IV.2. Environment

(GRI 2-23) (SFC VII)

Commitments and Policies

The Ecopetrol Group is committed to maintaining an accountable business conduct, as reflected in its 2040 Strategy, by means of its business policies, principles, and long-term commitments.

Cultural principle “Life First” under the Declaration of Culture, guides the Ecopetrol Group and its work team in their HSE actions, by establishing the commitment to preserve life in its different manifestations, as evinced in these behaviors:

We take care of ourselves and take care of others.

We act with rigor and discipline in light of the HSE management system.

We protect the environment and our surroundings with future generations in mind.

Ecopetrol applies the principle of precaution under the principle of due diligence and as part of its environmental management efforts; that is, in the absence of knowledge of a potential impact or risk, the Company takes measures to study and technically understand the potential impact or risk during the planning stages of the projects, before they occur, and adopts preventive or mitigation actions that have proven to be effective over time, which are observed and evaluated within the framework of continuous improvement defined in the HSE Management System.

(SASB EM-EP-160a.1) (SFC XVII)

Environmental Strategy

Ecopetrol’s environmental strategy23, approved by the HSE Vice Presidency, establishes the guidelines for Ecopetrol’s environmental management, including the vision, principles, and objectives, as well as the identification of strategic environmental pillars and levers.

It is articulated with the 2040 Strategy: Energy that Transforms, and it unfolds within the framework of the HSE Management System, in accordance with the guidelines set forth in the ISO 14001 standard.

The main specific objectives of the strategy are as follows:

Environmental legal compliance.

Systematic identification and management of potential environmental impacts and risks associated with Ecopetrol’s activities, with a focus on continuous improvement and implementation of the mitigation hierarchy.

Continuous improvement through the definition of strategic pillars and levers.

Foster the environmental culture in employees, contractors, and the Ecopetrol Group.

Generate long-term environmental value around our operations.

Facilitate compliance with corporate environmental goals on the path towards the energy transition.

The environmental strategy is aligned with Ecopetrol’s Risk Management System (SRI), in order to prevent the materialization of potential risks that can impact natural resources and the biota and be prepared to respond to potential emergencies that may pose risks on the environment. It is applicable to all Ecopetrol projects and activities and may, in turn, be adopted by the companies of the Ecopetrol Business Group.

The Environmental Strategy is based on the following basic principles:

Environmental protection is a corporate responsibility that is fostered through its business culture.

Environmental legal compliance is the foundation of environmental management.

The mitigation hierarchy as the cornerstone for the environmental planning of projects and operations.

Continuous improvement as a path to excellence in environmental performance.

The environmentally intelligent challenge for the fulfillment of corporate goals.

The path to net positive environmental impact.

La estrategia ambiental definió ocho (8) pilares estratégicos:

1

Environmental planning and compliance

Prior awareness and diagnosis of environmental aspects and determinants, as well as the specific regulations of the areas where Ecopetrol S.A. undertakes its projects and operations, allow the identification of potential environmental impacts and essential opportunities for the conception and planning of measures focused mainly on the implementation of the mitigation hierarchy, thereby contributing to the successful advancement of operations, the viability of new projects, and sustainable development in the territories where the Company operates.

Ecopetrol, in managing and obtaining environmental authorizations, applies national regulations associated with citizen participation in the territories where it intends to carry out its operations and projects, in order to report on the scope of activities and the environmental and social impacts that may arise, as well as the joint construction of environmental management measures with the different social stakeholders in the area of influence of the projects and operations.

Similarly, during execution, the Company establishes permanent communication mechanisms with the authorities, communities, associations, and other stakeholders, in order to learn and respond to concerns associated with the environmental management of its projects and operations. For this, the company has created the Citizen Participation Office to address petitions, complaints, claims, and suggestions, and meet the requirements of the party concerned, in the times established by Colombian law.

It is important to highlight that the Colombian state, through ANLA, as part of the National Environmental System, is responsible for appraising and authorizing projects, works, or activities in the hydrocarbon sector. To fulfill the legal and environmental terms of a project, Ecopetrol files the request for an Environmental License or the modification thereof with the relevant authority. It is a process used for the planning and administration of projects to ensure that human and economic activities adjust to ecological and resource restrictions, thus constituting a key mechanism to promote sustainable development in the Nation”. (ANLA, 2020)24.

The environmental licensing process begins by filing an Environmental Impact Assessment conducted by the party concerned, which includes, among other aspects, the identification of environmental and social impacts with and without the project, which can be classified as indirect, synergistic, and cumulative.

Similarly, the evaluation and assessment must be conducted using methodologies according to the nature of the project by justifying the assessment of each impact, be it negative or positive. Furthermore, the Environmental Impact Assessment proposes environmental management programs that comprise a detailed description of the set of actions, measures, and activities aimed at preventing, mitigating, correcting, and offsetting the environmental and social impacts arising from the development of a project, work, or activity.

In terms of environmental legal compliance based on the sub-element of the HSE Management System, corporate guidelines are available, and the Environmental Legal Compliance Index is also measured annually to monitor compliance with the requirements.

2

Climate action

Ecopetrol reaffirms its commitment to reduce its carbon footprint, thus adding efforts to limit the global temperature increase to below 1.5°C. To this end, the Company deploys actions to maintain its operations low in carbon emissions and resilient to the effects of climate change, by adequately managing climate-related risks and opportunities.

3

Towards water neutrality

Ecopetrol declared its commitment to be water neutral by 2045, which has been defined as the balance between the water required by the Company for its operations and the direct water footprint, considering efforts to reduce it as much as economically and technically possible, and subtracting the compensation of 100% of the remaining water required to operate through compensation projects executed in the water basin where the Company operates. To achieve this, Ecopetrol has committed to a 66% reduction by 2045 in the catchment of fresh water for industrial use compared to the base year (2019), to eliminating 100% of industrial wastewater dumping into bodies of fresh water, and to offsetting 34% of the remaining water consumption through initiatives that contribute to improving availability in the water basins where it operates.

4

Comprehensive Waste Management

Ecopetrol adopts operating and organizational measures to reduce (up to economically and technically feasible levels) the quantity and hazard caused by the waste generated, based on three (3) fundamental aspects:

- a) Reduction at the source or origin.

- b) Recovery of materials through the use of waste by implementing the Multi-R or 9Rs concept of circular economy.

- c) Incorporation of technologies.

5

Biodiversity and ecosystem services

The strategic biodiversity pillar is intended to adequately manage the risks and opportunities associated with biodiversity and ecosystem services, while addressing the expectations of the Stakeholder Groups and maintaining the operating license. This pillar consists of four (4) fundamental areas:

- Mitigation hierarchy: its purpose is to prevent, avoid, and mitigate impacts on biodiversity and offset residual impacts. Ecopetrol does not intend, nor does it plan to conduct exploration, production, or refining activities in areas of high biodiversity value, categories I to IV according to the International Union for Conservation of Nature (IUCN), nor in areas declared World Heritage Sites by UNESCO.

- Nature-based solutions: they are designed to maintain biodiversity and ecosystem services in strategic areas, by identifying synergies between nature, society, and the local economy to respond to challenges such as climate change (Natural Climate Solutions), climate management, water resources, and biodiversity.

- Generation of knowledge: produces current information on biodiversity and ecosystem services to strengthen the decision-making process.

- Biodiversity culture: the purpose is to strengthen the Company, the value of biodiversity, and ecosystem services.

6

Circular economy

It has been defined as a “production and consumption system that promotes the efficient use of materials, water, and energy, considering the recovery capacity of ecosystems, the circular use of material flows through the implementation of technological innovation, partnerships, and collaborations between stakeholders, and the promotion of business models that respond to the foundations of sustainable development” (ENEC. MADS, Mincomercio, 2019). In this sense, the circular economy is adopted as an enabler that contributes to the fulfillment of goals associated with the energy transition, net zero carbon emissions, the reduction of the water footprint, the closing of the materials and waste cycle, and the diversification of new businesses, to ensure the competitiveness and long-term sustainability of the Company, while striving for the conservation of natural resources and the well-being of society.

7

Clean Air for the Environment

The clean air for the environment pillar focuses on monitoring and managing the contribution to reducing criteria pollutant emissions and/or improving air quality, based on specific initiatives to reduce pollutant emissions and the benefits of decarbonization, energy transition, and clean fuels. The main objectives are:

- Reduce criteria pollutant emissions to world-class standards and contribute to the improvement of air quality to protect the health of the environment.

- Adopt a Verified Inventory of Atmospheric Emissions in the assets operated by Ecopetrol.

- Contribute to achieving and sustaining the level of air quality in the areas of influence of the operations at the target levels specified in the WHO’s Air Quality Guide.

8

Prevention and remediation

The prevention and remediation of environmental impacts caused by operational and process safety incidents focuses on prevention, by incorporating proactive risk management and analyzing the potential materialization of environmental risks inherent to the different businesses of the Company, for which the five (5) lines of work below have been proposed:

- Proactive risk management.

- Incorporation of technology in the management of environmental information.

- Analysis for continuous improvement.

- Remediation and improvement of the condition.

- Impact on culture.

Ecopetrol aligns the pillars of the environmental strategy with applicable national and international commitments, such as the Paris Agreement, the Sustainable Development Goals, national policies, and the National Development Plan, among others, in order to leverage environmental goals and contribute to sustainable development in the country.

Similarly, the environmental strategy and the associated commitments are communicated to all Stakeholder Groups on a permanent basis and in accordance with their needs and expectations. In this regard, the Company publishes its strategy and commitments on its website and via external and internal communication, as well as the engagement plan with partners and environmental authorities, and other pertinent mechanisms.

For more information on the environmental strategy, visit the Ecopetrol website, under the TESG/Environmental section, or click here.

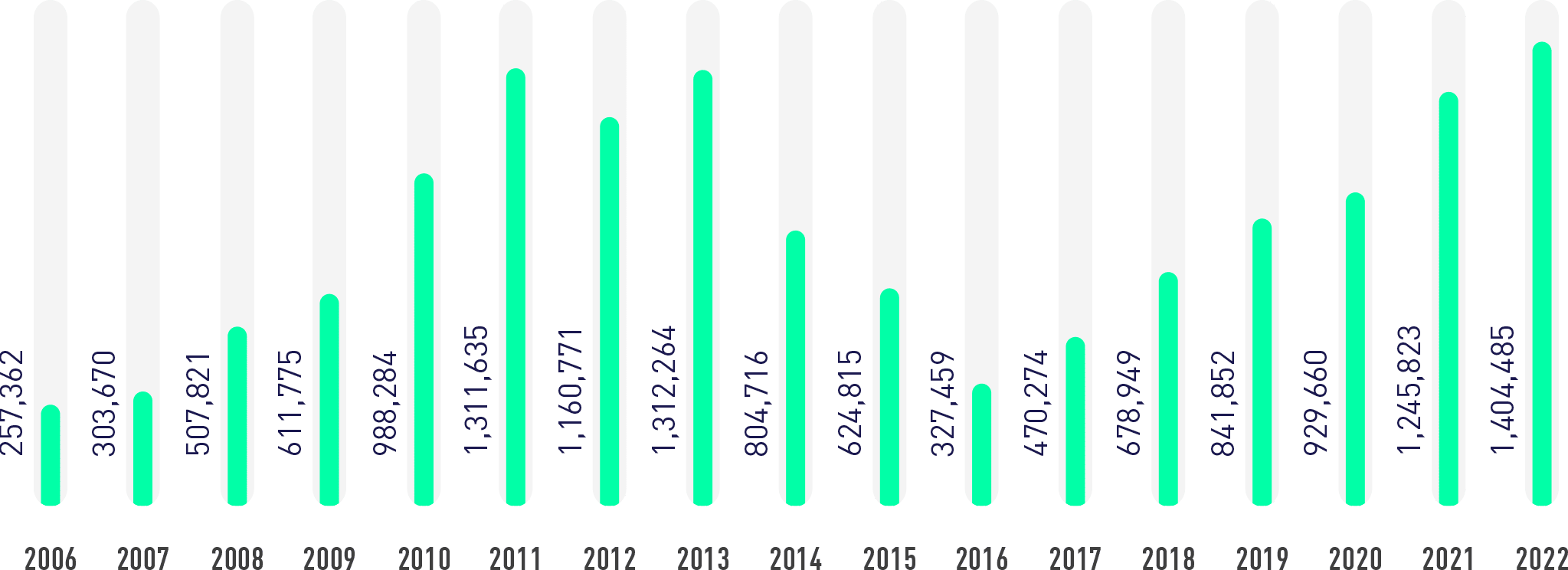

Environmental Investments and Expenses

In 2022, Ecopetrol invested roughly 1,404,485 TRILLION COP in environmental management. This information is presented in Figure 37 and it is reported to the Comptroller General of the Republic in the first quarter of each year.

This figure shows an 11% increase compared to 2021, mainly due to: operating investments due to administrative issues, water resource management, investment in forests, and projects associated with biodiversity.

The environmental management investment made in 2022 was distributed as follows:

1

182,617 BCOP allocated mostly to environmental activities such as environmental education,

dissemination of environmental activities, hiring of personnel for environmental management, preparation of environmental studies, and legal procedures, as well as the operation and maintenance of environmental monitoring equipment and networks.

2

67,773 BCOP allocated to the management of natural water resources, conveyed in water recovery and protection programs, the purchase and assembly of equipment to control and monitor the quantity and quality of surface and/or underground water resources, and the protection of water basins.

3

52,024 BCOP were intended for the recovery and protection of forests, including mandatory investments such as environmental compensation.

4

276,904 BCOP for air recovery and protection, with the acquisition of equipment and development of productive technologies to reduce atmospheric emissions.

5

200,225 BCOP for soil recovery and protection, represented in soil protection management and related physical works (geotechnical protection measures).

6

22,728 BCOP in biodiversity, represented in preservation and conservation projects, incorporating flora and fauna components. Some of the most significant projects include the Ecoreserves, participatory monitoring (biomonitors), and related genetic studies.

7

427.106 BCOP in drinking water and basic sanitation, conveyed in wastewater treatment projects, the construction and implementation of drinking water supply works, and the management and disposal

of solid waste and hazardous waste.

8

175.108 BCOP in risk management, represented in activities for the prevention of operational incidents that affect the environment and support in the development of environmental recovery plans and post-disaster activities.

Environmental Planning and Compliance

In terms of environmental planning, the guidelines for environmental viability diagnosis were updated in 2022 to incorporate the assessment of the impacts associated with strategic pillars in the early stages of the projects, based on the mitigation hierarchy, and incorporating early measures for the prevention and minimization of potential impacts and environmental risks.

Ecopetrol holds 426 current environmental authorizations issued by national and regional environmental authorities, distributed as follows:

| Business segment | Environmental Licenses/ Environmental Management Plans/ Environmental Management Measures | Permits for the use and exploitation of natural resources | Lifting of bans |

|---|---|---|---|

| Upstream (Exploration and Production) | 172 | 228 | 6 |

| Refining | 2 | 14 | 0 |

| Others | 0 | 4 | 0 |

3,902 administrative acts issued by environmental authorities were notified to Ecopetrol in 2022, of which 1,657 contained requirements that are subject to systematic monitoring at the strategic, tactical, and operating level, to ensure compliance in time, manner, and place of the obligations set forth by said authorities.

195 procedures were managed and filed with ANLA and the Regional Autonomous Corporations (CAR) in 2022, and the following environmental authorizations were obtained:

National Authority for Environmental Licenses (ANLA)

One (1) environmental license for PPII Kalé – YNC.

One (1) modification to the environmental license issued by Resolution 373 of 1998 for the Medina Occidental exploratory drilling area.

One (1) modification to the environmental license issued by Resolution 0886 of 1998 for the project in the area of the Cusiana TA development wells.

One (1) modification to the environmental license issued by Resolution 0617 of 1994 for the project in the area of the Cusiana R and V development wells.

One (1) modification to the environmental license issued by Resolution 944 of 1999, modified by Resolution 1224 of 2015 for the project in the Yaguará production field.

One (1) modification to the comprehensive environmental management plan – PMAI for Mares (Centro, Lisama, and Llanito Blocks).

One (1) modification to the comprehensive environmental management plan – PMAI for the Apiay Block.

44 environmental authorizations obtained through the legal channel referred to as minor changes with pronouncements.

Regional Autonomous Corporations (CAR)

68 environmental authorizations were obtained from the Regional Autonomous Corporations for the use and exploitation of natural resources in Ecopetrol fields.

In terms of environmental legal compliance, the guidelines for the Management of Environmental Legal Compliance Information were updated in 2022.

The annual Environmental Legal Compliance Index, to monitor compliance with the requirements, stood at 99.9%, the highest registered in Ecopetrol.

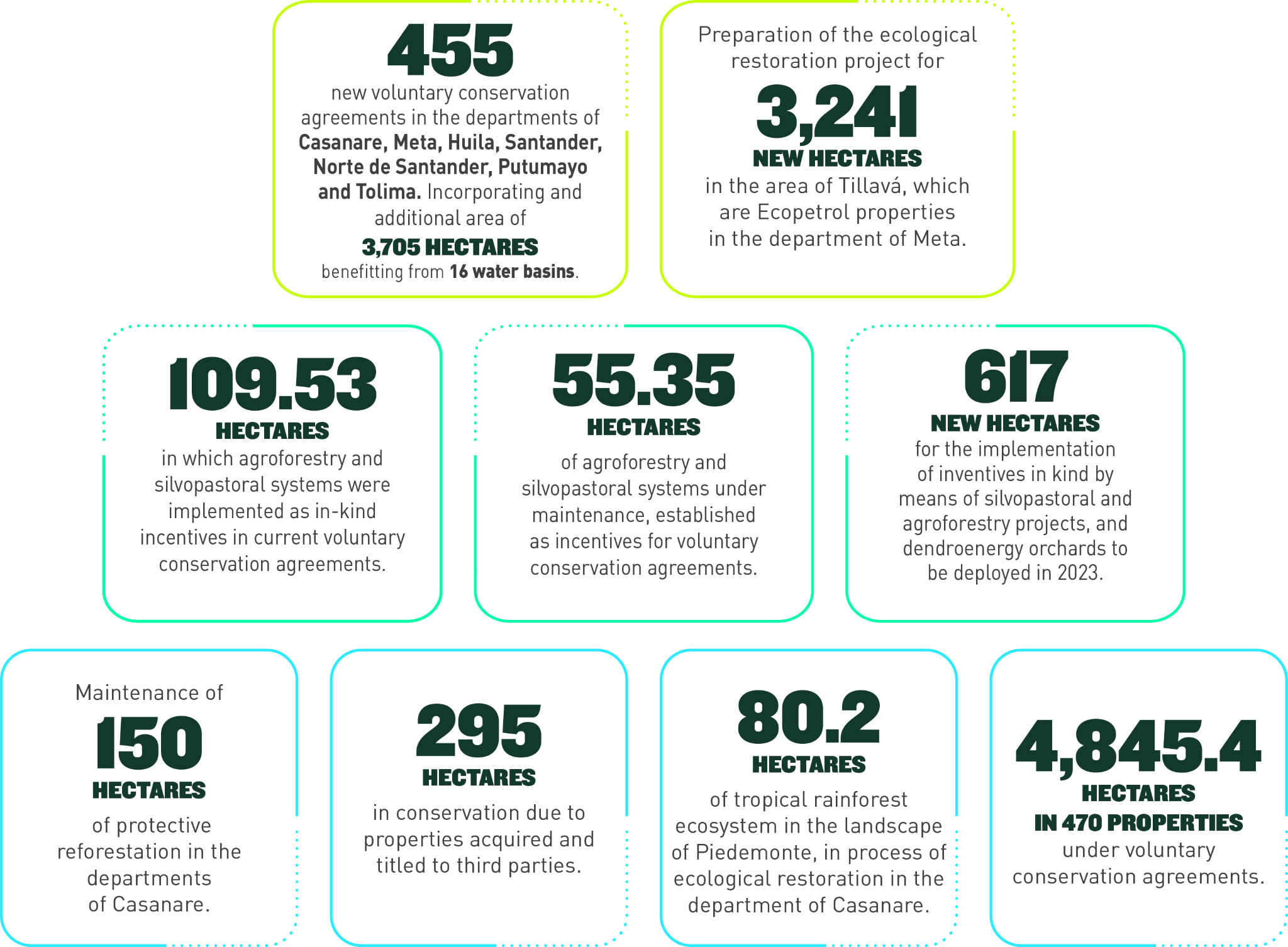

Compensation for the Use of Natural Resources

and Forced Investment of No Less Than 1%

The environmental obligations deriving from the use and exploitation of natural resources and the catchment of water from water basins are executed in accordance with the 1% investment plans and the compensation plans for the use and exploitation of natural resources approved by the environmental authority and incorporated into control and monitoring instruments (environmental licenses, management plans, and environmental permits).

As of December 31, 2022, Ecopetrol was executing 105 1% investment plans and 115 environmental compensation plans that will contribute to the conservation of biodiversity in 13,000 hectares.

The main mechanisms for complying with these obligations are:

The signing of voluntary conservation agreements with incentives in kind through the participation of local communities.

The acquisition of properties for protection, conservation,

and preservation purposes.

Actions for ecological restoration and the rehabilitation

and recovery of ecosystems.

Some of the main achievements attained in compliance with these obligations are:

- Signing of 455 new voluntary conservation agreements in the departments of Casanare, Meta, Huila, Santander, Norte de Santander, Putumayo, and Tolima, incorporating an additional conservation area of 3,705.17 hectares benefiting from 16 water basins.

- 295 hectares under conservation through properties acquired and titled in the name of regional authorities for conservation purposes.

- Agroforestry and silvopastoral systems were implemented in 109.53 hectares as an incentive in kind under the current voluntary conservation agreements.

- 617 new hectares for the implementation of incentives in kind, including silvopastoral and agroforestry projects and dendroenergy orchards to be deployed in 2023.

- 80.2 hectares of tropical humid ecosystems in the heart of Piedemonte undergoing ecological restoration in the department of Casanare.

- Conservation measures implemented in the 4,845.4 hectares part of the 470 properties under voluntary conservation agreements.

- Appraisal of the ecological restoration project of 3,421 new hectares in the heart of Tillavá, which are properties owned by Ecopetrol in the department of Meta.

- Maintenance of 150 hectares of protective reforestation in the department of Casanare.

- Maintenance of 55.35 hectares of agroforestry and silvopastoral systems and dendroenergy orchards established as incentives in the voluntary conservation agreements.

In 2022, a total of 9,747 hectares were covered with the activities of the environmental compensation plans and the forced investment of no less than 1%, by deploying conservation actions that include preservation, restoration, and sustainable use efforts.

The achievements in biodiversity and ecosystem services with the implementation of compensation plans for the biotic environment and the forced investment of no less than 1% in 2022 are shown in Figure 38 below:

Roadmap

Climate Change

Exceptional

Material Element

(GRI 3-3, 11-1-1) (WEF 7, 7E, 11E, 13E) (SFC XV)

| Impacted stakeholder groups | Areas that manage the impacts | Ecopetrol business line or segments generating the highest impact |

|---|---|---|

| Suppliers | VCU | Upstream |

| Associates and Partners | VAB | Midstream |

| Customers | VNE | Downstream |

| Employees | VCF | Commercial |

| Investors | VHSE | Low emission solutions |

| State | VPU | |

| Society and Community | VRP | |

| VSE |

Why is the Element Material?

GHG emissions, including methane, and their effect on global temperature rises, are considered a negative impact due to the changes generated in long-term climate conditions, evinced in the occurrence of extreme weather events ( floods and droughts) that mainly affect the most vulnerable populations, as well as the right to a healthy environment, personal safety, water, and development, among others. Given the above, Ecopetrol defined climate change as an exceptional material element, establishing a roadmap with short, medium, and long-term actions to manage its impacts.

The identification of low emission solutions and the consolidation of mitigation programs in the direct operations of the Company alleviates the effects of climate change and generates positive economic impacts, process efficiencies, and GHG emission reductions.

In the same way, the consolidation and development of Natural Climate Solution projects (avoid deforestation, restoration, reforestation, and rehabilitation) generate a positive impact on strategic ecosystems with tangible benefits for the communities, and also enable the options for the compensation of GHG emissions.

The operations undertaken by the Company in the production, transport, refining, and trading of hydrocarbons and their derivatives have an impact on climate change due to GHG emissions that may alter future climate conditions and cause changes in the climate dynamics of the territories.

Ecopetrol advances in the analysis of climate scenarios based on science, to dive into the identification of physical and transition risks, as well as financial and strategic impacts on the management of the Company.

Policies

and Commitments

In developing the 2040 Strategy and the Environmental Strategy, the Ecopetrol Group announced its plan towards net zero carbon emissions by 2050 (Scopes 1 and 2). This plan includes the goal of reducing 50% of its Scope 1, 2, and 3 emissions by 2050, and 25% of its Scope 1 and 2 emissions by 2030, compared to 2019. This commitment includes compliance with other international agreements, such as the methane reduction initiative of the Climate and Clean Air Coalition (CCAC) led by the United Nations and the “Zero Routine Flaring by 2030” initiative led by the World Bank. Additionally, the Company has an annual emission reduction goal in pursuit of advancing the Company’s compliance levels in the medium and long term.

The GHG emissions target for 2022 was 262,761 tCO2eq, which was exceeded by 59% with 416,672 tCO2eq.

(GRI 3-3-d) (SASB EM-EP-110a.3) (SFC XV, XVII) (TCFD M-1.2.1)

How is the Material

Element Managed?

In developing the environmental strategy, Ecopetrol has adopted a strategic pillar known as Climate Action, which seeks to maintain a low carbon emission operation, decrease the vulnerability of the infrastructure and the operations to climate variability and change, as well as adequately manage risks and identify opportunities associated with climate change. This strategic pillar includes five main areas:

To achieve the goals and contribute to the mitigation of climate change impacts, the Company has defined the decarbonization plan focused on the following measures:

Permanent updating and continuous verification of the GHG inventory by a third party every two (2) years.

Identification, development, and implementation of operating initiatives associated with energy efficiency, renewable energy, reduced flaring and fugitive emissions, and venting (methane).

Development of emerging technologies such as green hydrogen (H2) and CCUS.

Implementation and consolidation of a compensation portfolio through Natural Climate Solutions, to offset residual emissions that cannot be avoided or reduced in the operation and which can, in turn, generate social and environmental benefits.

Diversification towards low emission businesses and optimization of the current portfolio by means of economic instruments such as the internal carbon price.

How is the material

element evaluated?

It is evaluated by monitoring the advancement and compliance with the actions established in the TESG roadmap for the climate change element and the management indicators of the Company’s Balanced Management Board (TBG), which includes the GHG emissions reduction indicator.

Progress is also measured in specific programs:

- (i) Energy efficiency.

- (ii) Renewable energy.

- (iii) Reduction of flaring and fugitive emissions.

- (iv) Natural Climate Solutions projects, among others.

With regard to the climate-related physical and transition risks that may affect the operation, the facilities, and the environment, the Company monitors the treatment actions, controls, and KRIs through the “Inadequate climate change and water management” business risk.

Short, Medium, and Long

Term Goals and Projects

Short Term (2023-2024)

Update and verify the GHG inventory every two

(2) years.

Reduce 1.6 tCO2e (2020-2024).

Implement operating reduction projects.

Produce roughly 900 MW of renewable energy for

self-generation by 2025.

Develop Natural Climate Solution -SNC projects.

Medium Term (2025-2030)

Reduce 25% of GHG emissions by 2030 (Scopes 1 and 2).

Zero Routine Flaring by 2030.

Produce 50,000 t of green hydrogen by 2030.

Increase energy efficiency +6% by 2030.

Incorporate 1,000 MW

of renewable energy by 2030.

Capture between 2-4 MtCO2e through Natural Climate Solutions (SNC) by 2030.

Long Term (>2030)

Net zero emissions by 2050 (Scopes 1 and 2).

Reduce 50% of Scope 1, 2, and 3 emissions by 2050.

Produce 1 Mt of hydrogen by 2040.

Gradually incorporate projects associated with H2 and CCUS.

Consolidate the project portfolio into Natural Climate Solutions to capture between 2-4 MtCO2e per year.

Increase energy efficiency by approximately 10% by 2040.

Main Achievements in the Management

of the Climate Change Roadmap

Reduction of 416,672 tCO2e (2020-2022) in energy efficiency and renewable projects, among others. Accumulated reduction of 910,113 tCO2e (2020-2022).

586,226 tCO2e verified by a third party.

95% of production assets operated with methane detection and measurement. 1,699 leaks fixed out of the 1,690 planned.

Implementation of the internal carbon price as a mandatory variable for economic evaluation to adopt decisions on current and future investments.

Natural Climate Solution projects with Fundación Natura, TNC, WCS, and Conexión Jaguar – ISA, which enable the capture of 1.3 Mt of CO2e.

Subsidiaries Cenit, ODL, ODC, Bicentenario, Ocensa, and Esenttia obtained the Carbon Neutrality certification.

Sale of 4 million barrels of Castilla Blend crude and 300,000 barrels of offset extra-carbon gasoline.

Publication of three (3) decarbonization clauses to promote mitigation actions in the supply chain.

In 2022, the CDP (Disclosure Insight Action) acknowledged Ecopetrol for the results and leadership in the development of its Climate Change program with an A- rating, which positions the Company as an industry, regional, and global benchmark on the subject matter.

Climate Change Management

and Governance

The Board of Directors defines and supervises the strategy defined by Ecopetrol and its Group. They permanently monitor and address issues associated with the TESG pillar under the 2040 Strategy, which includes climate change and the energy transition, among other topics.

The Company’s senior management plays a fundamental role in executing the strategy defined by the Board of Directors, while integrating climate-related metrics and defining the short, medium, and long-term action plan.

- Presidency (CEO):

responsible for steering and managing the Company. He is responsible for the Company’s Balanced Management Board and for reporting on the progress made to the Board of Directors. - Executive Vice Presidency of Operations:

leads the Company’s operations, the execution of the initiatives associated with the Decarbonization Plan, and the implementation of the Net Zero Emissions strategy for the hydrocarbons business, as well as the objective of improving fuel quality. - Vice Presidency of Low Emission Solutions

leads the advancement of the Company’s energy transition, integrating the areas of gas, biogas, liquefied petroleum gas (LPG), energy, renewables, hydrogen, and CCUS. - Vice Presidency of Corporate Strategy and New Businesses:

designs the energy transition strategy, including the generation of low emission opportunities. - HSE Vice Presidency:

guides climate change, the circular economy, and biodiversity efforts through the Sustainability and Decarbonization Management team. Specifically in terms of climate change, it leads the implementation of the Decarbonization Plan, defines emission reduction and compensation goals, manages the Atmospheric Emissions Management System (SIGEA), defines the guidelines for the management of emission compensations, and sets climate change adaptation measures to reduce climate-related vulnerabilities and risks. - Vice-Presidency of Corporate Affairs and Secretary General:

ensures the governance of the different reporting instruments (including RIGS, DJSI, and CDP Climate Change and Water, among others), the monitoring and analysis of the “Generating Value with TESG” pillar, and the roadmaps of the material elements. - Corporate Vice Presidency of Compliance:

responsible for the SRI and the management of business risks, including those associated with climate change and the energy transition. - Corporate Vice Presidency of Finance:

leads the implementation and analysis of the internal carbon price, and responsible for portfolio management and capital allocation. Evaluates and analyzes the financial impact of climate-related risks and opportunities and sustainable financing alternatives. Similarly, it leads the engagements with investors such as Climate Action 100+ and Net Zero Asset Managers Initiative, risk rating agencies and environmental, social, and governance radars-ESG (e.g.: MSCI, Sustainalytics, and others). It is responsible for the coordination and publication of the TCFD and SASB reports. - Upstream Vice Presidency:

leads the implementation of decarbonization projects and climate change adaptation measures for exploration and production operations. - Marketing Vice Presidency:

participates in the process of estimating GHG emissions from hydrocarbon operations until they are marketed, and manages the acquisition of carbon credits to supply the internal demand of the Ecopetrol Group and to offset the emissions associated with some products marketed by the Company. - Vice Presidency of Refining and Industrial Processes:

responsible for the identification, evaluation, and implementation of initiatives aligned with the Company’s energy transition, decarbonization, and integrated water management strategy. - Vice Presidency of Science, Technology, and Innovation:

leads the technological and digital transformation to leverage the TESG pillar under the 2040 Strategy, as well as the decarbonization and energy transition process.

(GRI 11-2-2) (TCFD -1.2, E-1.3, GR-1.2) (SFC XV)

Climate-related risks

In 2022, Ecopetrol advanced in the process of identifying and evaluating physical and transition climate risks, considering short, medium, and long-term climate scenarios.

Physical and transition risks are often seen as opposites. The greatest transition risks are associated with the most aggressive reduction policies, such as the goal of net zero emissions, while physical risks are greater in lax policy scenarios, in which emission increases are expected to cause more extreme weather events. Accordingly, the IEA, the IPCC, and the SSP have set in motion multiple future climate scenarios that capture a series of policy decisions and climate outcomes.

Ecopetrol identified and analyzed seven (7) physical risks related to chronic threats (drought and thermal stress) and acute threats (precipitation, coastal flooding, river flooding, fires, and winds) in 95 sites associated with the Group’s most important assets. The modeling was conducted using Cervest’s EarthScan platform with the following IPCC scenarios:

- (i) Scenario aligned with the objective of the Paris Agreement (SSP1- RCP2.6).

- (ii) Peak emissions scenario in 2040 (SSP2- RCP4.5).

- (iii) Business as usual scenario (SSP5- RCP8.5).

EarthScan uses regional climate models with diverse data sets to analyze the physical vulnerability of assets, relative to the potential impact of climate hazards. The probability and severity of climate events are estimated up to 2100.

In terms of transition risks, six (6) market, technology, reputation, and regulation-related risks were identified. Market and regulatory risks were prioritized for the modeling, using the following analysis avenues:

- (i) Quantification of the impact on income arising from a changing demand for hydrocarbons.

- (ii) Quantification of the impact on costs due to changes in carbon prices.

- (iii) quantification of the financial repercussions deriving from higher abatement costs due to limitations on the use of compensations.

The model used the scenarios in the 2022 WEO of the International Energy Agency:

- (i) Net Zero Emissions (NZE).

- (ii) Announced Pledges Scenario (APS).

- (iii) Stated Policies Scenario (STEPS).

(GRI 11-2-2) (SFC XV) (TCFD E-1.3)

Impact of Climate-related Risks

on the Organization’s Business,

Strategy, and Financial Planning

The physical risks arising from climate change can cause (acute) events, which are related to climate variability phenomena such as the “El Niño” or “La Niña”, in the case of Ecopetrol, or long-term (chronic) changes in weather patterns. Physical risks may entail financial repercussions for the Company, such as direct damage to assets or indirect impacts caused by interruptions in the production chain.

In 2022, Ecopetrol conducted the assessment of physical risks in its assets in Colombia to understand the Company’s vulnerability to future climate scenarios. The results showed that the increase in maximum temperatures and the duration of heat waves pose the greatest threats to the entire asset portfolio. This is one of the most important risks in terms of worker safety and even operating interruptions. However, it is not expected to have a direct impact on the infrastructure. Moreover, six (6) locations are at substantially higher risk of coastal flooding (including the Cartagena refinery), and more moderate river flooding is anticipated at four locations (including the Barrancabermeja refinery).

The rest of climate threats are not expected to increase substantially across the portfolio.

To mitigate potential impacts and guarantee the continuity of activities in the event of prolonged weather events, Ecopetrol has implemented regional climate variability adaptation plans, which incorporate measures for water resource management, climate resilient infrastructure, restoration and conservation of strategic ecosystems, and climate compatible operations.

With regard to the impact on financial planning, based on the assessment of the physical risks, Ecopetrol will advance in the estimation of potential losses in the assets with the highest probability of being impacted by the materialization of risks. Based on the analysis of financial implications, the Company will define actions to reduce the impact on its business strategy.

The transition to a low carbon economy may entail political, legal, technological, and market changes to address mitigation and adaptation requirements related to climate change. Depending on the nature, speed, and focus of these changes, transition risks can exert different levels of financial and reputational impacts on the organizations.

(GRI 201-2, 11-2-2) (TCFD GR-1.1) (SFC XV)

The evaluation conducted by Ecopetrol in 2022 included stress tests on the long-term strategy of the upstream asset portfolio. The portfolio’s resilience was evaluated by comparing the VPN of future cash flows from IEA scenarios with the VPN of Ecopetrol’s base case. In both cases, the hypotheses associated with the analysis avenues were applied. However, this first analysis will be subject to review and assessment to determine the potential impact on the Company’s financial and strategic planning.

The process of identification and evaluation of climate-related risks (physical and transition) is conducted in line with Ecopetrol’s risk management framework, TCFD guidelines, and best practices in the sector. The process broadly considers the following elements, which must be discerned separately into physical and transition risks:

Plan:

defining the context in which the external climate-related physical, regulatory, market, technological, and reputational risks that could materially impact the business are monitored. The methodology and parameters for modeling are also established.

Identify:

based on the analysis of the internal and external context, threats and opportunities, uncertainties, sources of risk, vulnerabilities, and capacities, with the purpose of defining the risks that can positively or negatively divert the Company’s achievement of its strategic objectives.

Measure and evaluate:

risk assessment based on the defined parameters, hypotheses, and data to measure the impact on the company. The appetite, or level of risk that the company is willing to accept without taking measures must be defined, which will set an important precedent to assess the risk and to make decisions on the approach to be adopted. Risk assessment helps sustain the decisions adopted for future actions in each company, as well as the processes, activities, businesses, and others, and the prioritization thereof to guarantee that the available resources are used to address the most critical aspects.

Respond:

the company must evaluate the results of the risk assessment and determine specific action plans to mitigate or adapt to those that exceed a specific threshold for action. Response plans can be proactive (e.g. divestment or investment in an asset, engineering controls) or reactive (e.g. reinforcing emergency response plans, improving employee communication mechanisms), while action plans must assign responsible parties and be integrated into the company’s annual risk management process.

Monitor and review:

according to the review cycles determined by risk management and the strategy, the parties responsible for the action plans must evaluate whether the interventions and actions have given the expected results, or if they need to be adjusted or modified. The team must review whether the initial hypotheses and the data used are still valid or need to be reassessed. The company must also monitor risk exposure and compare actual and projected impacts to validate and improve the modeling.

Report:

the company must document the results of the risk assessment, the measures adopted, the hypotheses, and the impact, to include them in the reports submitted to the parties interested in risk management, which must back the duties and responsibilities of senior management in this regard, as well as those of the Committees and the Board of Directors.

The foregoing must be based on Ecopetrol’s Comprehensive Risk Management System, in alignment with ISO 31000 and COSO ERM 2017.

To manage climate-related risks, Ecopetrol incorporated “Inadequate climate change and water management” into the business risk map, which includes nine (9) mitigation measures, five (5) KRIs, and 10 controls associated with the process. This is reviewed annually within the framework of the risk management cycle. The appraisal scenarios and mitigation measures will be updated in 2023 based on the analysis of physical and transition risks.

Monitoring the Effectiveness of the Measures Adopted

The effectiveness of the actions and measures adopted to mitigate GHG emissions is monitored using the “Decarbonize operations: GHG reduction KRI” indicator, which is monitored monthly and reported quarterly. This indicator is part of the Ecopetrol Group’s Balanced Management Board (TBG) and Long-Term Incentive Plans (ILP), directly monitored by the Board of Directors.

Similarly, there is a business risk called “Inadequate Climate Change and Water Management,” which monitors compliance with emission reduction goals, as well as other specific climate change actions and controls such as the evaluation of internal carbon price guidelines, cost-effective technologies for water management and decarbonization, the probability of occurrence of extreme weather events, the monitoring of climate change regulations, among others.

Lessons Learned and Incorporation into

the Company’s Operating Policies and Procedures

The reduction of GHG emissions, as the main measure to mitigate the effects of climate change, is incorporated at various levels of the Company. In terms of the “Energy that Transforms” long-term business strategy, it is linked to the areas of “Growing with the energy transition” through the diversification of energy and low emission businesses, and “Generating value with TESG” through the acceleration and prioritization of decarbonization and energy efficiency, and the Risk Management System through the “Inadequate climate change and water management” business risk, against which operating actions have been implemented to minimize the materialization thereof. Similarly, the Company is conducting a more detailed analysis of physical and transition risks based on climate scenarios, in order to identify new opportunities and measures to mitigate strategic and financial climate-related impacts that can be incorporated into its financial and risk procedures.

How are Stakeholders Involved in

Taking Action to Manage Climate Change?

Climate change management involves different Stakeholder Groups:

Shareholders and investors:

constant interactions with this Stakeholder Group to address requirements and requests in this regard, in pursuit of demonstrating the adoption of real commitments for the management of GHG emissions and a fair and gradual energy transition that positively impacts their investments.

(GRI 305-1, 11-1-5, 11-1-6, 11-1-7) (WEF) (TCFD)

Metrics

The GHG emissions target for 2022 was 262,761 tCO2eq, which was exceeded by 59%, with 416,672 tCO2eq.

| Emissions | Unit of measurement | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Gross value of direct GHG emissions (Scope 1) | TonCO2e | 14,448,557 | 13,418,819 | 13,436,094 | 13,309,595 |

| Gross value of indirect GHG emissions when generating energy (Scope 2) | TonCO2e | 636,803 | 859,944 | 574,750 | 416,501 |

| Gross value of other indirect GHG emissions (Scope 3) | TonCO2e | 144,502,609 | 139,526,904 | 137,264,619 | 150,528,333 |

Nota 1. Para este cálculo los gases incluidos son: CO2, CH4 y N2O.

Note 2. Ecopetrol’s atmospheric emissions inventory for Scopes 1 and 2 is structured under the operational control approach. As recommended by ISO 14064 -1 and the GHG Protocol, base year emissions must be recalculated each time a company experiences major changes such as acquisitions, divestitures, and mergers, as well as significant changes in the emissions estimation methodology. This is recalculated not only for the base year but also for the historical series in order to maintain consistency in the reported data. In accordance with the foregoing, the emissions in the base year (2019) and in the historical series have been recalculated considering the following:

* Bottom-up and top-down methane measurements taken in the production segment, as part of the Company’s plan to improve the detection, quantification, and closure of fugitive and vented emissions, covering 95% of the Company’s facilities; adjustment and construction of own emission factors, and changes in the emission estimation methodology. These adjustments represent increased emissions in the order of 2.4 million tons of CO2e/year.

* The reversal of the Nare asset in the production segment, which increases by approximately 0.9Mt of CO2e.

* The update of the inventory in accordance with the NTC ISO 14064 – 2020 version, including transportation emissions in Scope 1 (these emissions were being reported in Scope 3).

Note 3. The 2022 report shows a significant reduction in Scope 2 emissions (28%), mainly due to changes in the sources of electricity generation, which are less CO2 intensive. The emissions data for Scope 3 is structured under the operational control approach (same as Scope 1 and 2). The emissions associated with Ecopetrol S.A. and the Cartagena Refinery are estimated accordingly. Emissions increased in 2022, mainly due to rises in: i) national fuel sales (gasoline, diesel, and gas), ii) national crude oil purchases (for loading in refineries), and iii) refined product imports (especially gasoline).

Note 4. i) Data adjusted based on the update of the 2019, 2020, and 2021 SIGEA ii) The data for 2022 corresponds to information inventoried for the first 10 months of the year, and averaged for the months of November and December. This data may change once the final information is available.

(GRI 305-1, 305-2, 305-3, 11-1-5, 11-1-6, 11-1-7) (WEF 7,7E) (TCFD M1.2.1)

| Emissions | Unit of measurement | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Scope 1 biogenic CO2 emissions | TonCO2e | 1,254 | 1,222 | 1,115 | 1,005 |

| Scope 2 biogenic CO2 emissions | TonCO2e | 0 | 0 | 0 | 0 |

| Scope 3 biogenic CO2 emissions | TonCO2e | 265,184 | 224,087 | 276,338 | 297,901 |

*Biogenic GHG emissions are the emissions from the combustion of biomass or derivative fuels (e.g., biodiesel and fuel alcohol), which are considered neutral, since they are generated in the natural carbon cycle.

Note. i) Data adjusted based on the updates of the 2019, 2020, and 2021 SIGEA ii) The data for 2022 corresponds to information inventoried for the first 10 months of the year, and averaged for the months of November and December. This data may change once the final information is available.

(GRI 11-1-5, 11-1-6, 11-1-7) (WEF 7, 7E) (SASB EM-EP-110a.1) (TCFD M-1.2.1)

- Compendium of Greenhouse Gas Emissions Estimation Methodologies for the Oil and Gas Industry – API

- FECOC

- UPME

- AP-42

- ARPEL

- CORINAIR

(SASB EM-EP-110a.1) (WEF 7,7E) (TCFD M-1.2.1)

| Emissions | Unit of measurement | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Carbon dioxide (CO2) emissions | TonCO2e | 5,931,131 | 5,714,216 | 5,519,952 | 5,342,845 |

| Methane (CH4) emissions | TonCO2e | 2,736,389 | 2,784,829 | 2,737,323 | 2,670,270 |

| Nitrous oxide (N2O) emissions | TonCO2e | 22,455 | 23,207 | 22,468 | 21,167 |

| Hydrofluorocarbon (HFCs) emissions | TonCO2e | NA | NA | NA | NA |

| Perfluorocarbon (PFCs) emissions | TonCO2e | NA | NA | NA | NA |

| Sulfur hexafluoride (SF6) emissions | TonCO2e | NA | NA | NA | NA |

| Nitrogen trifluoride (NF3) emissions | TonCO2e | NA | NA | NA | NA |

| Scope 1 gross global emissions | TonCO2e | 8,689,974 | 8,522,251 | 8,279,742 | 8,034,282 |

| Percentage of methane (CH4) | % | 31.5 | 32.7 | 33.1 | 33.236 |

Note 1. The consolidated emissions from the exploration and production segment of the hydrocarbon business line are reported.

Note 2. The option of Not Applicable is given to Hydrofluorocarbon Emissions (HFCs), Perfluorocarbon Emissions (PFCs), Sulfur Hexafluoride Emissions (SF6), and Nitrogen Trifluoride Emissions (NF3), which are not part of Ecopetrol’s emissions inventory.

Note 3. The disaggregated emissions of each of the pollutants measured in the inventory are reported in the Exploration and Production segment for Scope 1. The sum of the three (3) GHGs reported (CO2, CH4, and N2O) is equivalent to Scope 1 emissions for this segment.

(SASB EM-EP-110a.1) (WEF 7,7E) (TCFD M-1.2.1)

| Emissions | Unit of measurement | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Carbon dioxide (CO2) emissions | GWP | 1 | 1 | 1 | 1 |

| Methane (CH4) emissions | GWP | 28 | 28 | 28 | 28 |

| Nitrous oxide (N2O) emissions | GWP | 265 | 265 | 265 | 265 |

| Hydrofluorocarbon (HFCs) emissions | GWP | NA | NA | NA | NA |

| Perfluorocarbon (PFCs) emissions | GWP | NA | NA | NA | NA |

| Sulfur hexafluoride (SF6) emissions | GWP | NA | NA | NA | NA |

Note 1. The consolidated emissions from the exploration and production segment of the hydrocarbons business line are reported.

Note 2. The option of Not Applicable is given to Hydrofluorocarbon Emissions (HFCs), Perfluorocarbon Emissions (PFCs), Sulfur Hexafluoride Emissions (SF6), and Nitrogen Trifluoride Emissions (NF3), which are not part of Ecopetrol’s emissions inventory.

(SASB EM-EP-110a.1) (WEF 7,7E) (TCFD M – 1.2.1)

Emissions Under

Regulatory Limits

No information associated with this indicator is reported because there is no regulation associated with said emissions (or the methane emitted) in Colombia; therefore, a percentage covered under the regulatory limit of GHG emissions is not applicable.

(SASB EM-EP-110a.1) (WEF 7,7E) (TCFD M-1.2.1)

| Scope 1 gross global emissions | Unit of measurement | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Amount of hydrocarbons burned- flaring | TonCO2e | 1,167,505 | 921,565 | 905,422 | 953,120 |

| Amount from other combustions | TonCO2e | 4,705,861 | 4,713,633 | 4,536,010 | 4,274,770 |

| Amount of process emissions | TonCO2e | 2,413,994 | 2,475,349 | 2,439,135 | 2,430,017 |

| Amount of vented emissions | TonCO2e | NA | NA | NA | NA |

| Amount of fugitive emissions from the operation | TonCO2e | 402,613 | 411,704 | 399,165 | 376,375 |

| Amount of Scope 1 gross global emissions | TonCO2e | 8,689,974 | 8,522,251 | 8,279,742 | 8,034,282 |

Note 1. The consolidated emissions from the exploration and production segment of the hydrocarbons business line are reported.

Note 2. The process emissions category includes emissions associated with gas treatment, storage tank venting, and well venting.

(GRI 305-4, 11-1-8) (TCFD M-1.2.1)

GHG Emissions

Intensity

The intensity of the upstream segment is estimated by dividing Scope 1 and 2 emissions generated in the segment into production, which includes crude oil, gas, and white products, expressed in terms of barrels of oil equivalent -BOE-, under the organizational limit set by operating control.

The intensity of the downstream segment is estimated by dividing Scope 1 and 2 emissions generated in this segment into the annual inflows to the Barrancabermeja and Cartagena refineries, expressed in terms of barrels of oil equivalent -BOE-, under the organizational limit set by operating control.

(GRI 305-4, 11-1-8) (TCFD M-1.2.1)

| Process | Unit of measurement | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Production | KgCO2e/BOE | 40.39 | 43.51 | 43.36 | 41.46 |

| Refining and petrochemical | KgCO2e/BOE | 41.95 | 41.59 | 39.68 | 40.12 |

Note 1: i) Data adjusted based on the updates of the 2019, 2020, and 2021 SIGEA; ii) The data for 2022 corresponds to information inventoried for the first 10 months of the year, and averaged for the months of November and December. This data may change once the final information is available.

Note 2. The carbon intensity of the production segment underwent significant changes throughout the historical series, mainly associated with the inclusion in the inventory of bottom up and top down methane measurements taken from the different assets of the Company and the reversal of the Nare asset.

Note 3. The gases included in the table are CO2, CH4, and N20.

(GRI 305-5, 11 -2 -3, 11-1-7) (TCFD M-1.2.1) (WEF 7, 7E) (SFC XV, XVI)

Reduction of GHG Emissions

| Emissions | Unit of measurement | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Energy efficiency | TonCO2e | 161,473 | 128,596 | 186,713 | 154,976 |

| Fugitive and vented emissions | TonCO2e | 0 | 23,257 | 59,817 | 101,602 |

| Flaring optimization | TonCO2e | 210,370 | 47,994 | 45,135 | 150,852 |

| Renewable energy | TonCO2e | 8,760 | 0 | 1,929 | 9,243 |

Note: i) Data adjusted based on the updates of the 2019, 2020, and 2021 SIGEA; ii) The data for 2022 corresponds to information inventoried for the first 10 months of the year, and averaged for the months of November and December. This data will change once the final information is available.

(GRI 11-2-3) (TCFD M-1.2.1)

| Description of the initiative | Gases included in the calculation | Scopes that presented reductions | Standards or methodologies used for the calculation | Development stage |

|---|---|---|---|---|

| Energy efficiency: Includes projects associated with changes in the energy matrix for another with less impact and process optimization. 76 projects were executed in the period of 2019 – 2022 (3 in 2019, 14 in 2020, 24 in 2021, and 35 in 2022). | CO2 CH4 N2O | Scope 1 | Reductions estimated through mass balance and/or emission factors in Ecopetrol’s own calculation model. | Implemented |

| Fugitive and vented emissions: Includes projects associated with the elimination of leaks and venting in the processes. 18 projects were executed in the period of 2019 – 2022 (6 in 2020, 8 in 2021, and 4 in 2022). | CH4 | Scope 1 | Reductions estimated through mass balance and/or emission factors in Ecopetrol’s own calculation model. | Implemented |

| Flaring optimization: Includes projects associated with the flaring optimization volumes through the sale, self-generation, or optimization of the process. 19 projects were executed in the period of 2019 – 2022 (2 in 2019, 6 in 2020, 9 in 2021, and 7 in 2022). | CO2 CH4 | Scope 1 | Reductions estimated through mass balance and/or emission factors in Ecopetrol’s own calculation model. | Implemented |

| Renewable energy: Includes projects associated with the generation of energy based on renewable sources. 7 projects were implemented in the period of 2019 – 2022 (1 in 2019, 2 in 2021, and 4 in 2022). | CO2 | Scope 2 | Reductions estimated through mass balance and/or emission factors in Ecopetrol’s own calculation model. | Implemented |

Note: Ecopetrol establishes an emissions reduction goal each year, which is defined based on the implementation of new projects in the different operating areas of the Company. For this report, projects of the same type were grouped into four (4) large programs defined in the climate change roadmap (energy efficiency, fugitive, and vented emissions, flaring optimization, and renewable energy). The reductions reported each year for the four (4) programs were estimated using the immediately preceding year as the reference year. Accordingly, N/A is selected in the box labelled “reference year for the calculation of reduction”.

(GRI 11-2-3) (TCFD M-1.2.1)

The implemented emission reduction projects are quantified through mass balance and emission factors. The reference emission factors below are used for the calculation:

- Compendium of Greenhouse Gas Emissions Estimation Methodologies for the Oil and Gas Industry

- FECOC

- UPME

- AP-42

Management Strategy for Fugitive

and Vented Emissions and Flaring

Ecopetrol has implemented a fugitive and vented emissions management strategy, approved in 2020 by the Executive Committee – ExCo, with the following lines of action:

Update and adjustment of the inventory, construction of own emission factors, and definition of reduction goals.

Incorporation of design criteria and best engineering practices to reduce fugitive and vented emissions.

Implementation of the methane emission leak detection and repair program (LDAR – Leak Detection and Repair).

Within the framework of the Coalition for Climate and Clean Air (CCAC), a UN-led initiative that Ecopetrol has been a member of since 2019, the Company adhered to OGMP 2.0 in 2020 (Oil and Gas Methane Partnership), by acquiring the following commitments:

- Defining a methane goal that leverages compliance with the sectoral goal proposed by CCAC member companies to reduce methane emissions by 45% by 2025 and between 60% to 75% by 2030 over the levels estimated for 2015.

- Reaching level 4/5 proposed by the CCAC, for which the following actions are necessary: i) increase direct measurements by combining bottom up and top down technologies, ii) calculate own emission factors, and iii) generate higher levels of transparency and credibility in the reports.

- Attaining measurement level 4/5 by 2024 in 100% of the assets operated directly, and by 2026, in 100% of the assets not operated directly.

The following activities have been furthered to meet these commitments:

- Detection and quantification of fugitive and vented emissions using different state-of-the-art technologies such as infrared cameras and flow meters (bottom up approach), as well as analysis of satellite images and flights with methane sensors (top down approach), covering close to 95% of the Company’s operations.

- Update and adjustment of the inventory based on own emission factors built from bottom up and top down measurements taken in the field.

- Repair program for identified leaks, repairing more than 1,800 leaks and reducing more than 100,000 tons of CO2e, including Hocol.

With regard to the reduction of flaring, Ecopetrol aims to eliminate its routine flaring by 2030, in line with the World Bank’s “Zero Routine Flaring by 2030” initiative, through which it seeks to terminate routine flaring in existing fields as soon as possible and no later than 2030, and not conduct routine flaring in new oilfield developments.

Internal Carbon Price

In 2022, Ecopetrol approved the Internal Carbon Price as a mandatory variable, established as a base scenario in the economic evaluation to adopt current and future investment decisions. This scenario considers the impact of Scope 1 and 2 GHG emissions on Net Present Value (VPN, as per its Spanish acronym) and mitigation alternatives. The Company annually reviews the value assigned to the Internal Carbon Price, with a price curve that currently stands at 20 US/tCO2e and rises to 40 US/tCO2e by 2030.

(ECP 007) [gri src=”11-2-4″]

Participation in Climate

Change Public Policy

Ecopetrol takes on the challenges of the energy transition by seeking a balance between its contribution to mitigate the effects of climate change and the development and socioeconomic well-being of the country.

To this end, the Company contributes to the construction and discussion of climate change policies and regulations in different spaces and initiatives, both at the public and private level. Since 2022, it has been a member of Asocarbono (Colombian Association of Carbon Market Actors), whose purpose is to review government regulatory propositions and issue recommendations. Similarly, it is part of ANDI’s (National Association of Industrialists) environmental committee, where regulatory issues on climate change are discussed and proposals are generated in line with the purposes of each organization. At the public level, Ecopetrol has a direct relationship with the Ministry of Mines and Energy and the Ministry of Environment and Sustainable Development, to address the regulatory agendas of the oil and gas sector.

In 2022, we participated in the following regulatory consultations:

- Draft resolution “Regulating the conditions, criteria, and requirements for validation and verification processes in greenhouse gas mitigation initiatives and also issuing other provisions”.

- CONPES Document “Energy Transition Policy”.

- Foundations of the 2022-2026 National Development

- Plan, on issues related to climate change.

- Draft decree “Regulating Articles 22 and 57 of Law 2099 of 2021 issued by the MME on Carbon Capture, Use, and Storage (CCUS) technologies”.

- “Guidelines for the preparation of Comprehensive Management Plans for Business Climate Changes in the Mining and Energy Sector”.

- Draft decree for the modification of Carbon Tax-related articles under Decree 1076 of 2015 of the MHCP.

- Review of the considerations associated with carbon management in the Terms of Reference of ANH’s “Open Area Nomination Process – PANA”.

Roadmap

Integrated Water Management

Exceptional

Material Element

(GRI 3-3, 11-6-1) (WEF 7, 11E, 13E)

| Impacted stakeholder groups | Areas that manage the impacts | Ecopetrol business line or segments generating the highest impact |

|---|---|---|

| Society and Community | VRP | Upstream |

| State | VPU | Downstream |

| VHSE | ||

| VTI | ||

| VDS |

(GRI 3-3, 11-6-1) (WEF 7, 11E, 13E)

Why is the Element Material?

The impacts arising from the use and exploitation of water resources may be related to the effect on the water supply of the basins and on water quality. On the one hand, its extraction and consumption, given certain circumstances, could lead to changes in the availability of the resource for downstream users.

On the other hand, the discharges could change the quality of surface and underground water bodies.

The foregoing can generate impacts on the right to water and other related rights.

However, positive impacts are also generated on the environment through Integrated Water Management at Ecopetrol, in the form of conservation, restoration, and preservation of water basins, as well as improved access to drinking water and sanitation for the communities near the areas of operation of the Company.

The activities in the downstream, followed by the upstream, concentrate the largest volumes of deposits. However, the water consumption of the assets in no case exceeds 2.5% of the water supply of the basins, thus avoiding significant negative impacts on the water availability for downstream users.

On the other hand, the activities in the upstream, followed by the downstream, generate the largest volumes of industrial discharges into bodies of water. To prevent negative impacts from these discharges, environmental assessments are conducted from the planning stage based on the load and the assimilation and dilution capacity of the receiving body to confirm that no significant impacts are generated on them.

Ecopetrol treats 100% of its wastewater before it is discharged, thus ensuring compliance with the maximum permissible values established in environmental regulations. Quality monitoring is also conducted in the receiving bodies to confirm that they are not affected by the Company’s discharges.

Policies and Commitments

Responsible water management is a corporate responsibility that seeks to protect and preserve said resource and the availability thereof. It is also essential for the operating continuity of the different areas of the business. For this reason, integrated water management is classified as an exceptional

material element due to:

Its significance in the generation of ecosystem value in the short, medium, and long term.

It is included in the Company’s corporate risks.

Its relevance for the Stakeholder Groups, which is why water-related conflicts need to be prevented and water availability must be ensured for the environment.

Ecopetrol is publicly committed to sustainable water management by adhering to the CEO Water Mandate.

Towards water neutrality:

Ecopetrol declared its commitment to be water neutral by 2045, defined as the balance between the water required for operations and the direct water footprint, considering efforts to reduce it as much as economically and technically possible and subtracting the compensation of 100% of the remaining water required to operate by executing compensation projects in the water basins where it operates.

To this end, Ecopetrol has committed to a 66% reduction by 2045 in the catchment of fresh water for industrial use compared to the base year (2019), as well as the elimination of industrial wastewater discharges into fresh water bodies, and with the compensation of 34% of the remaining water consumption, through initiatives that contribute to improving water availability in the basins where the Company operates.

This ambition implies taking proactive actions, beyond environmental compliance, in order to manage the physical, regulatory, and reputational components of water-related risks and generate benefits for the community and the environment, with more control over the sustainability of the business in territories that gradually continue to raise their social and environmental protection expectations.

How is the Material

Element Managed?

The roadmap establishes three (3) strategic lines of action:

01

Operational water management efficiency to reduce the catchment of fresh water, and the load and volume of discharges.

02

Integration of expertise and technology to enable cost-efficient measures for water reuse and recirculation, the reduction of production water on the surface, and the use of alternative water sources.

03

Sustainability and water security in the environment to improve the water conditions of the supply basins and ensure the remaining compensation for water neutrality.

How is the Material

Element Evaluated?

The water neutrality strategy is periodically evaluated using the following indicators:

Reduction in the volume of fresh water collected for industrial use.

Percentage of reuse of collected water and production water that leverages the reduction of fresh water catchment and discharges into surface water bodies.

Water volume to be reused in agroforestry activities.

(GRI 3-3-e) (WEF 7, 11E, 13E)

Short, Medium, and

Long term Goals and Projects

Short Term (2023—2025)

Short-term goals are defined every year by means of the three (3) year business plan to advance towards the fulfillment of long term goals.

In this sense, the goals set for 2023* are indicated below:

Maximum catchment limit: 724 KBWPD, that is, a 12% reduction compared to the baseline.

Reuse of production water: 31.5%

Reuse of collected fresh water: 40.1%

Reuse of 60 KBWPD of treated production water in agroforestry cultivation pilot.

* The goals include the commitments adopted by the Upstream and Downstream Vice Presidencies, as well as the incorporation of the Tren Nare assets operated by Ecopetrol since November 2021.

Long Term (>2030)

The water neutrality commitment includes the following goals by 2045:

66% reduction of freshwater catchment for industrial use, compared to the baseline year (2019)**.

Zero industrial discharges into bodies of fresh water.

Compensation of the remaining catchment (34%) through compensation projects in the

same basins from which the water is extracted.

** If new assets are received, their water management volumes will be included in the baseline to maintain comparability with it.

(GRI 3-3-e) (WEF 7, 7E, 11E, 13E)

Main Achievements in Managing the

Integrated Water Management Roadmap

26% reduction25 in the volume of water collected for industrial use, thereby meeting the projected 14% goal for 2022.

Reuse of 131.5 million m3 (77.5% of the water required to operate).

58% increase in the volume of reused production water.

Deep aquifers: establishment of the local isotopic baseline and hydrochemical model for the Valle Medio del Magdalena aquifer system.

Completion of early water polishing tests.

100% of assets operated with water footprint calculation, four (4) of them verified by Icontec.

Completion of the short, medium, and long term water availability study.

Updating and monitoring of the hydrological environmental baseline and surface water

quality of Valle Medio del Magdalena.

Reuse of 3.8 million m3 of production water in agroforestry crops.

Progress in the collective action mechanism for the management of water security in Villavicencio and Acacias, together with 11 public and private entities.

(GRI 303-1, 11-6-2) (WEF 11E) (TCFD M-1.1)

Interaction with Water as a Shared Resource and Management of Discharge-related Impacts

131.5 million m3 of water were used in 2022, equivalent to 77.5% of the total required to operate, which represents an 18% increase compared to the previous year, as a consequence of larger volumes of production water reused for recovery, mainly in the Castilla, Casabe, and Rubiales fields and larger volumes of water collected reused in the Barrancabermeja refinery.

On the other hand, 38.1 million m3 of fresh water were collected from surface, underground, and aqueduct sources, equivalent to 22.5% of the water required to operate, thus registering a 6% decrease in catchments compared to 2021 (-13% without including the Tren Nare), mainly due to the entry into operation of the Casabe Field Reinjection Plant, which reduced catchments by 90%. 61% of total catchments derived from surface sources, 19% from underground, and 20% from aqueducts and external suppliers, through 104 water catchment points in 23 basins.

In terms of effluent management, 430.6 million m3 of production water (11% more than in 2021 and, on average, 11 barrels of water per barrel of crude oil extracted) and 34.5 million m3 of wastewater were generated from the use of collected water and the intake of rainwater in the treatment systems.

58% of production water was reinjected for final disposal, 26% was reused mainly in reinjection for recovery purposes, 15% was discharged into bodies of water (prior treatment), and 1% was reused in the irrigation of agroforestry crops in the Agro-energy Sustainable Area (ASA) of Castilla.

The Company’s total discharges, including wastewater from all segments, amounted to 80.3 million m3, which represents a 23% increase compared to the previous year, mainly due to the impact of closing the discharge of the Castilla field, which was reactivated in June 2021. The upstream segment generated 81.3% of total discharges (mainly production waters), downstream accounted for 18.6%, and corporate areas 0.1%.

95.8% of the discharges were into surface water bodies, 3.2% into the sea, 0.8% into the ground, and 0.2% of discharges in 23 water basins were delivered to external managers and sewers. The upstream segment generated 81.3% of total discharges (mainly production waters), downstream accounted for 18.6%, and corporate areas 0.1%. In total, 21 basins were used for the disposal of discharges.

Environmental planning identifies the potential impacts that each operation or project can generate on water bodies, determining their supply and quality conditions and defining the management measures in the environmental management plans. The impacts can be mainly related to a potential effect on the water supply and quality of the basin for downstream users. However, in addition to avoiding the materialization of negative impacts, Ecopetrol also generates positive impacts on the environment through its Integrated Water Management, in terms of conserving, restoring, and preserving water basins, as well as improving access to drinking water and sanitation in the communities near the areas of operation.

To avoid the materialization of negative impacts, the environmental assessment is conducted from the planning phase of the projects and operations, which defines the conditions (i.e. maximum use flows, ecological flow, use restrictions in periods of less rainfall, operating times, discharge volumes, flows to guarantee dilution/assimilation, among others) for the use of water in operations so as to not generate a significant impact on the availability or quality of the resource. These conditions are subject to the approval of an environmental permit by the competent authority, which is generally an integral part of the environmental license. In the operating phase, Efficient Use and Water Saving Programs (PUEAA, as per its Spanish acronym) are implemented to optimize the use of fresh water collected through reuse or recirculation initiatives, which in turn reduce discharges.

Similarly, the resource is continuously monitored to determine the supply conditions and quality of the water bodies and discharges, so that no discharges are not made if the dilution capacity lowers during the periods of less precipitation, for example. The monitoring results are recorded in the SIGAR – Water tool to identify any deviations and trigger the corresponding action plans. These are also reported periodically in the Environmental Compliance Reports (ICA, as per its Spanish acronym) for verification and monitoring purposes by the environmental authority.

The Company has robust treatment systems to remove pollutants in wastewater, and thus meet the quality standards established in environmental regulations for discharges into bodies of surface water, seawater, or into the ground. These quality criteria are defined by the competent environmental authorities, who determine the maximum permissible limits for discharges into surface water bodies and sewers (Resolution 631 of 2015), seawater (Resolution 0883 of 2018), and to the ground (Decree 1076 of 2015), for each productive sector of the industry. For the specific case of the hydrocarbon sector, the most relevant parameters and their maximum limits were defined for each activity in the value chain (exploration, production, refining, and transportation), with more than 40 quality parameters in mind.

The strategic line of knowledge integration chases after technological alternatives through polishing pilots, enrichment with nano fertilizers, and optimizations in the reuse of treated production water for irrigation in agroforestry activities.

It is worth noting that conversion plans to clean technologies have been implemented, which have improved the quality of discharges and eliminated more than 5 million m3/year of industrial discharges.

(GRI 303-1-b, 303-2-a, 11-6-2) (TCFD M-1.1)

Water Footprint

Ecopetrol uses the water footprint methodology in direct operation assets based on the provisions of the ISO 14046:2014 standard and the Water Footprint Network WFN, respectively, to identify impacts and show the benefits of reducing pressure on water resources by implementing measures to achieve operating efficiency in water management, as well as decarbonization and circular economy initiatives. Based on the analysis of the indirect water footprint, the raw materials and inputs that generate the highest impact have been identified, as well as the product and service suppliers that could adopt initiatives to reduce water-related risks.

This methodology is based on the following impact indicators:

1

Consumption footprint:

Extracted fresh water that evaporates or is incorporated into the product, or is not returned to the basin.

2

Water scarcity footprint:

Impact of water consumption with respect to available fresh water.

3

Degradation footprint:

Deterioration of the quality of fresh water due to the presence of polluting substances. It also allows the identification of priority substances in the discharges with the following indicators:

- Human toxicity: based on the USEtox model, which appraises the hazard of wastewater discharges in terms of carcinogenic and non-carcinogenic toxicity for humans (CTUh).

- Ecotoxicity in freshwater: based on the USEtox model, which evaluates various toxicological mechanisms caused by the release of substances with a direct effect on the health of the ecosystem (CTUe).

- Ecotoxicity of seawater: based on the Recipe model.

- Freshwater acidification: based on the Accumulated Exceedance AE model, which assesses the effect of acid rain on freshwater due to the release of NOx, SOx, and NH3 into the atmosphere.