Differentiating factors in our operation

Science, Innovation,

and Technology at Ecopetrol

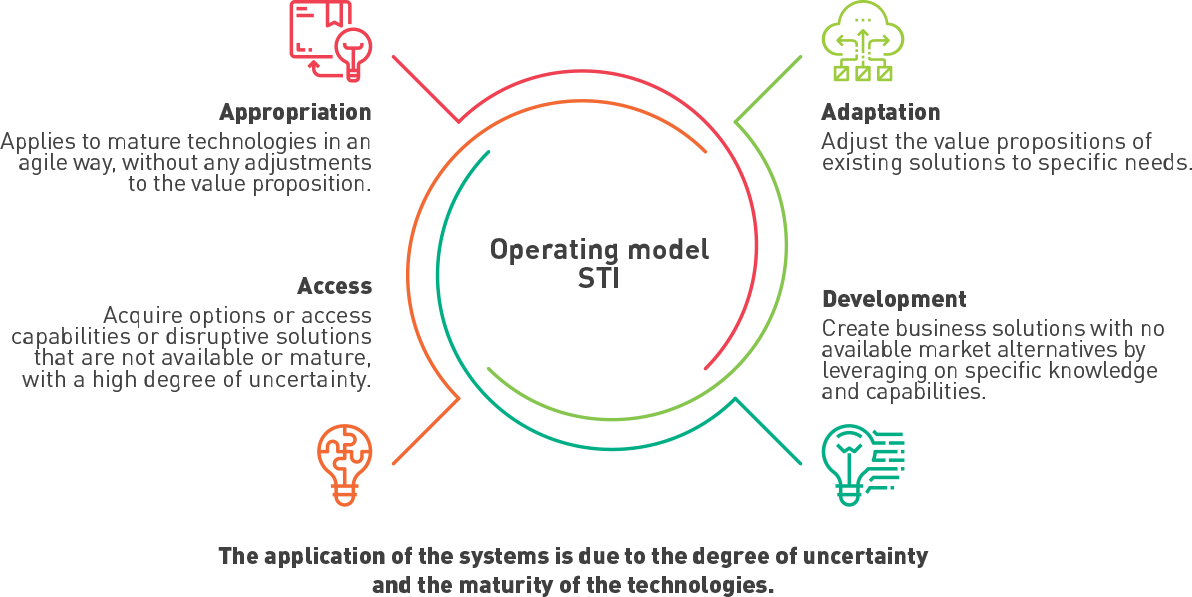

Ecopetrol’s 2021-2040 Vision for Science,

Technology, and Innovation (STI)

USD 20 y

USD 30

1

2

3

Ecopetrol Group’s Digital Strategy

Graph 19.

Ecopetrol Group’s digital strategy

Balance Ecopetrol Digital 2021

USD 93.3

millones

136.6 %

compliance.

Digital investment plan

Digital capabilities

Moreover, to expedite the adoption of digital capabilities in the country, Ecopetrol launched 20 challenges, through the 100×100 challenges program, of which 11 were already executed, also contributing to the generation of employment and growth.

Science and Technology at Ecopetrol

USD 254.8

million,a

un cumplimiento del

160%

In 2021, Ecopetrol invested COP 156.9 billion in the ICP. This represents a 94% increase compared to 2020,

Investments and expenses on I+D+i13

13. Updated chart in MUSD.

Key Technological Differentiators

and Intellectual Property:

1

2

3

Intellectual property

| Intellectual Property Registry | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Patents Granted | 5 | 15 | 8 | 8 | 8 |

| New Patent Applications Filed | 12 | 17 | 19 | 17 | 24 |

| Copyrights Obtained | 39 | 25 | 41 | 46 | 31 |

Innovation Ecosystem

- The 100×100 program, which triggered the launch of 20 open innovation challenges to be solved by entrepreneurs, 11 in 2021 alone, has generated +95 jobs in this sector. This program was granted recognition for Good Sustainable Development Practices under the UN Global Compact’s SDG 8, Colombia chapter.

- A national innovation ecosystem was promoted with Innpulsa Colombia to identify solutions and strengthen national ventures, through open innovation and public-private collaboration.

- With Plug-and-Play, a Silicon Valley incubator, construction pilots were undertaken for non- productive times in drilling and for reservoir simulation.

- Ecopetrol participated in the Cleantech program (from Israel) that offers cutting-edge technological solutions for energy storage and implementation of advanced analytics.

- The TESG digital prototype was developed in partnership with IHS Markit and Microsoft for timely and transparent management in the reduction of greenhouse gas and methane emissions.

Through the ICP, Ecopetrol has established a network for co-research and co-development with national and international institutions. Similarly, with more than 30 agreements and seven (7) “Under the Same Roof” research partnerships, the company was able to strengthen the research, technological development, and innovation groups under the National Science, Technology, and Innovation System.

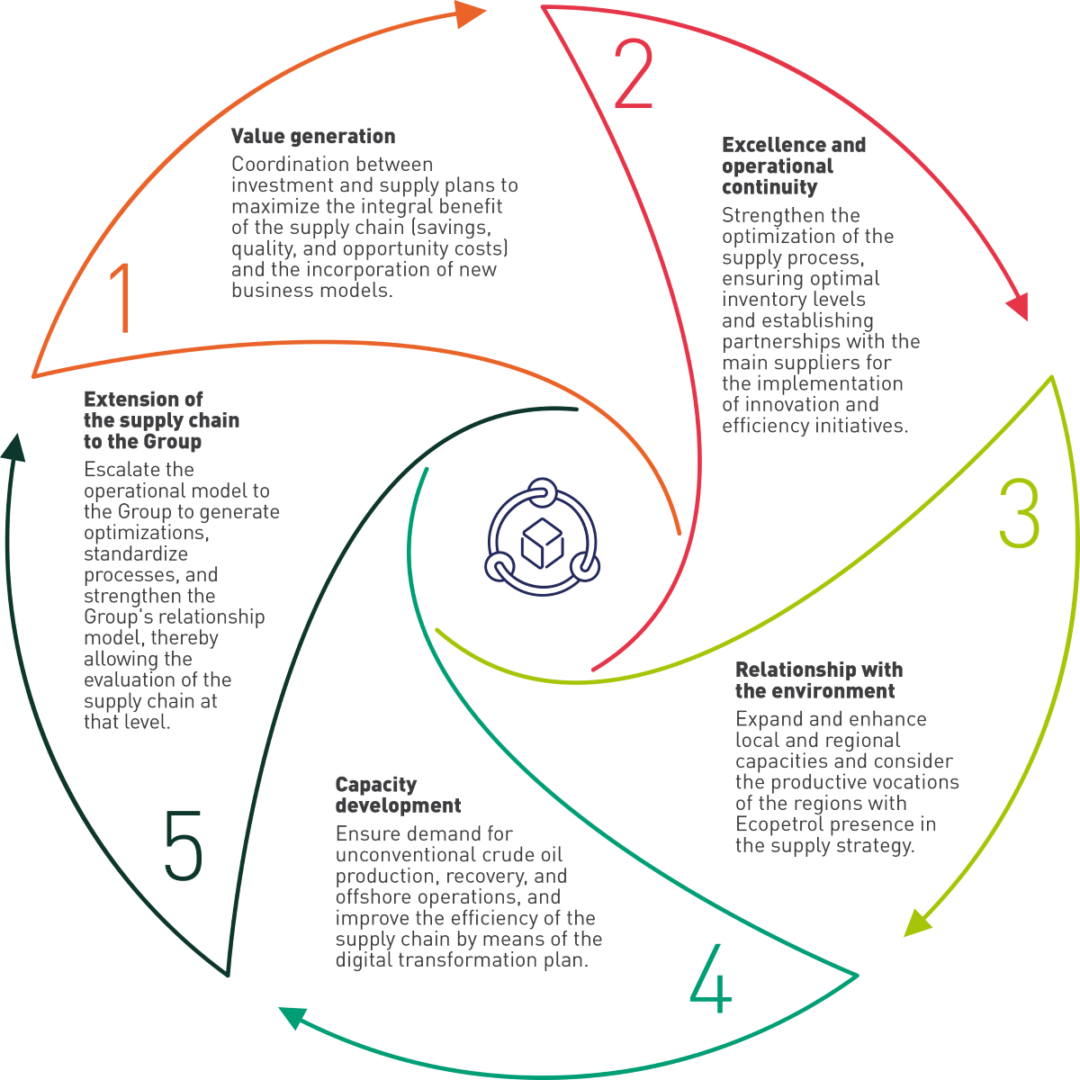

Recruitment and Supplier

Management

(308-1) (414-4)

(308-1) (414-1)

Number of contracts managed per year

(102-9) (WEF 17)

12,213

2018

10,488

2019

8,521

2020

9,887

2021

Number of contractors at the end of each year

(102-9) (WEF 17)

3,817

2018

3,926

2019

3,480

2020

3,554

2021

Local Hire

| Recruitment | Unit of measurement | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Total Contract Value | COP | 10,102,266,315,612 | 12,882,710,288,371 | 12,213,041,342,863 | 15,823,530,409,025 |

| Local Hire Value | COP | 5,106,717,402,056 | 7,299,754,112,650 | 6,003,572,900,536 | 8,413,035,379,158 |

| Proportion of local recruitment | % | 51 | 57 | 51 | 53 |

Number of Ecopetrol Contractor employees distributed by gender

| Gender | Unit of measurement | 2018 | 2019 | 2020 | 2021 | |||||

| Male | # | 28,203 | 28,457 | 27,277 | 32,793 | |||||

| Female | # | 6,602 | 7,254 | 6,687 | 8,116 | |||||

| Total | # | 34,805 | 35,711 | 33,964 | 40,909 |

Risk management

in the value chain

(308-2) (407-1) (408-1) (409-1) (414-2)

3,554

Tier 1 suppliers (direct suppliers), of which

219

80%

Supplier Evaluation

| Frequency of supplier evaluation | % evaluated annually | % evaluated at least once every 3 years | Total |

|---|---|---|---|

| Critical suppliers | 0 | 100 | 100 |

| Suppliers with high sustainability risk | 100 | 0 | 100 |

Supplier performance evaluation results in the following aspects

(308-1) (414-1)

| Evaluation aspects | Unit of measurement | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| HSE aspects14 | % | 98.4 | 99 | 99.7 | 98.3 |

| Management of the context | % | 98.3 | 99.1 | 99.6 | 99 |

| Administrative aspects | % | 98.3 | 98.4 | 99.3 | 92.9 |

15,749

79%

266

ventures

were hired in the amount of nearly

COP 17,998 billion.