About This Report

Ecopetrol Group2 is a diversified group committed to the Energy Transition and Value Generation with TESG, as depicted in its 2040 Strategy: Energy that Transforms.

Accordingly, and as part of its commitment to transparency and accountability towards its Stakeholder Groups (GI, as per its Spanish acronym), Ecopetrol S.A. (Ecopetrol or the Company) annually publishes its Integrated Management Report (formerly Comprehensive Sustainable Management Report), incorporating the Annual Management Report, the Periodic Year-End Report, and the Corporate Responsibility and TESG Report, in which the Company reports on its performance, its impacts, and the main social, environmental, and governance achievements and challenges, which are part of Ecopetrol’s material issues.

The 2022 Integrated Management Report accounts for the management exerted by Ecopetrol S.A.; however, in specific cases, it includes information on the Corporate Responsibility and TESG efforts made by other Ecopetrol Group companies that leverage the 2040 Strategy.

(SFC)

Materiality criteria in the

disclosure of periodic information

1

Relevant risks to which the company and its subsidiaries are exposed.

Relevant risks are those that materially affect the advancement of the corporate purpose, the strategy, the financial situation, the investment plan, the operating results, the cash flow, and the growth prospects.

2

Risk materialization events.

The materialized risks whose amount is greater than 5% of the total value of assets, liabilities, operating income, operating profit, or profit before taxes will be relevant for the Ecopetrol Group.

3

Litigations and judicial and administrative proceedings involving the Company and its subsidiaries, and that also have the potential of affecting their operation or financial situation, and/or changing their financial situation.

Litigations and judicial and administrative proceedings whose risk assessment exceeds 5% of the Ecopetrol Group’s total value of assets, liabilities, operating income, operating profit, or profit before taxes.

4

Signing or terminating final agreements outside the ordinary course of the Company.

Signing or terminating agreements are relevant when they impact the Company with variations equal to or greater than 5% of the Ecopetrol Group’s total value of assets, liabilities, operating income, operating profit, or profit before taxes.

5

Signing agreements that give rise to obligations deriving from off-balance sheet operations by the Company or its subordinate entities and/or subordinate autonomous equities.

The signing of agreements by the Company or its subordinate entities are relevant when they give rise to obligations from off-balance sheet operations whose amount is greater than 5% of the Ecopetrol Groups’ total value of assets, liabilities, operating income , operating profit, or profit before taxes.

6

Enforcement of sanctions by State control bodies on the Company, its administrators, or the statutory auditor.

Litigations and judicial and administrative proceedings whose risk assessment exceeds 5% of the Ecopetrol Group’s total value of assets, liabilities, operating income, operating profit, or profit before taxes.

In the case of administrators and statutory auditors, any penalty incurred by law shall be applicable.

7

Changes in the capital structure; stakes in the Company’s capital and other matters related to its proprietary private capital structure; signing of agreements that give rise to financial obligations.

Changes in the capital structure, stakes in the Company’s capital, and other matters related to its ownership structure, as well as the signing of agreements that give rise to financial obligations are relevant when pertaining to:

- Changes in subscribed and paid-in capital and/or;

- Adoption of a liquidation or dissolution plan for the Company and/or;

- The fact that the Republic of Colombia ceases to be the effective direct or indirect owner of the majority of the Company’s voting rights of the shares with voting rights.

8

Signing of agreements that give rise to financial obligations acquired directly by the Company and/or its subordinate entities and/or its subordinate autonomous equities.

The financial obligations under the responsibility of Ecopetrol and its subsidiaries are relevant when they have a term of payment greater than one year, in the case of Ecopetrol; and in the case of the subsidiaries, when they exceed the consolidated liability of the last fiscal period by 10%.

9

Events that accelerate the obligations contracted by the Company or its subsidiaries and/or subordinate autonomous equities.

The acceleration of obligations is relevant for the Ecopetrol Group when they exceed 10% of the current liabilities of the last fiscal period.

10

Changes in the liquidity situation; operations conducted with parties related to the Company.

Changes in the liquidity situation are relevant when accounts receivable or possible contingencies that exceed 5% of the total value of assets or liabilities need to be provisioned for.

Non-recurring individual transactions with parties related to the Company are relevant when their variations are equal to or greater than 5% of the total value of assets, liabilities, operating income, operating profit, or profit before taxes.

11

Social and environmental issues, including climate issues that have an impact on the financial situation of the issuer.

Material environmental, social, and governance issues are those that, in the opinion of the Administration, affect the advancement of the Company’s strategy.

Process of preparing the Corporate

Responsibility

and TESG Report.

In 2020, Ecopetrol updated its materiality by means of an exhaustive internal review and consultation process with its Stakeholder Groups. This analysis included aspects such as the risks associated with each material element, regional and global sustainability trends, and the opinion of the Company’s seven (7) Stakeholder Groups. The objective was to build a list of elements or issues that Ecopetrol should focus on to ensure sustainability over time and the generation of value for its Stakeholder Groups.

The result of this exercise was the identification of 28 prioritized material elements divided into four (4) categories: exceptional, notable, differentiated, and in compliance, as specified under Section IV of this Report. Corporate Responsibility and TESG.

The Exceptional and notable material elements are part of the content and scope of the Company’s 2022 Integrated Management Report, extending across the Ecopetrol level. However, the Company has launched initiatives to achieve its ambition of reporting at the level of the Ecopetrol Group.

In 2023, the Ecopetrol Group will undergo the update process of its materiality and Stakeholder Groups.

This report has been prepared in accordance with the standards of 2021 Global Reporting Initiative (GRI). It similarly follows the guidelines of the following reporting frameworks:

The World Economic Forum’s (WEF)

Stakeholder Capitalism Metrics (SCM)

United Nations Sustainable

Development Goals – SDGs

Global Compact

Financial Superintendence

of Colombia (SFC)

Sustainability Accounting Standards Board (SASB) – (Exploration and Production)

Task Force on Climate-related Financial Disclosures (TCFD)

This report complies with the requirements established in External Circular 012 of 2022 of the Financial Superintendence of Colombia. The contents that respond to these requirements are identified with the acronym SFC or can be found as annexes in the Financial Statements that are part of this report.

The foregoing will be shown in this Comprehensive Report and will be identified by the corresponding codes of each reporting framework. This allows the Company to be in line with best practices and international standards associated with the disclosure of sustainability-related information. The annexes contain the GRI Index, as well as two specific ones for SASB and TCFD.

Ecopetrol has been highlighted as one of the most sustainable companies in the world. It was included in the MILA index for the second consecutive year and for the first time in the Emerging Markets index. The Company was also recognized as a member of the Sustainability Yearbook (#SPGSustainable1Yearbook).

For more information, visit

Periodicity

Ecopetrol presents its Integrated Management Report on an annual basis. This Report was presented to and approved by the 2023 General Shareholders’ Meeting and elaborates on Ecopetrol’s management and performance between January 1 and December 31, 2022. The latest report (Comprehensive Sustainable Management Report) was published and approved by the General Shareholders’ Meeting on March 26, 2022.

In relation to the financial statements under this Report, it is important to note that there are three (3) types of companies within the Ecopetrol Group: those in which Ecopetrol is the majority shareholder and has direct or indirect control; those in which Ecopetrol, in addition to having control, has a unity of purpose and direction, that is, those that make up the Ecopetrol Business Group; and those in which Ecopetrol holds a stock options.

The separate financial statements that are part of this report correspond to Ecopetrol. The consolidated financial statements include the companies with the same unity of purpose and direction as Ecopetrol. (See Annex 9).

The financial reports attached to this Report cover the same reporting period (January 1 and December 31, 2022) and are prepared in the same periodicity.

External Verification

Senior Management reviewed and approved the 2022 Comprehensive Sustainable Management Report and entrusted EY with the limited assurance of social, environmental, and economic indicators. (See Annex 1). EY provides statutory auditing services to Ecopetrol.

In previous years, the submission of the report had been subject to external verification, as shown in the pdf version of the 2021 Comprehensive Sustainable Management Report, page 378, available on the following link.

Point of Contact

Any concerns, queries, or additional information requests regarding this Report must be sent to the following email address: responsabilidadcorporativaecp@ecopetrol.com.co.

Outstanding achievements

Life first

TRIFR

0.33

Discoveries of new gas fields

in the Colombian Caribe region, Uchuva-1, and Gorgon-2.

Production levels

709.5

kbped

595.67 MUSD

in benefits certified through the Science, Technology, and Innovation (CT+I, as per its Spanish acronym) project portfolio.

Decarbonization

The goal of reducing 262,761 tCO2eq, of emissions by 2022 was exceeded by

59%

up to

416,672 tCO2eq.

Re-equipment

of our Human Talent

Re-equipment

of our Human Talent

98%

Total value of the

socio-environmental investment

615,334

MCOP3

+31% vs. 2021.

Energy transition

208 MW

were added to the Ecopetrol Group’s self-generation matrix, thanks to the incorporation of three projects in 2022: (1) small hydraulic power plant and (2) photovoltaic solar projects.

Reserve

Replacement Rate

104%

incorporating 249 MBOE.

The Ecopetrol Group incorporated cumulative efficiencies of up to

3.6 TRILLION COP

the highest figure since 2015.

Net income of

33.4 TRILLION COP,

doubling that of the previous year, and an EBITDA of 75.2 TRILLION COP with an EBITDA margin of

47%.

investment resources to projects and initiatives under the Sustainable Development portfolio, within the framework of the environment strategy, in the amount of 615,334 BILLION COP by the end of 2022, including strategic and mandatory investments. The environmental dimension includes contributions from the transportation segment, Hocol, Reficar, Esenttia, and ISA.

II.1. Ecopetrol Group

Sustainable Integrated Management Report

N.º of workers in

the Ecopetrol Group:

18,000+

N.º of contractor

employees:

130,000

Headquarters:

Bogotá, Colombia

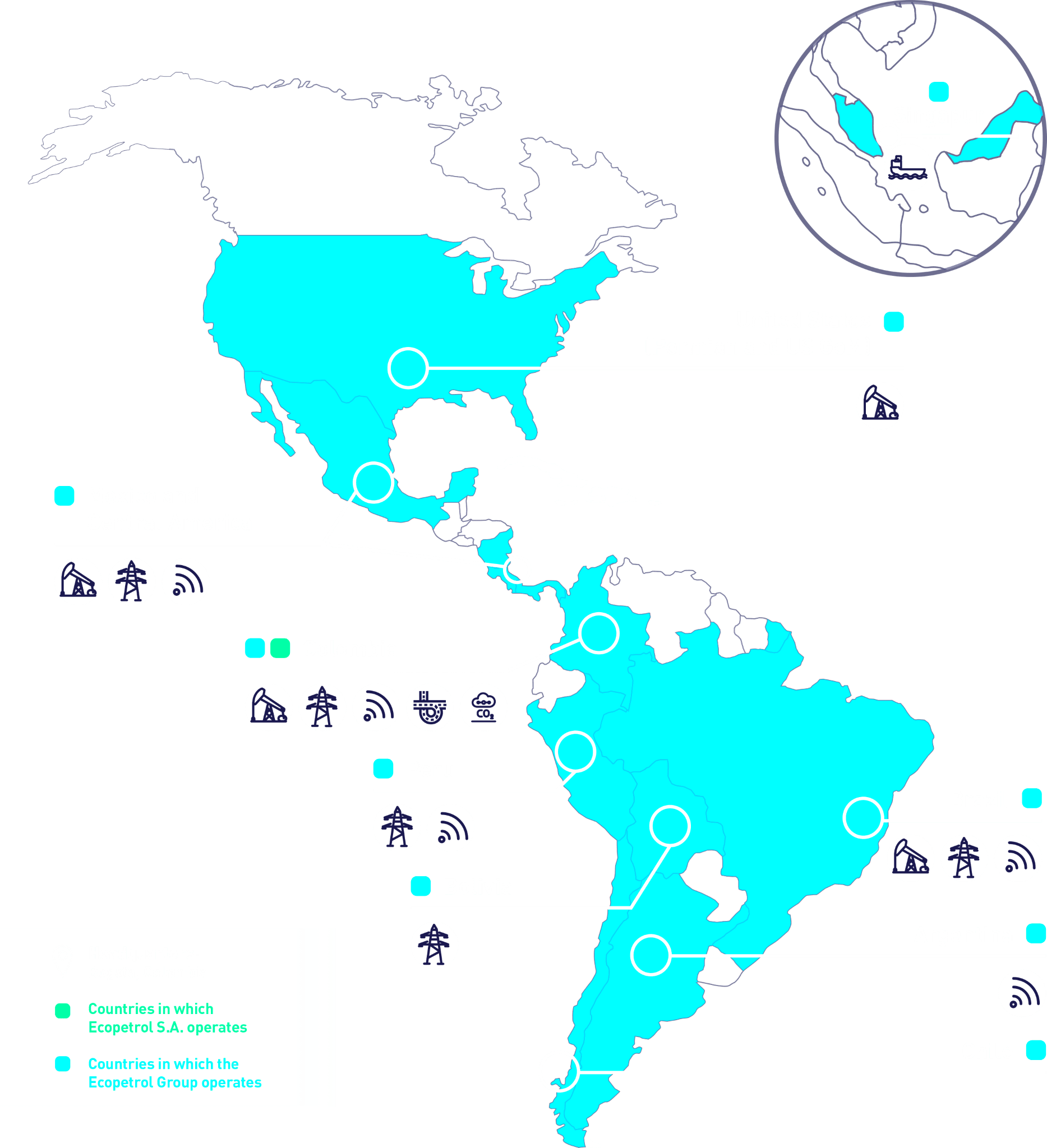

Countries in which Ecopetrol S.A. operates

Countries in which the Ecopetrol Group operates

Business lines:

Hydrocarbons

Low emission solutions

Transmission and toll roads

215

clients in the hydrocarbon

business line

Productos:

- Crude oil

- Diesel oil

- Fuel oil

- Turbo-combustion engine fuel

- Regular and premium motor fuel

- Kerosene

- Aviation fuel

- Petrochemical, chemical,

- and industrial products

- Gas

- Biogas

- Energy

- Road infrastructure

- Telecommunications and ICT

Our markets:

Colombia, Brazil, Chile, Peru, Argentina, Bolivia, Central America and the Caribbean, United States, Europe, and Asia.

II.2. About Ecopetrol

Ecopetrol is a national mixed economy company, affiliated to the Ministry of Mines and Energy (MME). The Company is commercial in nature, made up of public and private stakes, and fulfills its purpose in competition with individuals.

Ecopetrol’s corporate purpose is the undertaking, in Colombia or abroad, of industrial and commercial activities corresponding to or related to the exploration, exploitation, refining, transportation, storage, distribution, and trading of hydrocarbons and their derivatives and products; as well as research, development, and trading of conventional and alternative sources of energy; the production, mixing, storage, transport, and trading of oxygenated components and biofuels, the port operation, and the execution of any related, complementary, or useful activity for the advancement of the above objectives.

Ecopetrol currently leads a diversified energy group, managing the following business lines:

Hydrocarbon business line:

It includes the segments and operations in the different links of the hydrocarbon chain, as follows: upstream (exploration and exploitation), midstream (transport and logistics), downstream (refining and petrochemicals), and trading of crude oil, and petrochemical and industrial products. Its objective is to maximize the value of the businesses described above, focusing on efficiency and competitiveness and operations that are responsible with the territories, and with a relevant emphasis on the decarbonization of its operations.

Low emission solutions business line:

It involves the development of the LPG, biogas, energy management, hydrogen, renewable energy, carbon capture, storage and use, and geothermal businesses, among others. Its objective is to conceptualize and build a comprehensive energy solutions portfolio for the diversification and decarbonization of the Ecopetrol Group’s operations, leveraging on cross-cutting synergies with other business lines.

Transmission and toll roads business line:

It includes the electricity transmission, road infrastructure, and telecommunications businesses. Its objective is to enhance its performance and capture synergies with other business lines, maximizing the value of this type of business, which is characterized by having developed and implemented operating models and regulated returns.

To learn about the companies that make up each of the business lines, see Annex 5 of the 2022 Integrated Management Report.