION USD in 2022.

III.2. Business Plan

In 2022, the Company presented its long-term vision to the market, incorporating the contribution of each of the business lines to the financial results, as well as their growth and return expectations for related parties. One of the most relevant achievements of the business plan is Ecopetrol’s unified vision as an energy group that undertakes its operations in a profitable manner and in alignment with its decarbonization objectives. In the same way, the business plan shows the gradual adoption of low-emission businesses within the Company’s portfolio and includes the roadmap for these alternatives to be part of the incubation and become EBITDA generators for the Group in the medium and long term.

However, the roadmap proposed through the business plan poses challenges for Ecopetrol, since it implies guaranteed monitoring of the gradual fulfillment of the objectives associated with the competitiveness and sustainability of the hydrocarbon business line, while incorporating businesses associated with the reduction of greenhouse gas (GHG) emissions. Similarly, one of the challenges of the 2040 Strategy, which is directly highlighted in the business plan, is to ensure the Group’s growth and value generation for its three (3) business lines. Ecopetrol, as an energy group, seeks long-term EBITDA growth, a ROACE above the cost of capital, a payout to its shareholders between 40% and 60%, and leverage indicators in line with investment grade expectations. The achievement of these objectives goes hand in hand with constant monitoring based on the business plan to detect early warnings for the fulfillment of the strategy.

Expansion into the Permian (Delaware sub-basin)

In June 2022, Ecopetrol Permian LLC (an Ecopetrol subsidiary) and several OXY subsidiaries entered into a Joint Development Agreement (JDA) to develop drilling and production programs in the Delaware sub-basin in the Permian basin, within an approximate area of 21,000 acres over the period of 2022 – 2027. Said agreement allows Ecopetrol to expand its presence in the Permian, representing 49% of the rights in the drilling and production programs in the area.

Ecopetrol did not make any initial payment to enter the area. It will cover a percentage of OXY’s development investment (up to 75%) as the carry advances. The carry percentage to be covered by Ecopetrol will be linked to the price of one barrel of oil (WTI), which will be set during the course of the drilling activity. The activity in Delaware initiated in the fourth quarter of 2022 and production will increase starting the first quarter of 2023.

Moreover, an amendment was executed to the JV in Rodeo, granting Ecopetrol a greater stake in production (75%) as well as a deferral of its current obligations under carry until 2025. The effective date of this modification was January 1st, 2022, and it had a favorable impact on production by year end, with a 95% increase compared to 2021.

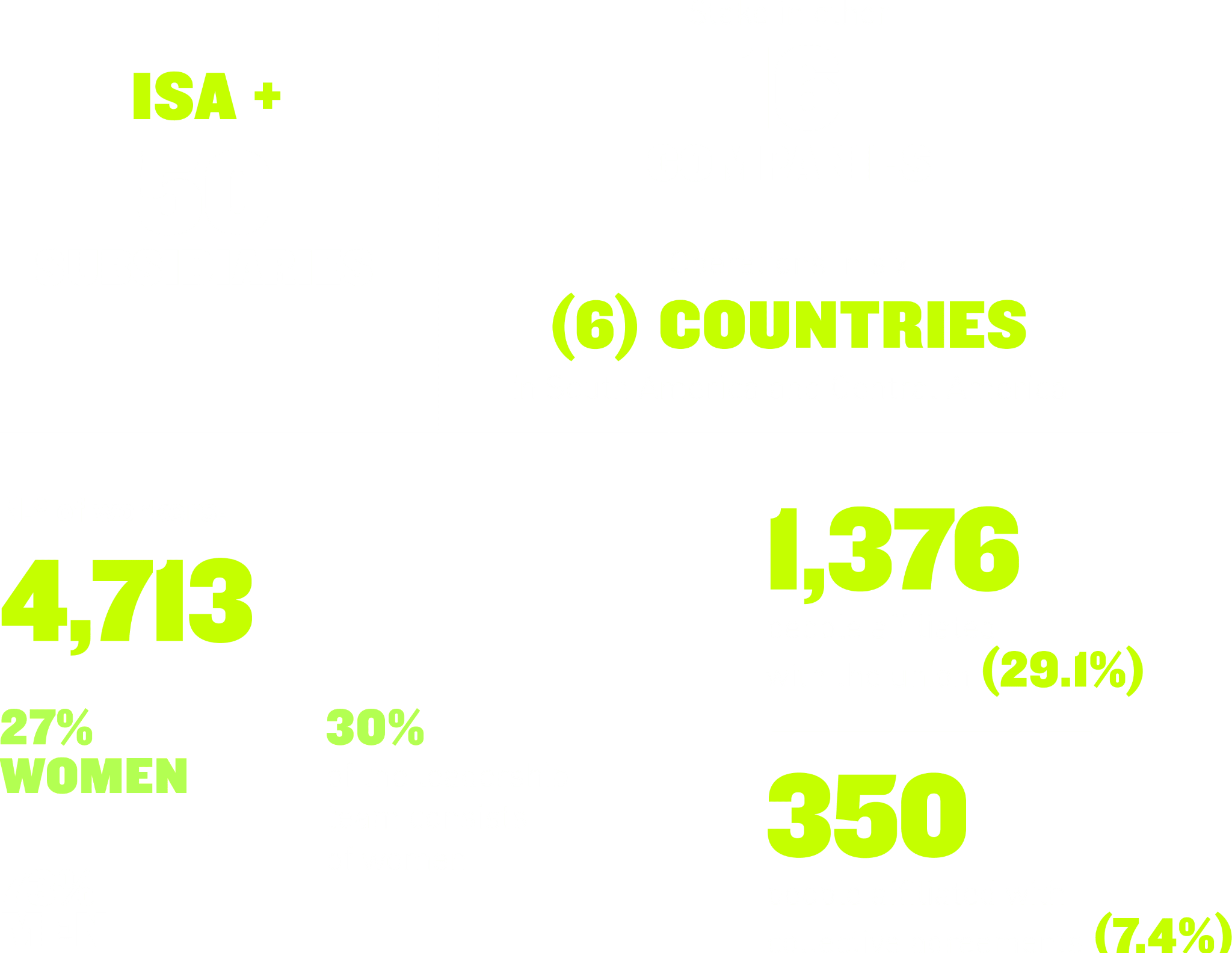

ISA’s Transition

With the acquisition of 51.4% of ISA and its companies, the transition process to the Ecopetrol Group’s control and reporting scheme ended in 2022, as well as the exploration and materialization of the first wave of synergies. Compliance with the legal and financial requirements associated mainly with the approval of the 2021 consolidated financial statements, the implementation of SOX controls in ISA, and the definition of the governance and interaction model were also achieved successfully. With regard to value generation, synergies were materialized in eight (8) thematic areas, including higher reliability of Ecopetrol’s electrical infrastructure by applying ISA’s cutting-edge expertise, the definition of the Conexión Jaguar program’s scaling strategy as a contribution to the carbon credit offer for the Ecopetrol Group, savings in the supply of common expense categories, and increased resilience in the supply chain. We will continue strengthening synergies and capturing value for the Group.

2022 Brazil Round

Ecopetrol Brasil participated in ANP’s Third Cycle of Permanent Offer held on April 13, and was awarded six (6) offshore blocks in the southern region of the prolific Santos basin, with a 30% stake, and Shell with a 70% stake as operator. The blocks that Ecopetrol is entering are the following: S-M-1599, S-M-1601, S-M-1713, SM-1817, S-M-1908, and S-M-1910. These concession contracts were signed on November 7 and 8. This new acquisition completes a total of 12 blocks in Brazil, of which 10 are exploratory and two (2) additional ones are in the development phase.

Exploration Agreement

with Anadarko (Oxy)

In the month of May, Ecopetrol and Anadarko Colombia Company, an OXY subsidiary, entered into a joint exploration agreement in the COL 1, COL 2, COL 6, and COL 7 blocks, located in deep waters to the northeast of the Colombian Caribe region, with the purpose of embarking on the search for hydrocarbons in an area with attractive potential. Ecopetrol will have a 40% stake in exploration and production rights, and Anadarko the remaining 60% as operator of the blocks. The agreement has already been formalized at the National Hydrocarbons Agency (ANH). The blocks are located off the coast, at an average distance of more than 150 km from the coastline.

III.3. 2022 Results for the Year

International market environment

for crude oil and related products in 2022

In the first half of 2022, Brent Crude maintained an upward trend, driven by favorable demand growth (the global economy continued to expand at a good pace and mobility continued to recover rapidly). The offer also contributed to the rise in the Brent price, with a slow growth in supply due to a very cohesive OPEC (the group’s production was below the agreed quotas all year), a Non-OPEC production that grew very slowly given the strict capital discipline of the industry in recent years, and the prospects of lower supply of Russian crude following the sanctions imposed on this country after the invasion of Ukraine at the end of February. In this context, the Brent price rose from 86 USD/bl in January 2022 to 118 USD/bl in June that year.

This upward trend was interrupted in the second semester. On the one hand, global inflationary pressures and the high price of fuels discouraged consumption in the economies. In line with the above, the central banks, pressured by inflation, embarked on an upward cycle of interest rates that deteriorated the economic outlook by the end of 2022 and the beginning of 2023. On the other hand, high gas prices, especially in Europe, due to the lower Russian supply, degraded the confidence levels and the economic activity of this continent. Finally, China’s “zero-Covid” policy strongly impacted the demand of that country, accounting for a negative growth in its consumption of 400 kbd of oil for all of 2022, a situation unseen in many years. This deterioration in demand led OPEC+ to announce a 2 mmbd production cut in October, which prevented a further decline in the Brent. Given this situation, the Brent price fell throughout the second semester to a minimum of 81 USD/bl in December 2022.

In total, the average Brent stood at 99 USD/bl in 2022, far exceeding the value of 71 USD/bl in 2021. Geopolitical factors played a crucial function in determining the price in 2022, since the market balance showed a slight accumulation of inventories globally: according to Platts, average supply in 2022 was at 101.2 mmbd, 740 kbd above demand (in OECD countries, however, there was a slight reduction in crude inventories).

Refineries continued on the positive path of 2021 in their 2022 operating margins. Product cracks benefited from the recovery in demand, especially in the first half of the year, which was not accompanied by a rapid recovery in supply, despite the high cracks, given the reduction in global refining capacity, which decreased in net terms by close to 1 mmbd in 2020 and 2021. This dynamic kept global gasoline and especially diesel inventories at low levels for a good part of the year. The Russia-Ukraine conflict also favored product cracks, especially diesel: the reduction in the supply of Russian gas to Europe in 2022 raised gas prices in this continent (practically tripled between 2021 and 2022), thus raising the cost of processing for refineries, which should have experienced higher income (via diesel crack, their main refining product) to guarantee their operation. Finally, refineries also benefited from lower costs in their diet vs. the one in 2021: the diversion of Russian crude to other markets, especially Asia, at high discount rates, deteriorated the spreads of intermediate and heavy crudes. In total, the global refining margin, an average of the margins in the main refining centers, stood at 8.4 USD/bl in 2022, more than doubling the margin of 3.4 USD/bl in 2021.

Moderate optimism is maintained for 2023. Several agencies and multilateral organizations have reduced their growth forecast for 2023, mainly as a consequence of interest rates rising globally. The World Bank, for example, recently adjusted its 2023 growth forecast to 1.7%, from the 3.0% it had expected six (6) months ago. OPEC+ remains cohesive and any strong deterioration in demand would surely be accompanied by a similar adjustment in the group’s production, which seeks to maintain a market balance consistent with a crude oil price of at least 80 USD/bl. Moreover, the abandonment of the “zero-COVID” policy by China at the end of 2022 anticipates a significant consumption recovery in that country that would serve as support for Brent and other commodities and that would counteract the deterioration in demand in other geographies. Refining margins would remain high, in historical terms, although they would see a decline versus the levels of 2022: new refining capacity, coupled with a slowdown in demand, would help diesel and gasoline inventories to rise close to the averages of the last five years.

The international gas and

LNG market environment

The conflict between Russia and Ukraine, in addition to the maintenance works and sabotages of the Nordstream gas pipeline, which carries gas from Russia to Germany, has resulted in a significant TTF benchmark price increase in continental Europe. The indicator experiences a shift greater than 98%4, reaching a record high of 106 USD/Mbtu.

Alerts on a shortage of natural gas during wintertime in Europe led several countries like Germany to reconsider electricity generation based on fuels such as coal to complement generation using natural gas.

LNG imports peaked in August, with most flows destined for Europe to fill storage levels and face increased winter demand. With this and other measures such as promoting savings in consumption, Europe managed to fill 83% of its storage capacity at the end of December, to a level that is expected to cover its energy requirements during the winter.

Limited regasification infrastructure in Europe led to delayed vessel unloading and increased floating LNG storage to back up unmet demand, driving daily freight rates to as high as $470,000/day in the Atlantic basin, which represents an increase of 365% compared to the average rate of 2021.

Concerns about dependence on Russia’s natural gas have increased the number of floating storage regasification unit (FSRUs) construction projects, mainly in Europe. 23 regasification units are expected to come into operation by 2023, especially the entry of two (2) units in Germany with a capacity of 6.1 Mtpa.

The above measures are expected to guarantee Europe’s energy security to face a 2023, in which, most likely, no natural gas flows will be received from Russian.

The lack of reliability in the natural gas supply due to the aforementioned situation led to the replacement of natural gas with alternative sources such as coal or liquids for generation, in addition to lower household consumption in response to the high gas rates, mainly in Europe. The accumulated global demand deterioration is expected to reach 55Mm3 by November, with 90% corresponding to demand from the European market.

Entorno economía colombiana 2022

The Colombian economy grew at a rate of 7.5% in 2022, one of the highest in the region, thereby consolidating the country as one of the economies with the strongest recoveries in the world, growing 11.0% in 2021 after the recession caused by the pandemic in 2020.

The expansion of the economy was leveraged by a growth in consumption. Household spending grew at an average annual rate of 9.5%, driven by the recovery of employment (more than 1.6 million jobs were created in 2022 vs. the same period in 2021) and the growth of consumer credit, which was growing at a rate of more than 20% per year by the end of 2022. Investments also recorded positive growth, averaging 11.8%, throughout the year. From the external perspective, imports, driven by the boom in domestic consumption, grew much faster than exports (24% vs. 15%), subtracting momentum in the growth of the entire economy.

The strong growth in consumption not only affected foreign accounts, increasing the current account deficit to 7.2% of GDP in the third quarter, one of the highest in history, but was also an important factor in raising inflation. 2022 closed with a 13.1% inflation rate, the highest since 1999, where, in addition to demand pressures, price dynamics were also driven by the exchange rate depreciation (14% in annual terms) and by supply chain issues.

This demand, as well as the price dynamics, led Banco de la República to raise its rates throughout 2022 by eight (8) percentage points, up to 12% by year end. This strong rate increase, in addition to the high inflation and the slowdown in foreign demand, will have a negative impact on consumption and investment in 2023. Accordingly, a significant moderation in economic growth is expected, with a GDP growth that could be close to 1.0% in 2023.

Ecopetrol’s growth and

contribution to Colombia’s GDP

Contribution of the oil sector to the Gross Domestic Product (GDP)

In 2022, the behavior of GDP in the mining sector presented a slight increase of 0.6% compared to the previous year, mainly due to:

- i) 2.5% growth in oil and gas extraction activities.

- ii) 3.9% growth in metallic mineral extraction activities, exploitation of other mines and quarries, and support activities for other mines and quarry exploitation activities.

- iii) –5.4% contraction of stone coal and lignite extraction activities.

The growth in the oil and gas extraction indicator was due to the increase in crude oil production, which averaged 754 kbd in 2022 compared to 736 kbd in the previous year.

Ecopetrol’s growth and contribution to the national GDPl

Ecopetrol’s contributed 2.3% to the national GDP in 2022. This lower contribution compared to the previous year is mainly because Ecopetrol’s increase in production in Colombia stood at 2.1% (662 kbd in 2022 vs. 649 kbd in 2021) compared to the country’s increase in production of 2.4%.

Oil Sector Contribution to GDP (billion constant pesos in 2015)

| 2021 | 2022 | |

|---|---|---|

| National GDP | 907,352 | 975,365 |

| Oil extraction GDP | 24,813 | 25,444 |

| Contribution to GDP from the oil sector | 2.7% | 2.6% |

| Contribution to GDP by Ecopetroll | 2.4% | 2.3% |

Financial strategy and resultss

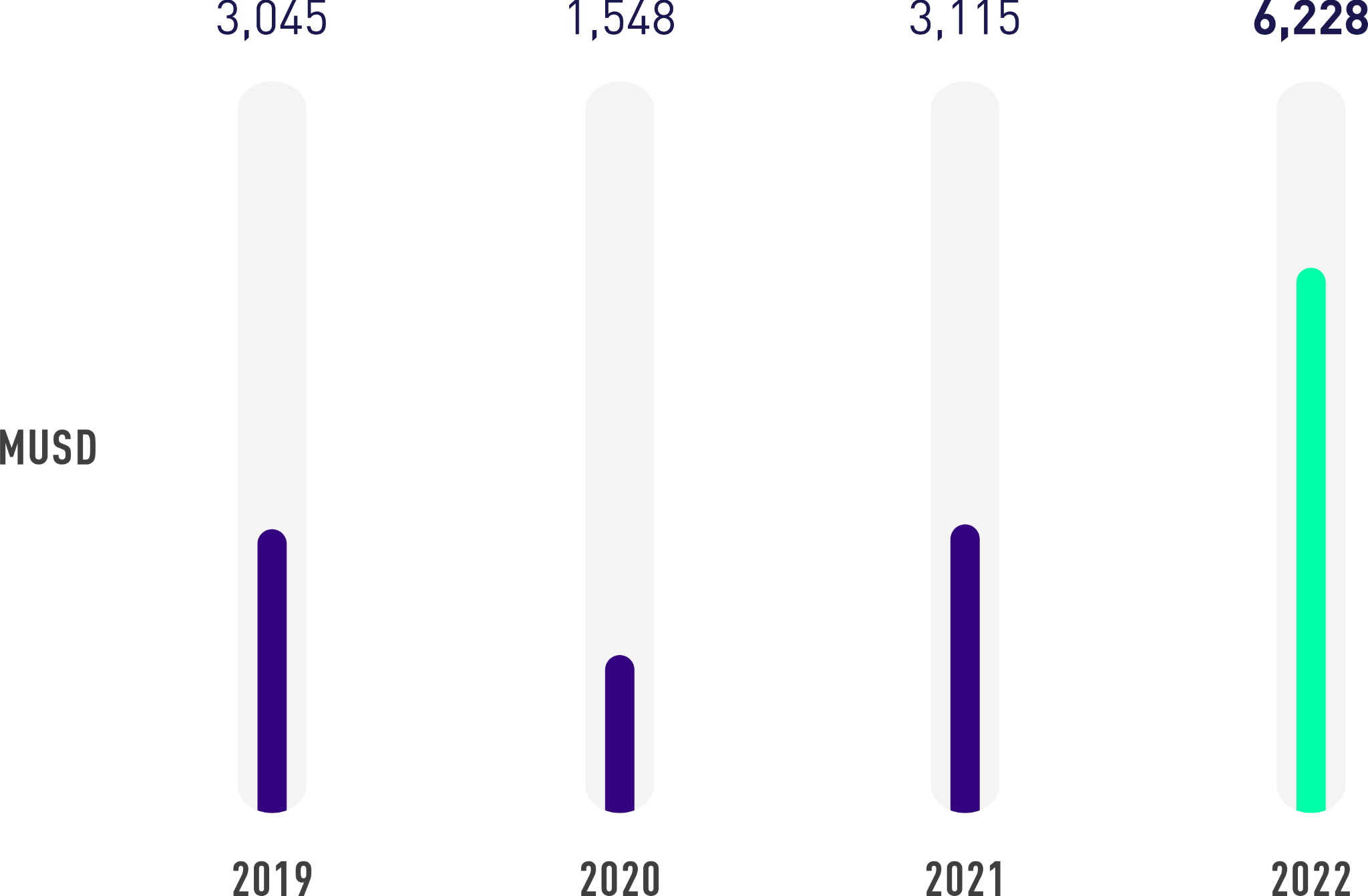

The Ecopetrol Group closed 2022 with the best financial results in its history, with a net profit of COP 33.4 trillion, doubling that of the previous year, and an EBITDA of COP 75.2 trillion with an EBITDA margin of 47%. This solid financial performance was leveraged by:

- i) The favorable pricing environment.

- ii) Higher production contributions from the Permian and Ecopetrol S.A.

- iii) Record results in the refineries.

- iv) Solid results from ISA.

The foregoing allowed the Group to offset:

- i) Inflation and the exchange rate effect on operating costs and expenses.

- ii) Higher debt interest rates.

- iii) Higher level of exploratory expenses.

- iv) The increase in the nominal income tax rate for 2022.

Accumulated revenues at the end of 2022 increased by 73.8% compared to 2021 as a result of:

- i) Higher weighted average sales price of crude oil, gas, and products.

- ii) Higher average TRM.

- iii) Higher sales volume due to increased production from the Permian and Ecopetrol S.A., and the growth of domestic demand for fuel and gas products.

- iv) Greater services throughout 2022, mainly due to the consolidation of ISA’s revenues, compared to only four (4) months in 2021.

The foregoing was partially offset by lower exports of middle distillates, given the major maintenance scheduled at the refineries.

Sales costs, including variable and fixed costs for 2022, experienced a 60.9% increase compared to 2021, as a result of:

- i) Larger crude oil, gas, and product purchases due to greater fuel requirements to meet the economic recovery of the market and major maintenance scheduled during the year at the refineries, as well as increased purchases of crude oil for the start-up of the crude oil plant interconnection project in Cartagena.

- ii) Higher operating activity costs due to increased activity, tariff rise in contracts, the exchange rate, the inflationary effect, larger purchase of energy, as well as fewer Covid-19 restrictions.

- iii) Higher labor costs due to salary increases and greater provision of health services.

- iv) Consolidation of ISA’s results throughout 2022 versus just four months in 2021.

Operating and exploratory expenses also rose at the end of 2022 compared to 2021 due to:

- i) The single recognition in 2021 of an income in Cenit and Oleoducto Bicentenario, as a result of the settlement reached with Frontera.

- ii) The incorporation of ISA’s results throughout 2022 compared to four months in 2021.

- iii) Increased exploration expenses due to the recognition of exploratory activities in unsuccessful wells and greater activity in Ecopetrol Brazil and Hocol.

- iv) The increase in customs operations mainly due to the larger volume of DAP sales.

- v) Greater social investments executed through agreements and community aid, as well as higher taxes and inspection fees, among others.

Financial expenses recorded increases by the end of 2022 compared to 2021 due to:

- i) The incorporation of ISA’s net financial results throughout 2022 compared to just four months in 2021.

- ii) Higher interest rates on the debt acquired in the second half of 2021 to finance the purchase of ISA and the exchange rate effect on debt-related interest in dollars.

- iii) Increased expenses due to exchange rate differences, mainly pertaining to the income associated with the conversion adjustment of the investment in dollars made in Savia, as a result of its sale in 2021, as well as the devaluation of the peso against the dollar given the Ecopetrol Group’s net liability position in dollars in 2022.

The foregoing was partially offset by higher yields and the appreciation of the investment portfolio and bank accounts.

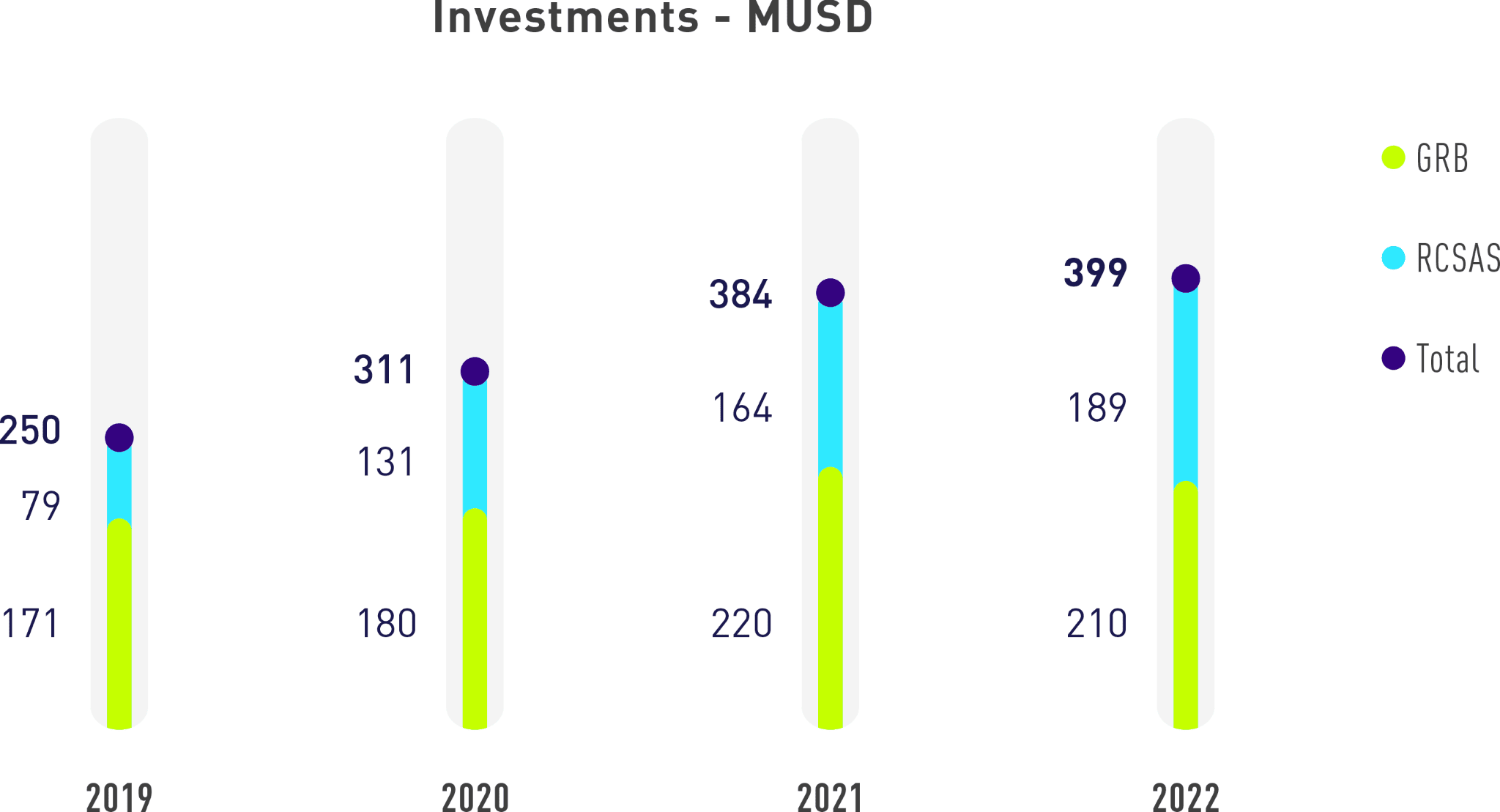

Investment analysis

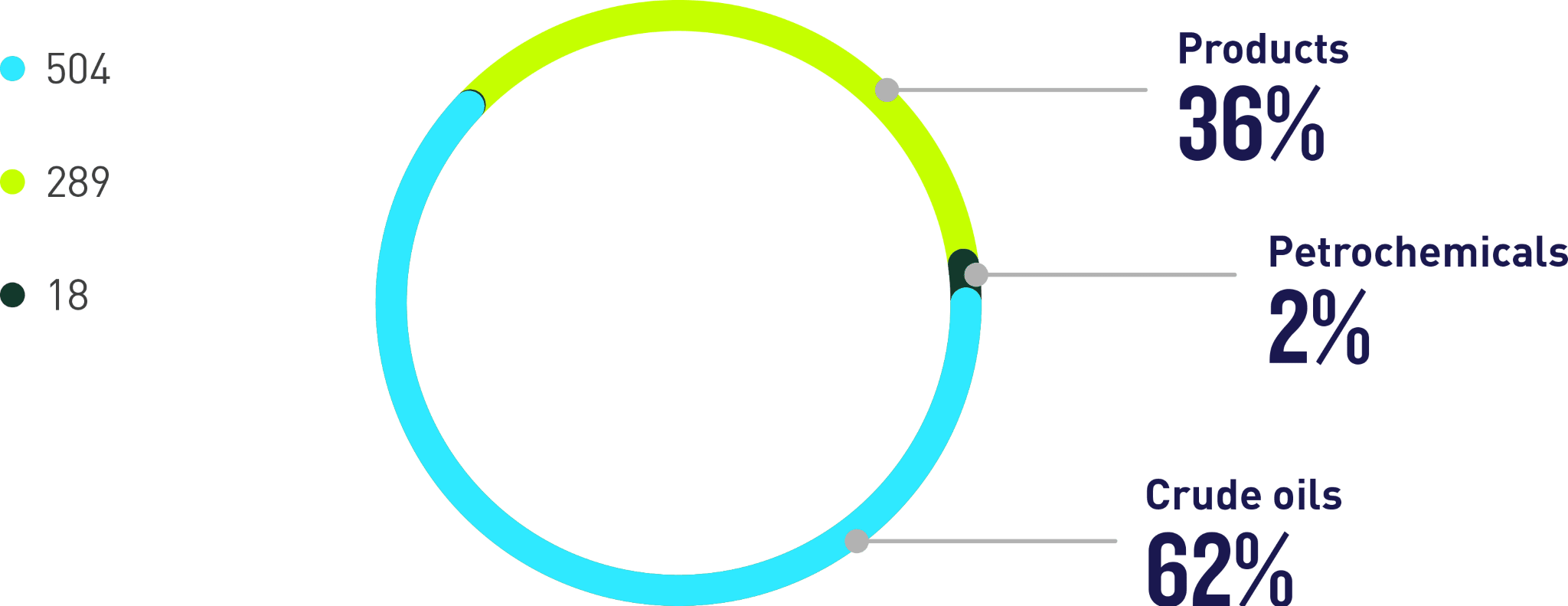

In 2022, the Ecopetrol Group executed organic capital investments in the amount of 5,488 BUSD, reaching the high range of the goal set for 2022 of 4.8 BUSD – 5.8 BUSD. Of all organic investments in the oil and gas business, 79% were made in Colombia, and the remaining 21% in the US and Brazil.

The investments focused on the growth of the gas chain represented 10% of the investments executed in the year. These investments were mainly driven by the execution of projects in Piedemonte, in the assets of Floreña, Cupiagua, and Cusiana, the offshore exploration blocks, and the projects developed by Hocol.

For its part, ISA’s investments in 2022 amounted to 1.02 BUSD, with 84% concentrated in the energy transmission business (858 MUSD), and 14% (141 MUSD) and 2% (21 MUSD) in the roads and telecommunications businesses, respectively. Brazil and Colombia accounted for 33% and 23% of total investments, respectively, and the remaining 44% corresponded mainly to investments in Chile and Peru.

| Millions (USD) | Ecopetrol S.A. | Affiliates and Subsidiaries | Total 12M 2022 | Share | |

|---|---|---|---|---|---|

| Production | 2,156 | 982 | 3,138 | 70.2% | |

| Refining, Petrochemicals, and Biofuels | 220 | 218 | 438 | 9.8% | |

| Exploration | 280 | 158 | 439 | 9.8% | |

| Transport* | 0 | 320 | 320 | 7.2% | |

| Corporate** | 134 | 0 | 134 | 3.0% | |

| Total without ISA | 2,790 | 1,679 | 4,468 | 100.0% | |

| Energy transmission | 0 | 858 | 858 | 84.1% | |

| Toll roads | 0 | 141 | 141 | 13.8% | |

| Telecommunications | 0 | 21 | 21 | 2.1% | |

| Total ISA | 0 | 1,020 | 1,020 | 100.0% | |

| Total | 2,790 | 2,698 | 5,488 | – |

*Includes the total amount of investments by each of the companies under the Ecopetrol Group (Ecopetrol S.A.’s share and non-controlling interest).

**Includes investments in energy transition projects.

2023 Business

Plan update

The Ecopetrol Group updated its 2030 Business Plan, in alignment with the Group’s commitment to accelerate towards the path of transition and energy sovereignty in the country, while maintaining competitive returns for all shareholders pursuant to its 2040 Strategy: Energy that Transforms.

The plan contemplates organic investments for 2023 ranging between 5.6 BUSD and 6.6 BUSD. About 66% of total investments will go to projects in Colombia and the remaining 34% will be executed in the US, mainly in the Permian (19%), as well as in Brazil (9%), Peru (3%), and Chile (3%).

The resources from renewable self-generation, hydrogen, energy efficiency, carbon capture, and ISA (transmission and toll roads) represent about 23% of the 2030 investment plan. Around 900 MUSD in the next 3 years (roughly 70 MUSD in 2023), will allow the incorporation of 900 MW of renewable energy, the production of more than 50,000 tons of low-carbon hydrogen, the reduction of about 400,000 tons of CO2e emissions, and the advancement of carbon storage and capture studies.

The commitment to self-sufficiency in the gas business line includes investments ranging between 800 MUSD and 900 MUSD for exploration and production projects in Piedemonte Llanero, the Continental Caribe region, and offshore. The plan seeks to create at least two (2) new regional energy communities and connect close to 107,000 new households to the gas grid.

In addition, ISA will invest roughly 1.4 BUSD (~4.4 BUSD for the next 3 years), of which close to 1.2 BUSD will be used to build 9,657 kilometers of energy transmission lines by 2025 (6,227 kilometers for the transmission of unconventional non-renewable energy), thus consolidating ISA as a leader in energy transmission in Latin America.

Investments in the exploration and production segment will be focused on enhanced recovery technologies to maximize existing resources in the reservoirs and protect the basic curve to offset the natural decline of the fields. Investments in the transportation and refining segments correspond to 5% and 7% of the total plan for 2023, respectively.

In line with the Generating Value with TESG pillar, the plan considers investments close to 500 MUSD, mainly in projects associated with:

- i) Decarbonization (199 MUSD).

- ii) Integrated water management (200 MUSD).

- iii) Fuel quality (64 MUSD).

- iv) Investments related to other areas such as research, circular economy, health and process and industrial safety (46 MUSD).

Some of the most relevant operating and financial goals of the 2023 plan are:

Reduce about 400,000 tons of CO2e emissions and incorporate close to 900 MW of renewable energies and more than 50,000 tons of green hydrogen by 2025.

Build 9,657 kilometers of energy transmission lines by 2025 (6,227 kilometers for the transmission of non-conventional renewable energies).

Production levels between 720 and 725 thousand barrels of hydrocarbon per day in 2023 (76% oil and 24% gas), with potential growth to reach production levels between 730 and 740 thousand barrels by 2024.

Transported volumes greater than one million barrels per day, in line with the country’s production expectations and the demand for refined products.

Volúmenes transportados superiores a un millón de barriles por día, en línea con las expectativas de producción del país y la demanda de productos refinados.

Also, 472 BCOP are planned for social investments, which will strengthen the Group’s commitment to the local development of the regions, to execute the intervention of 240 kilometers of tertiary network in 2023, as well as to provide education for 90,000 students, access to drinking water for 16,000 inhabitants, and serve 13,000 new household gas users, among others.

Finally, the 2023 investment plan involves, among other things, financing with own resources, the collection of the account receivable from the Fuel Price Stabilization Fund (FEPC), and marginal leverage in line with a Gross Debt/EBITDA ratio lower than 2.1 times. The plan will be subject to revision during the first quarter of 2023 based on the evolution of its assumptions.

(GRI 201-1, 201-4) (SFC 7.4.1.2.3, 7.4.1.2.4)

Financial results

Balance sheet

The Group’s assets amounted to 306.4 TRILLION COP, with an increase of 62.1 TRILLION COP compared to 2021, mainly due to:

- i) Larger accounts receivable given the higher value of the FEPC (Fuel Price Stabilization Fund) account and the exchange effect on assets from concessions in ISA Brasil.

- ii) The increase in property, plant, and equipment generated by a higher CAPEX in Ecopetrol and Permian projects, and the positive conversion effect in companies using a functional currency other than the Colombian peso, offset with the depreciations of the year.

- iii) The higher deferred tax asset, generated mainly by the update thereof.

- iv) Larger inventories due to vessels in transit at the end of the year.

- v) Increased investments in associated companies and joint ventures, mainly due to the positive conversion effect of investments made in foreign currency.

The Group’s liabilities stood at 187.3 TRILLION COP, with an increase of 36.8 TRILLION COP mainly due to:

- i) Escalating debt caused by the devaluation of the peso against the dollar in 2022.

- ii) Higher income tax, mainly due to the outstanding results achieved by the Ecopetrol Group companies.

- iii) The increase in accounts payable in line with the expanded activity and prices during the year.

- iv) Better employee benefits, mainly due to a lower appreciation of autonomous equities.

Equity amounted to 119.1 TRILLION COP, of which 91 TRILLION COP corresponds to equity attributable to Ecopetrol shareholders and 28.1 TRILLION COP to non-controlling shareholders.

Detailed information on Ecopetrol’s financial statements (consolidated and unconsolidated) can be found on Ecopetrol’s website.

Indicadores financieros

Below are the results of the financial indicators in 2022:

Liquidity indicators

These correspond to the resources required by the Ecopetrol Group to operate in the short term, maintaining a margin to cover cash fluctuations as a result of current asset and liability operations.

At the end of 2022, current assets increased by 49% compared to the previous year, mainly due to:

- i) The increase in the account receivable from the Fuel Price Stabilization Fund.

- ii) The higher level of inventories due to in-transit vessels.

On the other hand, current liabilities increased by 88% mainly due to:

- i) The transfer of financial obligations maturing in 2023 from long to short term.

- ii) Larger commercial accounts associated with increased activities and higher prices.

- iii) Higher current taxes arising from the improved results.

Debt indicators

These represent the proportion of the Company’s investment financed with debt, that is, using third-party resources.

Total liabilities payable to third parties backed by the level of assets was 61% in 2022 and 62% in 2021. Similarly, the concentration of short-term indebtedness was 30% and long-term 70%.

Profitability indicators

The EBITDA margin for 2022 was 47.2% compared to 45.7% in 2021. In 2022, the Ecopetrol Group’s return on assets (ROA) was 13.6% (2021 – 9.9%), and the return on capital employed (ROACE) was 18.8% (2021 – 13.6%). These rising indicators are mainly due to the higher results in 2022 for all operating segments and Group companies compared to 2021.

Activity indicators

The asset turnover indicator, measured by the value of sales over the Group’s average assets, stood at 0.59 in 2022 (vs. 0.49 in 2021), reflecting the excellent results for the year.

(GRI 201-1) (WEF 18, 21, 32E)

Economic value generated and distributed

The economic value generated and distributed illustrates the basic way in which an organization generates wealth for its Stakeholder Groups. The economic value generated corresponds to the Company’s income.

For its part, the distributed economic value includes: operating costs, employee salaries and benefits, payments to capital providers, payments to the government, and social investments (see table).

| Economic value generated | ||

|---|---|---|

| 2021 | 2022 | |

| Income | 92,147,671 | 159,473,954 |

| Economic value distributed | ||

|---|---|---|

| Economic value | 2021 | 2022 |

| Operating costs (cost of sales and operating expenses) | 62,183,496 | 99,381,325 |

| Employee salaries and benefits (expense) | 1,577,109 | 2,027,302 |

| Payments to capital providers | 6,104,841 | 6,710,106 |

| Payments to the government | 16,771,372 | 42,437,114 |

| Investments in the community | 199,057 | 284,399 |

| Economic value distributed | 86,835,877 | 150,840,247 |

Evolution of Share Prices in Colombia

The COLCAP index, the main reference of the Colombian Stock Market, had a negative variation of 8.85% during 2022. Its maximum level was 1,635 in April, the lowest level occurred in September when it reached 1,112 and closed 2022 at 1,286.

During 2022, Brent appreciated by 10.45%, going from levels of USD ~78/bl at the beginning of 2022 to USD ~86/bl at the end of the year, with a maximum in March of USD ~127/bb and a minimum in December from USD ~76/bl. Ecopetrol’s share price closed the year at 2,420 COP, with a devaluation of 10.04% in the year. The action reached in 2022 a maximum of 3,610 COP in March and a minimum of 1,970 COP in September. Click on the following link for the detailed behavior of share prices in the BVC.

Evolution of the ADR on the New York Stock Exchange

Ecopetrol’s ADR closed 2022 with a price of USD 10.47 and presented a variation of -18.77%. The ADR reached a high of USD 19.65 in April and a low of USD 8.64 in September. Click on the following link for the detailed behavior of Ecopetrol’s ADR.

Relevant information

All relevant information disclosure obligations in Colombia and abroad were complied with. For more information, see Chapter IV.1. of the Corporate Governance Report. Transparency, fluidity, and quality of information.

| Releases of relevant information | 65 |

| Press releases | 430 |

| Documents published in the SEC | 44 |

| Total | 539 |

Capital and

ownership structure

Ecopetrol had

256,206

shareholders

as of December 31, 2022, with a

0.83%

variation in the number of shareholders compared to December 2021.

Ecopetrol’s shareholding composition as of December 31, 2022, highlights a 12.9% increase in the stake of foreign shareholders and an 8.7% drop in the stake of natural persons.

Identification of

the main shareholders

The twenty-five (25) shareholders with the largest number of Ecopetrol shares as of December 31, 2022 are listed below:

| N.º | Investor | N.º shares as of December 2022 | Stake |

|---|---|---|---|

| 1 | STATE ENTITIES | 36,385 | 88.49% |

| 2 | JPMORGAN CHASE BANK NA FBO HOLDERS OF DR ECOPETROL | 1,019 | 2.48% |

| 3 | ISHARES MSCI COLCAP STOCK FUND | 354 | 0.86% |

| 4 | PORVENIR HIGHER RISK MANDATORY PENSION FUND | 328 | 0.80% |

| 5 | PORVENIR MODERATE MANDATORY PENSION FUND | 312 | 0.76% |

| 6 | PROTECCIÓN MODERATE MANDATORY PENSION FUND | 288 | 0.70% |

| 7 | PROTECCIÓN HIGHER RISK MANDATORY PENSION FUND | 224 | 0.54% |

| 8 | COLFONDOS MODERATE MANDATORY PENSION FUND | 133 | 0.32% |

| 9 | NORGES BANK | 116 | 0.28% |

| 10 | COLFONDOS HIGHER RISK MANDATORY PENSION FUND | 84 | 0.20% |

| 11 | HORIZONS COLOMBIA SELECT DE S&P STOCK FUND | 84 | 0.20% |

| 12 | VANGUARD TOTAL INTERNATIONAL STOCK INDEX FUND | 64 | 0.16% |

| 13 | SKANDIA MODERATE MANDATORY PENSION FUND | 58 | 0.14% |

| 14 | JP MORGAN SECURITIES PLC | 57 | 0.14% |

| 15 | VANGUARD EMERGING MARKETS STOCK INDEX FUND | 44 | 0.11% |

| 16 | PROTECCIÓN RETIREMENT MANDATORY PENSION FUND | 43 | 0.11% |

| 17 | VOL-ECOPET PROTECCIÓN PENSION FUND | 41 | 0.10% |

| 18 | SKANDIA HIGHER RISK MANDATORY PENSION FUND | 39 | 0.09% |

| 19 | PORVENIR SEVERANCE FUND | 35 | 0.09% |

| 20 | ASHMORE AC + LATAM CLOSED COLLECT INVESTMENT FUND | 34 | 0.08% |

| 21 | PROTECCIÓN LONG-TERM SEVERANCE FUND | 32 | 0.08% |

| 22 | PORVENIR SPECIAL PLANNED RETIREMENT FUND | 32 | 0.08% |

| 23 | PORVENIR CONSERVATIVE MANDATORY PENSION FUND | 22 | 0.05% |

| 24 | COLFONDOS PLANNED RETIREMENT MANDATORY PENSION FUND | 21 | 0.05% |

| 25 | PROTECCIÓN CONSERVATIVE MANDATORY PENSION FUND | 19 | 0.05% |

In line with the Colombian Code of Best Corporate Practices5, no Ecopetrol shareholder, except for the Nation, individually owns a “significant stake” (equivalent to 10% or more of outstanding shares). By virtue of the authorized capitalization process, the Nation must retain, at least, eighty percent (80%) of outstanding shares with voting rights6.

Stock trading

In 2022, no Ecopetrol administrator requested authorization from the Board of Directors to sell Company shares.

Total capitalizationl

Table 6 shows the value of Ecopetrol’s market capitalization as of December 31, 2022.

| Number of shares | 41,116,694,690 |

| Share price as of December 31, 2022 (COP) | 2,420 |

| Market Capitalization (Colombian pesos COP) | 99,502,401,149,800 |

Share capital

A 31 de diciembre de 2022, el capital social de Ecopetrol no presentó variación respecto del año anterior.

| Capital autorizado Ecopetrol (COP) | 36,540,000,000,000* |

| Total acciones | 60,000,000,000 |

| Valor nominal (COP) | 609** |

* Equivalent to USD 7,596,357,740.

** Equivalent to USD 0.13.

This information was calculated with the TRM of December 31, 2022: COP 4,810.20

Ecopetrol’s shares are nominal, ordinary, grant their holder equal rights in the Company’s assets and benefits distributed, and each of them has the right to one vote in the deliberations of the General Shareholders’ Meeting, with the legal limitations applicable in each case (e.g., default by shareholders, among others). There are no treasury shares held by the Company.

5 Financial Superintendence of Colombia, External Circular n.º 028 of 2014.

6 Article 2, Law 1118 of 2006..

Shareholder and investor

service and communication

Ecopetrol provides equitable treatment to all shareholders, without prioritizing the interests of any over the others, considering that each shareholder has the same rights according to the class of shares they hold, and therefore, to guarantee the full exercise of the rights and a correct fulfillment of its obligations to its investors and shareholders, the Company addresses all petitions, claims, and requests for information in the same way, regardless of the value of the investment or the number of shares it represents.

In 2022, a total of 80,755 shareholder requests were received through all service channels and 99.51% of the various requirements were addressed in a timely manner. Also, no claims regarding compliance with the Code of Good Governance were filed by shareholders and investors.

A total of 13,137 satisfaction surveys were conducted on the service received by shareholders and investors.

The main shareholder loyalty activities conducted during 2022 are listed below:

Information Bulletin for Shareholders

Data update campaign using different customer service channels, with a total of 11,986 updated data points.

Participation in twelve international conferences with analysts and institutional investors.

Participation in the “Ecopetrol towards a TESG transformation” webinar organized by Casa de Bolsa Stock Brokerage Company, targeting minority shareholders and addressing critical issues and updates related to the Oil Sector and Ecopetrol.

“Semana del Emisor” (Issuer Week) took place using the Trii platform, an e-trading application associated with Acciones & Valores Stock Market Commissioner, where you can buy and sell shares of companies listed on the Colombian Stock Exchange and in the Colombian Global Market. Talks on the Company’s financial results, its TESG strategy, and progress made in the 2040 Strategy were given to minority shareholders during the week. In addition, a commission-free day was granted on transactions with Ecopetrol shares, closing the day with a record of 4,525 operations on the platform.

Ecopetrol’s visit to Medellín, Barranquilla, and Duitama with financial education talks for minority shareholders given by the Colombian Stock Exchange, together with the participation of some stock brokerage firms to provide information and conduct data updating processes.

Ecopetrol has been awarded the IR recognition (Investor Relations) by the Colombian Stock Exchange, which highlights the Company’s commitment to best practices in the disclosure of information and investor relations. Visit

for more information.

Financial assistance

received from the government

Current tax regulations do not provide for tax deductions that can be used by the Company. On the other hand, the same tax regulations provide for tax credits that can be used by the Company in determining its income tax. As of December 31, 2022, Ecopetrol has 860 BCOP in tax credits, which will be used to determine the income tax payable in 2023.

On the other hand, no financial assistance was received from Export Credit Agencies (ECAs) in 2022.

Transfers to the Nation

Ecopetrol is one of the largest national and territorial taxpayers in Colombia. Its tax policy seeks to comply with its legal obligations under current regulations and obtain the highest tax benefits for the Company. The taxes payable by Ecopetrol are summarized in the table below.

| Tax type | Impuesto |

|---|---|

| National |

|

| Territorial |

|

The amount paid by Ecopetrol includes the taxes payable by the Company and the tax withholdings or collections applied to third parties and transfers to the different tax authorities in its capacity as withholding agent. Ecopetrol’s individual and consolidated effective tax rate in 2022 was 33.8% and 31.4%, respectively.

by Ecopetrol

| TAX TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | PURPOSE |

|---|---|---|---|---|---|---|

| OWN TAXES | ||||||

| Income tax | 272,763 | – | 446,316 | – | 69,530 | Nation |

| Self-withholding for equity – CREE | – | – | – | – | – | Nation |

| Income self-withholding | 5,094,734 | 2,172,632 | 1,728,724 | 2,795,957 | 5,196,462 | Nation |

| Equity/Wealth Tax (valid until 2017) | – | – | – | – | – | Nation |

| National gasoline and Diesel (ACPM) tax | 45 | 45 | 31 | 30 | 30 | Nation |

| Carbon tax (effective as of 2017) | 619 | 1,128 | 446 | 800 | 146 | Nation |

| National Diesel (ACPM) surcharge | 29 | 26 | 18 | 16 | 16 | Nation |

| Sales tax | 765,949 | 756,350 | – | – | – | Nation |

| Industry and commerce tax | 136,012 | 167,124 | 165,289 | 149,353 | 312,817 | Municipalities |

| Property tax | 22,641 | 22,439 | 20,763 | 21,184 | 46,054 | Municipalities |

| Transport tax | 73,786 | 77,267 | 163,553 | 166,936 | 401,210 | Municipalities |

| Tax on financial transactions | 137,975 | 142,312 | 128,230 | 135,793 | 296,154 | Nation |

| Vehicle tax | 239 | 173 | 92 | 95 | 227 | Municipalities |

| Lighting tax | 10,590 | 11,646 | 19,374 | 40,534 | 62,620 | Municipalities |

| Gasoline surcharge | 6 | 5 | 2 | 2 | 3 | Departments/Municipalities |

| SUBTOTAL OWN TAXES | 6,515,388 | 3,351,147 | 2,672,838 | 3,310,699 | 6,385,269 | |

| THIRD PARTY COLLECTION | ||||||

| National gasoline and Diesel (ACPM) tax | 983,425 | 1,188,018 | 954,854 | 1,303,416 | 1,499,890 | Nation |

| Income/VAT/stamp withholding tax | 985,174 | 1,060,373 | 1,175,564 | 1,328,934 | 1,854,695 | Nation |

| National pro-university stamp | – | 3,132 | 675 | 2,063 | 17,293 | Ministry of Education / Nation |

| Construction contribution (effective as of 2020) | – | – | 688 | 14,942 | 100,088 | Ministry of Interior |

| COVID-19 solidarity tax withholdings | – | – | 45,216 | – | – | Nation |

| National Diesel (ACPM) surcharge | 49,658 | 50,870 | 31,594 | 26,690 | 27,183 | Nation |

| Carbon tax (effective as of 2017) | 224,730 | 363,930 | 235,123 | 264,210 | 341,462 | Nation |

| Industry and commerce withholding tax | 46,791 | 68,940 | 77,870 | 230,873 | 108,057 | Municipalities |

| SUBTOTAL TAX COLLECTION FROM THIRD PARTIES | 2,289,778 | 2,735,263 | 2,521,583 | 3,171,128 | 3,948,668 | |

| TOTAL | 8,805,166 | 6,086,410 | 5,194,421 | 6,481,827 | 10,333,937 | |

The Ecopetrol Group’s contribution to the Nation in 2022 represented transfers effectively paid in the amount of 42.4 TRILLION COP as follows: dividends 16.3 TRILLION COP, total taxes 16.4 TRILLION COP (includes taxes paid by the Company and tax withholdings or collections applied on third parties and transferred to the different tax authorities in its capacity as withholding agent), and royalties and purchases of crude oil and gas from the ANH in the amount of 9.7 TRILLION COP.

Tax-related issuess

The document containing the Ecopetrol Group’s Tax Policy is published on the Ecopetrol website at the following link. The main topics covered are:

01

Timely compliance with all national and international tax obligations based on current legislation.

02

The Ecopetrol Group’s strategy is not focused on adopting aggressive or risky tax decisions that could question its tax returns.

03

The Boards of Directors of Ecopetrol and of the different Group companies will be informed of the main tax implications arising from their operations or of all matters subject to their approval, particularly when they constitute a relevant decision-making factor.

04

In order to optimize the tax treatment of the different operations, the rules set forth in the agreements shall apply to avoid double taxation, if any.

Good Tax Practices

Documentation and standardization of the Group’s tax planning.

A transfer pricing guide is available to guarantee that the operations, agreements, and/or contracts entered into between the affiliates and subsidiaries of the Ecopetrol Group are carried out under market conditions, avoiding the erosion of tax bases.

Not using structures or the intermediation of instrumental companies through tax havens or territories that do not cooperate with tax authorities, without a real or valid business reason.

Monitoring and Control

Updating, publishing, and sharing the tax planning memorandum with all Group companies every time the National Government enacts a regulation that affects its guidelines.

Holding quarterly committees with the Group to review the implementation of benefits and update on tax issues.

Reporting relevant aspects such as the behavior of the effective tax rate, relevant transactions that affected it, a comparative table with data from the immediately previous period, the effect of the last tax reform on the group’s rate, among other matters.

Main aspects of Ecopetrol’s tax planning

Using the tax benefits contemplated under current regulations:

- Law 2277 of 2022 did not introduce any modification to the existing reduction of the presumptive income rate to zero (0) since 2021.

- VAT discount on the acquisition, construction, etc., of Productive Real Fixed Assets.

- Deduction of 100% of the ICA (Industry and Commerce Tax) effectively paid throughout the year.

- Tax benefits for using alternative energies.

- Optimizing the benefit of carbon credits.

- Discount of Article 256 of the Tax Code for investments in science, technological development, and innovation.

- Others.

- Involvement in the structuring and tax definition of the Group’s new businesses.

- Notification of changes in the tax legislation to the different areas of the Company and its subsidiaries.

- Teamwork with the Ministry of Finance and Public Credit (MHCP), the Ministry of Mines and Energy (MME), and the National Tax and Customs Authority (DIAN).

- Creation of Tax Committees in the Ecopetrol Group and quarterly litigation reports pertaining to all Group companies.

Tax Risks

Ecopetrol has identified some tax risks that could cause business losses, if materialized, as well as the payment of penalties and default interest to the tax authority.

The main risks are:

- Changes in the tax legislation of the countries in which the Company currently operates.

- Adopting aggressive tax positions that may lead to disputes with the tax authority.

- Changes in the existing tax doctrine that give rise to disputes with the tax authority.

The Company’s risk matrix and the procedure to assess the economic impact associated with the occurrence of risks is published at

III.4. About Ecopetrol’s Operations

III.4.1. Hydrocarbon Business Line

Exploration

It is the first link in Ecopetrol’s value chain in the hydrocarbons business line, and its main objective is to discover and delimit commercially viable accumulations of hydrocarbons to ensure the expansion of the reserves required for the sustainability of the Group. High technical assurance standards are maintained to this end, optimizing the management of the prospects and discoveries portfolio, steering efforts in compliance with the exploratory strategy, and streamlining the maturation process of opportunities, as well as their conversion into discovered, contingent, and reserve resources.

Production and Development

The second link in the value chain includes the production of crude oil, gas, and white products, either directly or in partnership with other companies. Its main objective is the extraction of hydrocarbons via optimal development of the fields.

Exploration and Production Strategy

This segment’s strategy seeks to grow with the energy transition, decarbonizing operations and strengthening the gas portfolio, focusing on sustainable value creation for Stakeholders and preserving competitive returns for the Company.

For the materialization of the strategy, which projects between 700-750 kboed of hydrocarbon production by 2040, with a peak of 800-850 kboed by 2030 at high price levels, Ecopetrol has designed several lines of action, including activities in existing conventional assets and in other geographies, exploration in the Caribe offshore and in the Colombian onshore, and international as well as new business opportunities.

More specifically, the exploration and production strategy focuses on:

- High competitiveness and resilience:

focusing on material opportunities with competitive equilibrium prices and renouncing unprofitable opportunities. - Quick trading:

concentrating efforts on gas and light hydrocarbon opportunities near existing fields, in line with the near field exploration strategy, and with an optimal start in the incorporation of reserves and production. - Hydrocarbons favorable to the energy transition:

greater emphasis on light crude oil and gas projects to ensure a emission reduction from new opportunities and expanding the gas share in the product portfolio. - Low execution risk:

focusing on opportunities with a high probability of execution, as well as ensuring risk mitigation actions for opportunities with high strategic value, but low probability of materializing. - Development of the Caño Sur and Akacías green fields.

- Value maximization in the recovery program, mainly in heavy crude oil and in the Magdalena Medio region.

- Protecting the basic curve, mitigating the natural decline of the fields and continuing with primary recovery, mainly in Rubiales.

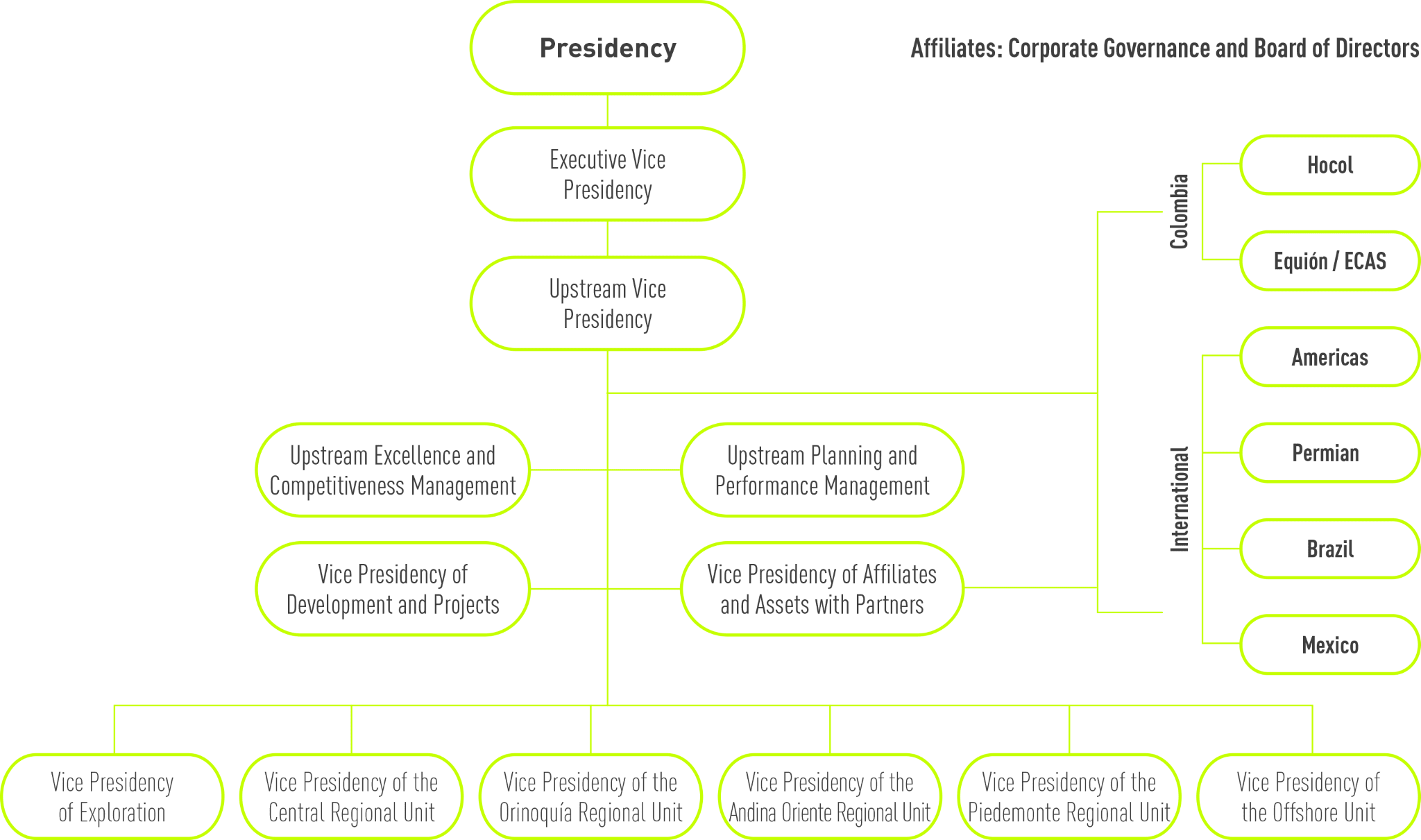

As of June 2022, with the purpose of responding to the Ecopetrol Group’s 2040 Strategy: Energy that Transforms, and more specifically, to the Growing with the Energy Transition pillar, a new operating model was approved for the upstream (exploration and production) to guarantee a comprehensive perspective of the segment, provide greater autonomy to the regions, and for better integration and synergy with the subsidiaries.

The new organization committed itself to the main objectives:

1

Achieve an accelerated and efficient maturation of opportunities to reach the market more quickly.

2

Fortalecer una visión integrada de la cadena de valor mediante una mejor integración y coordinación de las áreas del segmento.

3

Define a more efficient engagement mechanism with subsidiaries and partners to align objectives and exchange knowledge.

Exploratory Activity

Exploratory Drilling

Ecopetrol and its partners drilled 24 exploratory wells, in line with the proposed plan (23 in Colombia and 1 in the Gulf of Mexico), with seven (7) exploratory successes in basins of great interest to the Company, which will contribute to the country’s energy sovereignty: the Colombian offshore (Uchuva-1, Gorgon-2), Valle Superior del Magdalena (El Niño-2 and Ibamaca-2ST delimiter, confirming discovery announced in January 2022), Valle Medio del Magdalena (Morito-1), Llanos Orientales (Tejón-1), and Valle Inferior del Magdalena (Coralino-1).

| N.º | Well | Operator / Partner | Contract / Block | Results |

|---|---|---|---|---|

| 1 | El Niño-2 | Perenco 30% (operator), Ecopetrol 50%, CNOOC 20% | Boquerón | Successful |

| 2 | Tejon-1 | Ecopetrol 55% (operator) – Repsol 45% | CPO-9 | Successful |

| 3 | Morito-1 | Ecopetrol 100% (operator) | Magdalena Medio Exploitation Agreement | Successful |

| 4 | Gorgon-2 | Ecopetrol 50% Shell 50% (operator) | COL-5 | Successful |

| 5 | Uchuva-1 | Petrobras 44.44% (operator) Ecopetrol 55.56% | Tayrona | Successful |

| 6 | Coralino-1 | Hocol 100% (operator) | VIM-8 | Successful |

| 7 | Ibamaca-2 ST | Hocol 100% (operator) | Tolima | Successful |

| 8 | Guarapo-1 ST1 | Parex 80% (operator) ECP 20% | Fortuna | Under evaluation |

| 9 | Yoda A-1 | Hocol 100% (operator) | YDSN-1 | Under evaluation |

| 10 | Arrecife Norte-1 | Hocol 100% (operator) | VIM-8 | Under evaluation |

| 11 | Alqamari-2 | Ecopetrol 100% (operator) | Western Putumayo | Under evaluation |

| 12 | Tororoi-1 | Hocol 50% Geopark 50% (operator) | LLA-87 | Under evaluation |

| 13 | Tinamú-1 | Repsol (45%) Ecopetrol 55% (operator) | CPO 9 | Under evaluation |

| 14 | EST SN 15 | Hocol 100% (operator) | SN15 | Stratigraphic |

| 15 | Bololó-1 | Hocol 100% (operator) | VIM-8 | Dry |

| 16 | Pilonera-1 | Hocol 50% Lewis Energy 50% (operator) | SSJN1 | Dry |

| 17 | Boranda Sur-3 | Parex 50% (operator) Ecopetrol 50% | Boranda | Dry |

| 18 | Chinchorro-1 G | Hocol 100% (operator) | GUA-2 | Dry |

| 19 | Boranda Norte-1 | Parex 50% (operator) ECP 50% | Boranda | Dry |

| 20 | Kinacú-1 | Ecopetrol 100% (operator) | South Area | Dry |

| 21 | Starman-1 | Chevron 50% (operator) EAI 25% BHP 25% | MC412–USGoM | Dry |

| 22 | Yoda B-1 | Hocol 100% (operator) | YDSN-1 | Dry |

| 23 | Sinuano-1 | Hocol 100% (operator) | SN-8 | Dry |

| 24 | Ibamaca-2 | Hocol 100% (operator) | Tolima | Dry |

Advancements in the gas portfolio

Progress was made in 2022 in the evaluation of the Gorgon-2 and Uchuva-1 discoveries in the Colombian offshore to define the delimitation and development plan for these discoveries. On the Piedemonte Llanero, the Cupiagua XD 45 and Cusiana V31 exploratory wells were being drilled by the end of the year, in order to find new gas and light hydrocarbon accumulations in the vicinity of existing fields, in line with the Near Field Exploration strategy.

In turn, Hocol undertook exploratory activities in the areas of northern Colombia, with the successful drilling of the Coralino-1 well, confirming the presence of gas in the Ciénaga de Oro formation.

Seismic Information

In order to strengthen the exploratory areas already awarded, progress was made in the acquisition of national seismic information with the Flamencos 3D program operated by Ecopetrol and the SSJN1 2D program operated by Hocol, which are in the operating stage and are expected to complete registration in 2023.

Moreover, Ecopetrol acquired 2,639 km2 of 3D seismic information (4,486 equivalent km) in Llanos Orientales to expand the technical knowledge on this prolific basin. Similarly, Hocol acquired 472 km of 2D information and 923 km2 of 3D information (2,041 equivalent km) on different areas of interest, from the Llanos basin to northern Colombia. Ecopetrol Brasil acquired 2,595 km2 of 3D information on the Santos basin (4,412 equivalent km).

From 2017 to 2021, around 44,917 equivalent km of seismic information in the onshore and offshore basins of Colombia have been reprocessed and reinterpreted by the Ecopetrol Group, which has contributed to the reduction of uncertainty by improving the seismic image. This has leveraged interpretation to support the characterization of exploratory opportunities, in periods in which seismic acquisition has been complicated due to environmental restrictions and/or reduced investments because of crude oil prices.

During 2022, Ecopetrol S.A. and its subsidiary Hocol reprocessed and reinterpreted 12,101 equivalent km and 1,006 equivalent km of seismic information, respectively, in offshore areas of great relevance such as Piedemonte, Putumayo, northern Colombia, and Valle Medio and Valle Superior del Magdalena, allowing the continued identification, evaluation, and maturation of new opportunities.

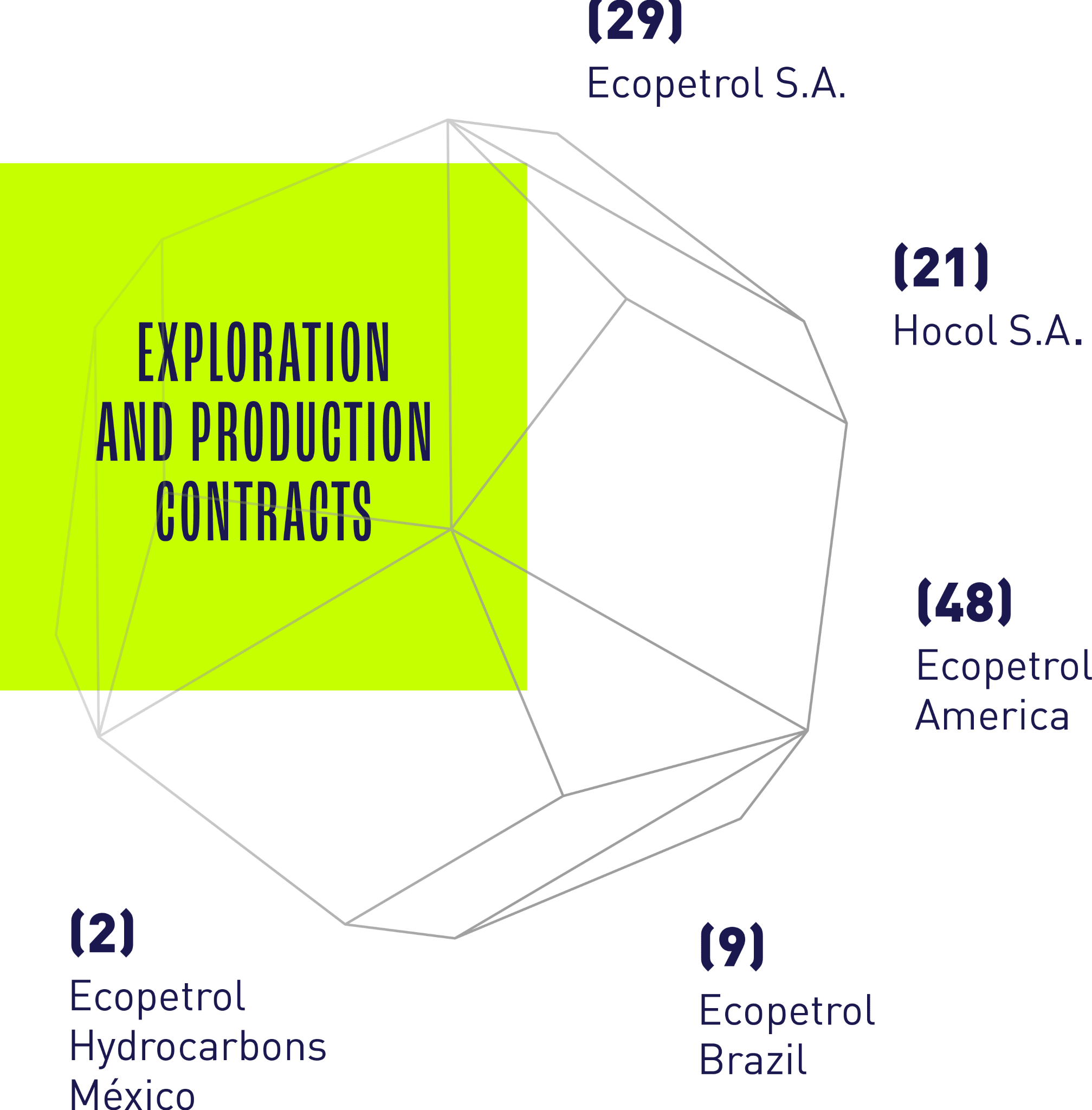

Contracts and Exploratory Areas

By the end of 2022, Ecopetrol had 109 exploratory assets, distributed as follows:

Some of these contracts have operating or non-operating partners.

| PARTNERSHIP | CONCESSION | E&P CONTRACT | CET*** | E&P AGREEMENT | CRC** | PSC* | Royalty/Tax Agreement | |

|---|---|---|---|---|---|---|---|---|

| MEXICO | 2 | |||||||

| BRAZIL | 7 | 2 | ||||||

| HOCOL | 1 | 19 | 1 | |||||

| ECOPETROL | 3 | 21 | 3 | 1 | 1 | |||

| EA | 48 |

Note:

*PSC: Production Sharing Agreement

**CRC: Shared Risk Contract

***CET: Technical Evaluation Contract

EA: Ecopetrol América (Gulf of Mexico)

Five (5) assets were in the divestment process at the end of 2022:

Also, exploratory opportunities have been identified in 30 production area assets that are part of the portfolio of projects in maturation (24 Ecopetrol S.A. and 6 Hocol).

The 109 exploratory assets cover a total of 7.19 billion hectares, distributed in the different subsidiaries and areas of exploratory interest: Colombia, Brazil, USA, and Mexico.

Production and Development

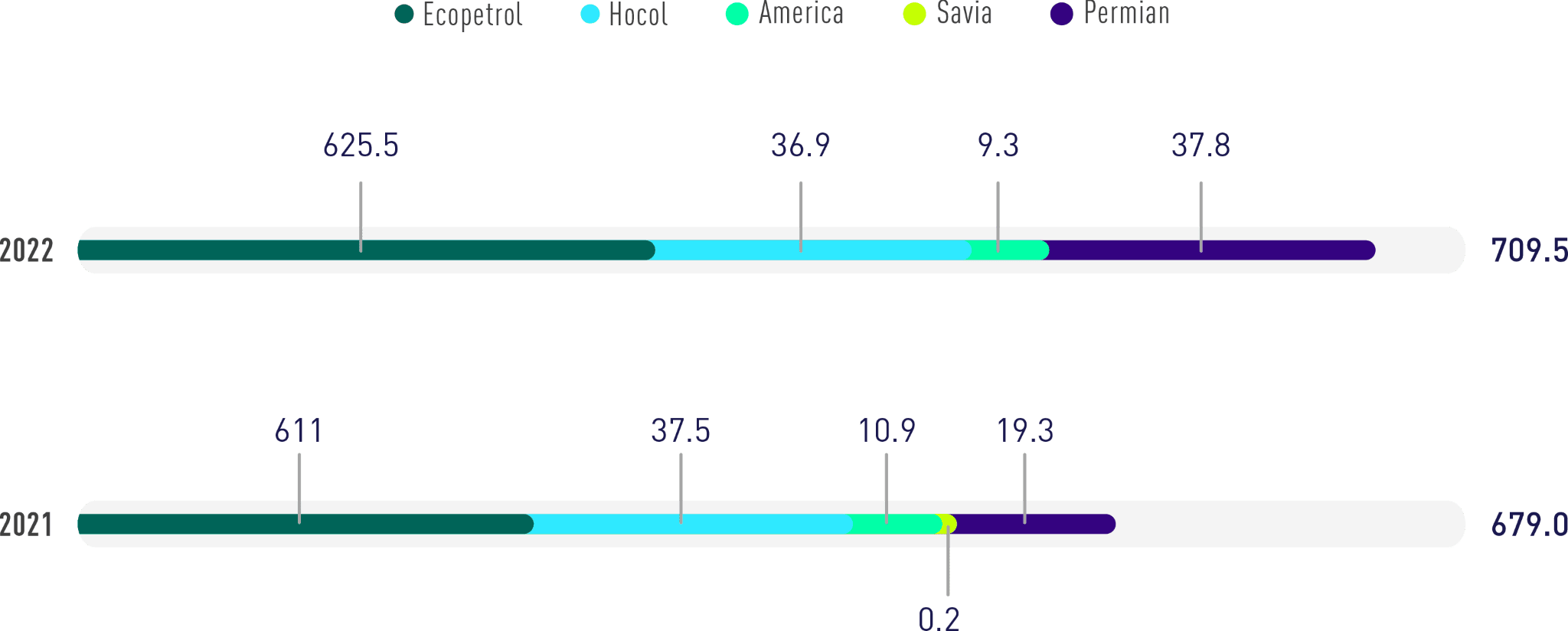

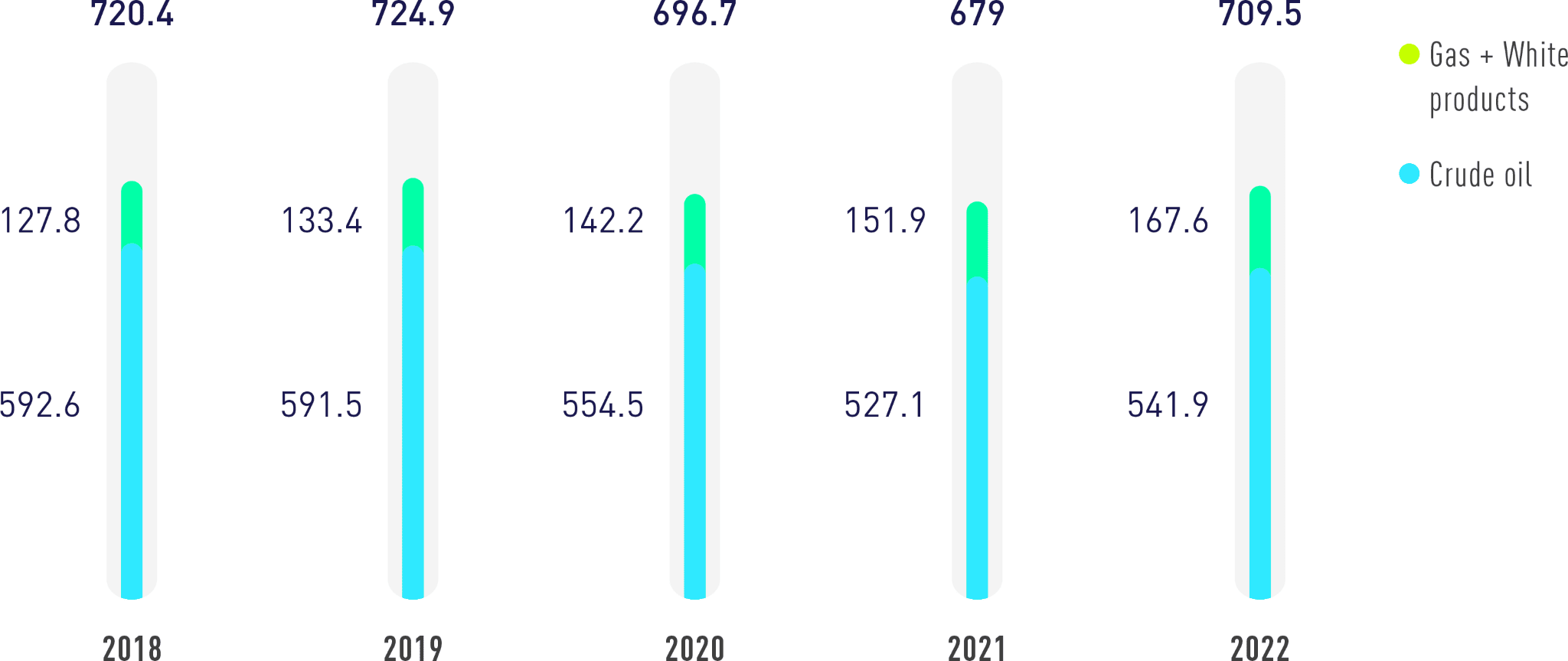

In 2022, the Ecopetrol Group’s production accounted for 709.5 thousand barrels of oil equivalent per day (kboed), of which 625.5 kboed were contributed by Ecopetrol and 84.0 kboed by the subsidiaries. Gas contribution represented 20% (139.6 kboed). The fields with recovery technologies contributed 40% of the Ecopetrol Group’s production.

Compared to the period of 2021, there was an increase of 30.5 kboed (14.4 kboed from Ecopetrol and 16.1 kboed from the subsidiaries), mainly due to the following factors: the incremental production of the Caño Sur and Permian assets, the reversal of the Nare partnership contract, and the management of the deposits in Chichimene, Akacías, and Rubiales, which resulted in lower water cuts, greater stakes in production due to the high prices in partnership operations, the restoration of production affected by public security events, and the lifting of operating restrictions in Castilla related to water management.

For the time being, Ecopetrol’s portfolio does account for, nor does it contemplate exploration and exploitation operations in the arctic region or the production of tar sands.

In accordance with the Guide for the Ecopetrol Group’s Corporate Governance Model (GEE-G-041), Ecopetrol participates as a shareholder in various companies, in order to add to the results of the business and the sustainability, strategic alignment, and optimization of the investment portfolio via the financial return generated by said companies.

In the case of the segments under the hydrocarbon business line and, particularly, the upstream segment, the necessary strategic alignment to articulate value generation efforts as a group is achieved through:

- i) The function of the upstream segment’s Vice President.

- ii) The Boards of Directors of the companies that make up the segment.

- iii) The execution of activities foreseen in the Group’s engagement mode

International Portfolio

The upstream has four (4) international subsidiaries in the United States, Mexico, and Brazil.

United States:

Permian:

- The Company has operations in the Permian, the most prolific basin in the world, with a first-tier operator (OXY). It has approximately 100,000 acres of low exploration risk, with no license expiration, and the operation unfolds in a stable regulatory framework.

- The business is characterized by:

- i) Increased production and materialization of reserves.

- ii) Agile and low-cost operations.

- iii) Short paybacks on annual campaigns (2-3 years).

- iv) Cash generation.

- The volumes produced are light (40 degrees API), which contributes to the diversification of the Group’s portfolio in the context of low CO2 emissions and water management.

- Below are some of the highlights of 2022:

- Zero recordable HSE events.

- Record production in October of 57.4 kboed (Ecopetrol’s production stake before royalties).

- The successful drilling of 103 development wells, with time and cost efficiency.

- In terms of TESG, low intensity of CO2 emissions < 8kgCO2e/boe can be highlighted, in addition to the recycling of more than 11 Mbls of water, equivalent to 40% of the production.

Ecopetrol America

- The deepwater exploration strategy in the Gulf of Mexico (USGoM) is focused mainly on the search and development of opportunities in the plays of Mioceno and Jurásico, prioritizing opportunities of low exploratory risk and that are close to existing infrastructure.

- It leverages geographic diversification and has access to high-quality reserves with top-tier operators such as Murphy, Hess, Oxy, and Quarter-North.

- It is the learning platform for strengthening deep-water exploration and production skills, and in terms of production, it offers access to barrels of medium and light crude oil in a low CO2 emissions environment.

- Below are some of the highlights of 2022:

- Well-related work was completed successfully in the Gunflint field, allowing EA production to recover by roughly 3.7 net kboed.

- Successful drilling of a new DC90 development well at Dalmatian, which will add to production by 2024 once completed.

Mexico

- The variables used to define Mexico’s strategy in 2019 show a negative trend to date, which is why this subsidiary is in the process of simplification (geographical exit).

- It is therefore worth noting that:

- i) No changes are expected to improve the opening conditions for the hydrocarbon business.

- ii) The current portfolio has limited prospects due to negative results in Block 6 and high risks in Block 8.

- iii) The country’s risk level has increased (e.g. limitation of import contracts and restrictions on crude oil export permits).

- In 2022, the National Hydrocarbons Commission (CNH) approved the assignment of the Block 8 contract to PEMEX. With regard to Block 6, the withdrawal from the block was filed and the completion of the process is expected for the third quarter of 2023.

Brazil

- Its activity focuses on offshore, with the strategic purpose of contributing to the internationalization of Ecopetrol via:

- i) The maturation of exploratory options in deep waters.

- ii) The acquisition of knowledge by developing offshore assets.

- iii) The incorporation of reserves in areas of high prospectivity.

- The Gato do Mato project is currently in maturation, with Ecopetrol holding a 30% stake, Shell (operator) 50%, and Total 20%.

- The Company’s Regional positioning was strengthened in 2022, thanks to the incorporation of six (6) new offshore exploratory blocks in the post-salt play of the Santos Sur basin.

National Subsidiaries

Hocol

- This subsidiary is intended to leverage growth, mainly in gas, as well as the Ecopetrol Group’s strategy in Colombia, with a differentiated and low-cost operating model.

- It has a high exploratory capacity with more than 70% of current production originating from discoveries in the last 15 years.

- Below are some of the highlights of 2022:

- The successful drilling of the Coralino-1 well in Córdoba, with a contribution of 2.77 MBOE of discovered resources yet to be delimited.

- Reduction of 14,102 TonCO2e (Scope 1 and 2) with the execution of 11 projects to reduce flaring and increase energy efficiency.

- Inauguration of the La Guajira Innovation and Entrepreneurship Center, leveraging the growth of a key region for the energy transition.

Well Drillings

In 2022, 536 development wells were drilled and completed: 250 from Ecopetrol’s direct operation, 162 were executed jointly with partners, 21 by Hocol and 103 by Permian, as shown in the table below:

| Company | 2021 | 2022 |

|---|---|---|

| Ecopetrol Direct Operation | 193 | 250 |

| Ecopetrol Operation with Partners | 95 | 162 |

| Hocol | 22 | 21 |

| Permian | 85 | 103 |

| Total Development Wells of the Business Group | 395 | 536 |

Number of maritime facilities: 2

(SASB EM-EP-000.C)Number of land facilities: 156

Inversiones upstream Grupo Ecopetrol

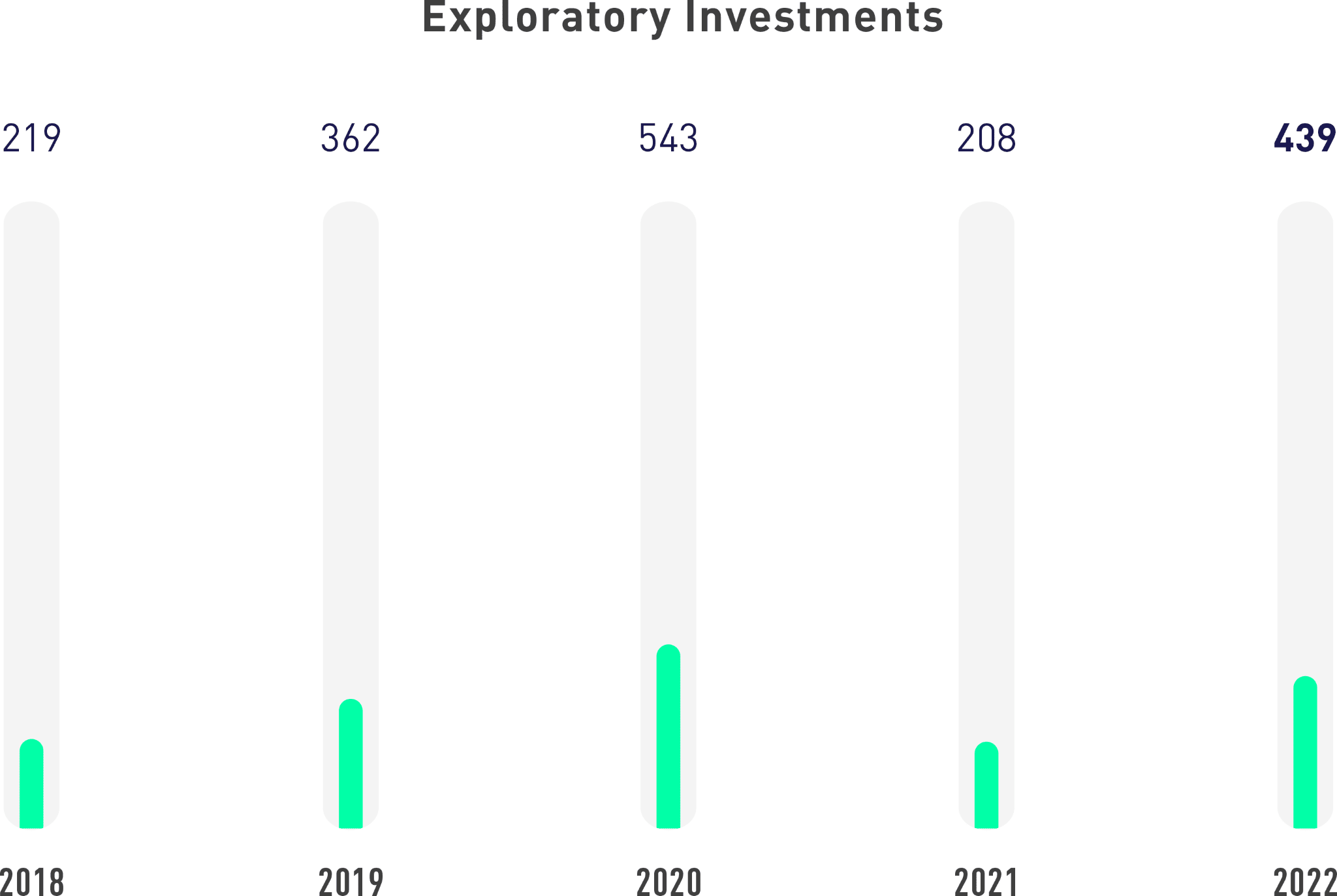

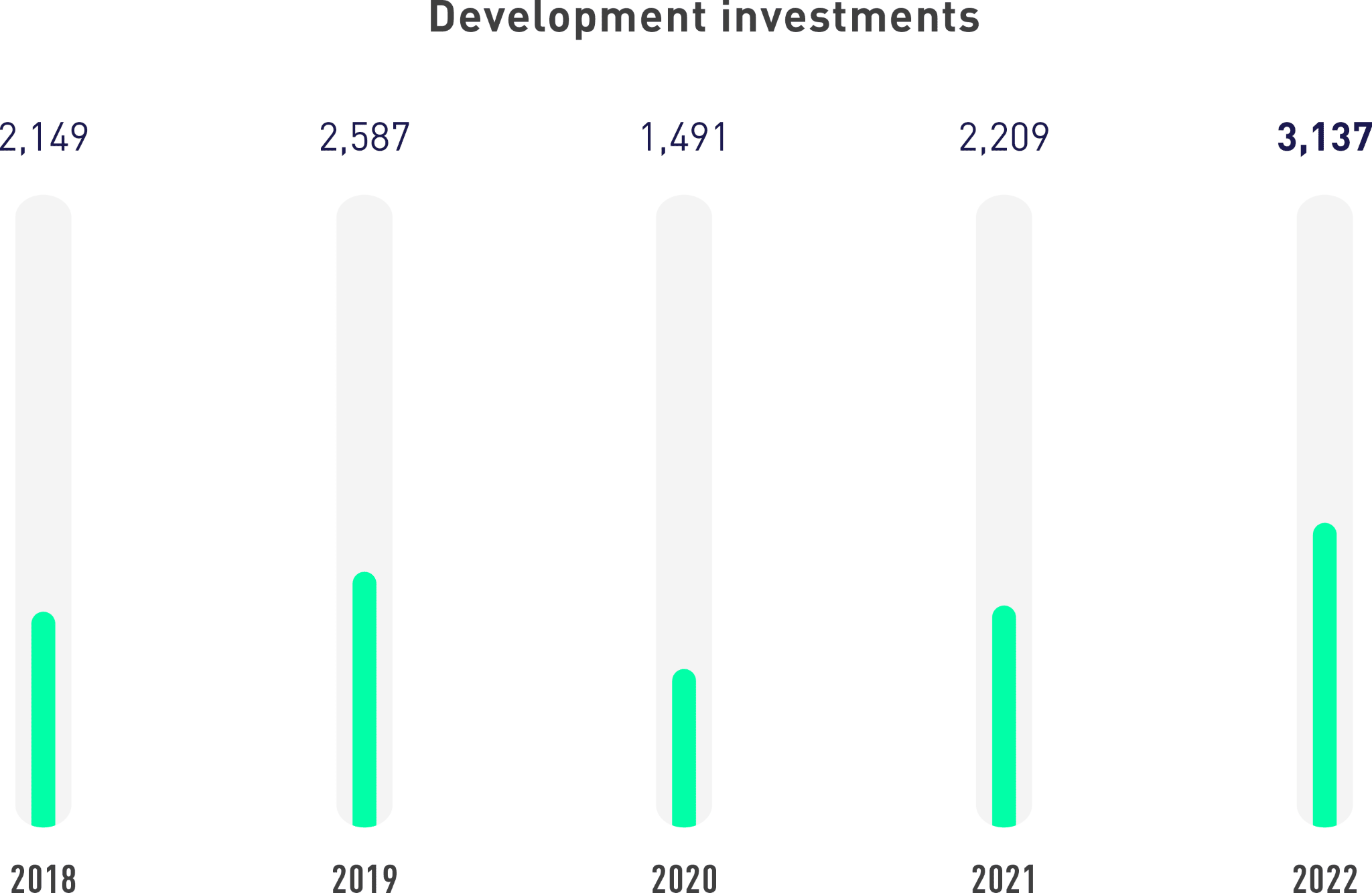

In 2022, the upstream executed a total capex of 3,576 MUSD. Exploratory investments amounted to 439 MUSD, rising 111% compared to 2021, and investments in development and production added up to 3,137 MUSD, a 42% increase compared to the previous term.

Exploration and Production Partners

The upstream partners participate in businesses and/or joint projects with Ecopetrol in the exploration and exploitation phases (development and production), with the purpose of generating value in the achievement of common objectives, within a transparent, reliable, and efficient environment of mutual benefit, framed within competitiveness and the energy transition. These relationships are regulated by formal agreements and are based on contributions from the parties.

As of June 2022, in the new segment model, the Vice Presidency of Subsidiaries and Assets with Partners (formerly the Vice Presidency of Assets with Partners) was incorporated, with the purpose of centralizing management with upstream partners, ensuring the execution of the strategy and the engagement plan, and identifying new growth opportunities by increasing partnership contracts in the portfolio.

The Company’s process flows were restructured, in line with the new model, which resulted in the creation of the new Value Maximization Flow in Subsidiaries and Assets with Partners – MFS, effective as of January 2023.

Both the Vice Presidency of Exploration and the Vice Presidency of Subsidiaries and Assets with Partners are responsible for the engagements with exploration and production partners. By year end in 2022, Ecopetrol had engaged with 25 partner companies, as shown in the table below:

| 1. CEPSA COLOMBIA S.A. | 14. PETROSANTANDER COLOMBIA INC. 1 |

| 2. COLOMBIA ENERGY DEVELOPMENT CO (CEDCO) | 15. PETROSOUTH ENERGY CORPORATION |

| 3. EMERALD ENERGY PLC | 16. SAINT – AUBIN INTERNATIONAL S.A.S. |

| 4. FRONTERA ENERGY | 17. REPSOL 1 |

| 5. GRAN TIERRA ENERGY COLOMBIA LTDA. 1 | 18. SIERRACOL ENERGY 1 |

| 6. HOCOL S.A. | 19. TEXICAN OIL & GAS LTDA. |

| 7. LAGOSUR PETROLEUM COLOMBIA INC. | 20. ISMOCOL – JOSHI – PARKO (UT IJP) TEMPORARY |

| JOINT VENTURE | |

| 8. LEWIS ENERGY | 21. SAN AGUSTIN ENERGY CORP COLOMBIA BRANCH |

| 9. NEXEN PETROLEUM COLOMBIA LTDA (CNOOC) | 22. CPVEN 2 |

| 10. NIKOIL ENERGY CORP. | 23. SHELL EP OFFSHORE VENTURE 2 |

| 11. PAREX RESOURCES 1 | 24. PETROBRAS 2 |

| 12. PERENCO 1 | 25. ANADARKO COLOMBIA 2 |

| 13. PETRÓLEOS COLOMBIANOS (PETROLCO S.A.) |

Effective members as of December 31, 2022.

- Partners with assets in the exploitation phase, with exploratory activities.

- Partners with assets in the exploration phase.

The engagement mechanisms with partner companies take place via Collaboration Contracts (Partnership, JOA, ORRI, CPI, CRC, etc.), E&P, and agreements with the National Hydrocarbons Agency (ANH).

Furthermore, strategic relationships are established with contractors that contribute to the fulfillment of objectives in abandonment and dismantling processes (subsoil equipment, communications, SES, scraping, dismantling, cleaning, environmental training, ambulances, firefighting, among others).

| Type of Contract | Total |

|---|---|

| Partnership contract (includes only risk and ORRI) | 37* |

| Exploration and production contracts with JOA | 17 |

| Incremental production contract | 4 |

| Business collaboration contract | 2 |

| Shared risk contract | 2 |

| Business collaboration agreement | 1 |

Note. As of December 31, 2022, Ecopetrol managed 63 contracts with partners.

* Includes five (5) partnership contracts transferred to Hocol S.A. as of July 1, 2018, with the area assigned to Ecopetrol.

In 2022, the investment executed in partnership contracts (exploration and production) by Ecopetrol S.A. amounted to 262.6 million dollars.

In 2022, the Vice Presidency of Subsidiaries and Assets with Partners developed a strategy together with the cross-cutting areas to manage partner relationships, including the following initiatives:

Diversity and inclusion:

Through training and the dissemination of messages related to the subject area.

Ethics and compliance:

Partners were trained in Ecopetrol’s Code of Ethics, sharing reflections and ethical discussions, as well as ratifying their commitment to ensuring ethical criteria and complying with procurement and contracting processes.

Engagement:

The first Ecopetrol Partner meeting took place in 2022, with the participation of senior leaders of both Ecopetrol and our partners, which secured the deployment of the 2040 Strategy: Energy that Transforms and addressed the main achievements and challenges in managing partners. Also, the first accounting and tax meeting was held in order to strengthen relationships and identify best practices and trends in this area, and activities were conducted to identify socio-environmental initiatives (diagnosis and baselines) in the assets held with partners.

Human rights:

Training was provided and efforts were undertaken to disseminate messages related to this subject.

Each of these initiatives was developed by implementing a plan with specific activities, and with quarterly monitoring throughout the year.

Reserve Balance

At the end of 2022, the Ecopetrol Group’s net proven reserves amounted to 2,011 MBOE, the highest in the last eight (8) years, of which 89% correspond to fields in Colombia and 11% to fields in the US.

The reserves were estimated based on the standards and methodology of the US Securities and Exchange Commission (SEC). 99.8% of the reserves were certified by three (3) renowned independent specialized firms (Ryder Scott Company, DeGolyer and MacNaughton, and Gaffney, Cline, & Associates). The price (Brent marker) used for the appraisal of the 2022 reserves was USD 97.9 per barrel compared to USD 69.2 in 2021.

The reserve replacement rate was 104% and the average life of the reserves is equivalent to 8.4 years. The Ecopetrol Group incorporated 249 MBOE of proven reserves and the total accumulated production for the year was 240 MBOE. Of the total balance of reserves, 75% are liquid and 25% correspond to gas.

A total of 215 MBOE were incorporated thanks to the management in the development fields, reflected in the optimal and timely maturation of new projects, better execution capacity, and the implementation of improved recovery expansion projects in fields such as Chichimene, Castilla, and Akacías, among others.

In terms of purchases, reserves were incorporated by acquisition and qualitative selection of areas in the Permian basin – USA (48 MBOE).

The increased reserves in 2022 are one of the pillars of the Ecopetrol Group’s strategy in order to guarantee its long-term sustainability.

| SEC Price USD/Bl | |||||||

|---|---|---|---|---|---|---|---|

| 56 | 44 | 55 | 72 | 63 | 43 | 69 | 98 |

The Ecopetrol Group’s main efforts for the incorporation of reserves in the medium and long term are focused on:

- i) The gas potential in the Colombian Caribe Offshore, Piedemonte Llanero, and the North Caribe Onshore, which will contribute to the country’s energy sovereignty and ensure the supply of natural gas to the market.

- ii) The crude potential of Llanos Orientales and Valle Medio del Magdalena, leveraged mainly on primary recovery (infill drilling) and the enhanced recovery program.

- iii) Internationally, the Permian basin in the US and the pre-salt in Brazil, in which Ecopetrol has a stake.