Ecopetrol’s Operation

New businesses

Ecopetrol – Parex agreement under

the Arauca Production Agreement

and the E&P Llanos 38 contract

Round 17 Brazil

2021 ANH Round

Table 10.

Bloques ofertados

| Company | Block | Agreement modality offered |

|---|---|---|

| Ecopetrol | LLA 141 | E&P |

| VMM 14 – 1 | TEA | |

| VMM 4-1 | TEA | |

| VMM 65 | TEA | |

| Hocol | SSJS 1-1 | E&P |

Ecopetrol and its subsidiary Hocol were allocated the five (5) blocks offered on December 16th, 2021, in the Hearing Minutes.

Exploration and

Production (Upstream)

Exploration

Ecopetrol Group’s

exploratory process

Exploratory Strategy

(i)

(ii)

(iii)

(iv)

Contracts and

Exploratory Areas

Graph 03.

Exploratory assets by type of contract

Note: *PSC: Production Sharing Contract**CRC: Shared Risk Agreement EAL: Ecopetrol America (Gulf of Mexico)

Distribution of Ecopetrol and Subsidiary exploratory areas (millions of ha)

EAL:

Exploratory activity

Piedemonte

Llanos

(i)

(ii)

Middle and Upper Magdalena Valley

Hocol

Offshore Colombia

International Portfolio

United States

Mexico

Brazil

Exploration Partners

Seismic Business Results

In 2021, Ecopetrol Group acquired 128,835.437 equivalent Km of seismic to evaluate the prospectivity of the areas in Colombia and Brazil.

Ecopetrol Group Seismic (equivalent Km)

Exploratory Drilling

13 wells,

of which

11 were in Colombia,

1 in the United States,

1 in Mexico.

At the end of the year,

3 were declared successful,

1 was a study well,

5 were declared dry, and

4 are under evaluation.

2021 Exploratory wells

| Well | LaheeClassification | Operator/partner | Contract/ Block | Status |

|---|---|---|---|---|

| Boranda Sur-2 | A1 | Parex 50% (Operator) ECP 50% | Boranda | Successful |

| Liria YW-12 | A2 | ECP 100% | Recetor A | Successful |

| Flamencos-3 | A1 | ECP 100% | Magdalena medio | Successful |

| Est SN-8 | Est | Hocol 100% | SN8 | Under study |

| Basari-1 | A3 | Hocol 100% | RC7 | Under evaluation |

| Carnaval-1 | A3 | Lewys Energy 50% (Operator) Hocol 50% | Perdices | Under evaluation |

| Prof Cira 3540 | A2b | Sierracol 52% (Operator) ECP 48% | La Cira Infantas | Under evaluation |

| Ibamaca-1 | A3 | Hocol 100% | Tolima | Under evaluation |

| Boranda Sur-1 | A1 | PAREX 50% (Operator) ECP 50% | Boranda | Dry |

| Boranda Centro-1 | A1 | PAREX 50% (Operator) ECP 50% | Boranda | Dry |

| Chimuelo-1 | A2 | ECP 100% | Tisquirama | Dry |

| Moyote-1 | A3 | Petronas 50% (Operator) ECP 50% | Block 6 | Dry |

| Silverback-2 | A3 | CVX 90% (Operator) EAI 10% | Silverback | Dry Wells drilled in activity at the sole risk of the partner |

| Perla Negra-1 | A3 | Parex 95% (Operator) ECP 5% Sólo Riesgo | Fortuna | Dry |

| Perla Negra-1 ML1 | A3 | Parex 95% (Operator) ECP 5% Risk Only | Fortuna | Under evaluation |

| Cayena 1 ST1 ML1 | A1 | Parex 95% (Operator) ECP 5% Risk Only | Fortuna | Under evaluation |

| Cayena 1 ST 1 ML2 | A1 | Parex 95% (Operator) ECP 5% Risk Only | Fortuna | Under evaluation |

Exploratory Investments

The exploration investments made by Ecopetrol Group amounted to USD 208 millions in 2021. Of the investments, 33% corresponded to partner activities. The largest investments were made in the Silverback, Recetor, VMM, RC7, and Boranda blocks, among others.

Development

and Production

Development and

Production Strategy

The Development and Production strategy is to grow with the energy transition, decarbonizing our operations, and diversifying towards low emission businesses, focused on TESG value creation for stakeholders, while preserving competitive returns for the company.

In 2021, Ecopetrol was able to consolidate its portfolio by increasing the viable volume by![]() 12 %

12 %

to 50 USD/bl, the Original Oil in Place by 3 trillion barrels (BBLS), for an HCIIP of 72 BBLS as a Group.

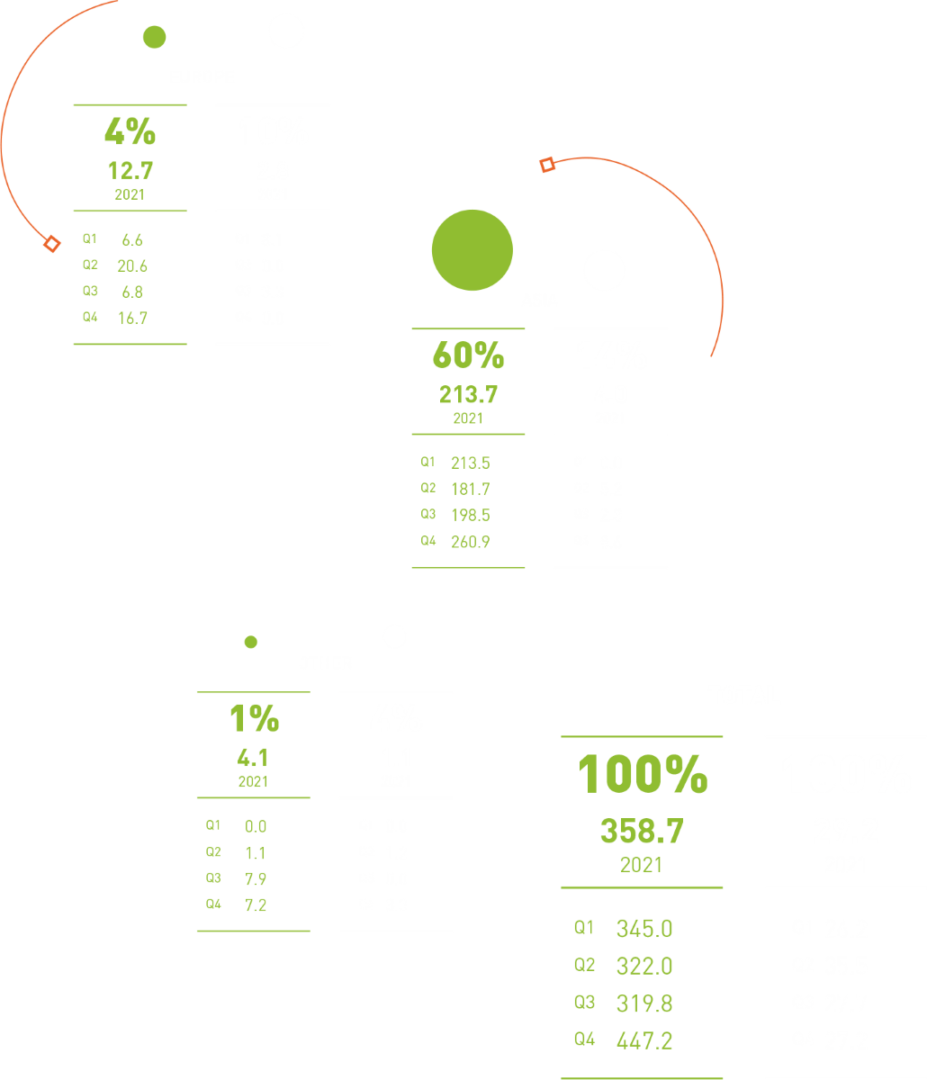

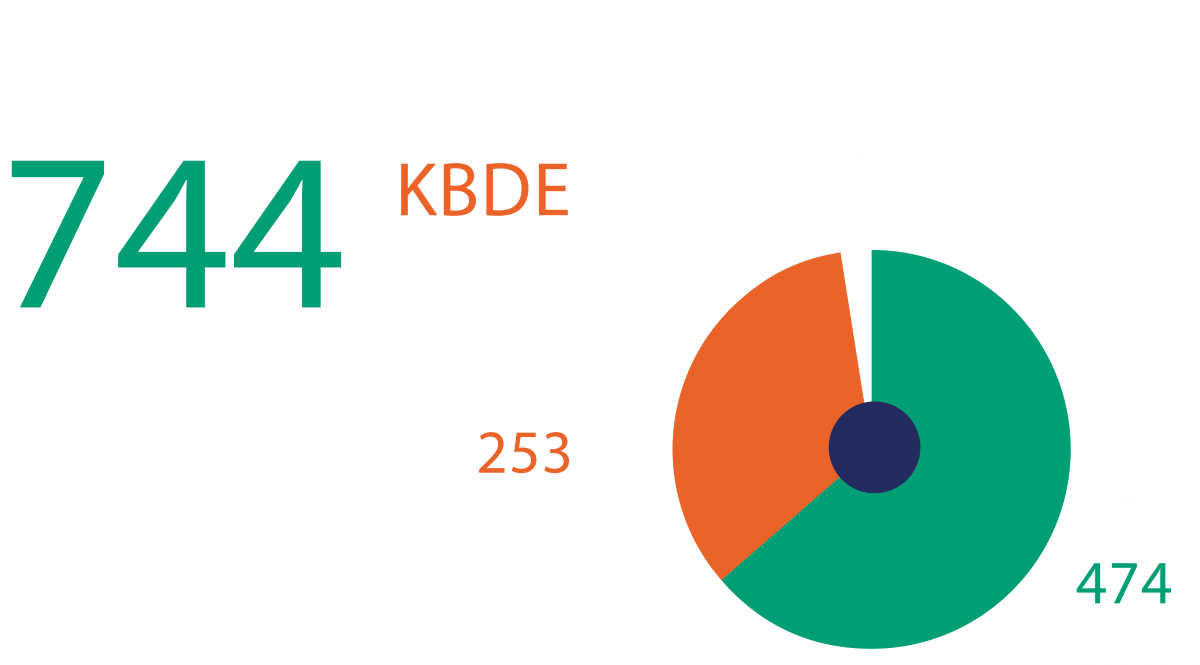

In 2021, the Ecopetrol Group’s output was![]() 679

679

thousand barrels

of oil equivalent per day (kboed), of which Ecopetrol S.A. contributed 611.1 kboed and the subsidiaries 67.9 kboed.

In the last quarter of the year, Ecopetrol S.A. received the operation of the six (6) fields of the Nare asset, upon termination of the Partnership Contract with Mansarovar Energy Colombia Ltda.

Graph 07.

2021 Production by company in the Ecopetrol Group (kboep)

Fuente: Vice Presidency of Development and Production

2021 equivalent crude oil and gas production in the Ecopetrol Group

Ecopetrol S.A.’s 2021 equivalent crude oil and gas production

Well drilling

193 are 100% operated by Ecopetrol,

95 were executed together with partners,

22 by Hocol, and

85 by Permian.

Table 12.

Development wells drilled and completed

| Company | 2020 | 2021 |

|---|---|---|

| Ecopetrol S.A. Direct Operation | 157 | 193 |

| Ecopetrol S.A. Operation with partners | 45 | 95 |

| Hocol | 24 | 22 |

| Permian | 18 | 85 |

| Total development wells Ecopetrol Group | 244 | 395 |

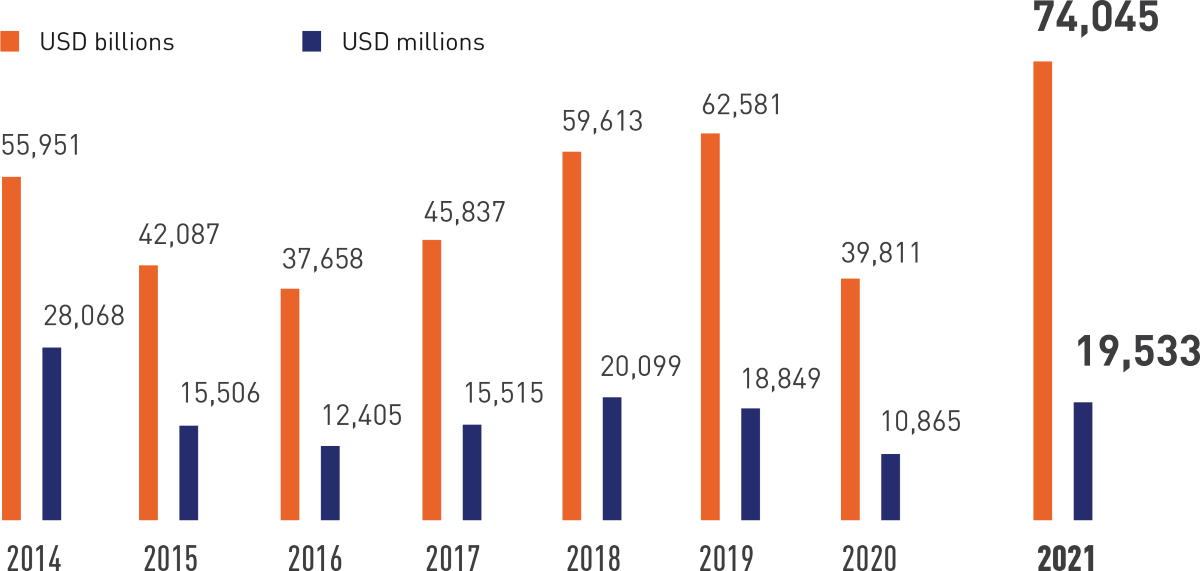

Ecopetrol Development Investments (USD millions)

Production partners

In By the end of 2021, Ecopetrol managed 48 collaboration contracts in the exploitation phase with the following 22 partner companies:

Partner companies

| Sierracol Energy | Petróleos Colombianos S.A. (PETROLCO) |

| Frontera Energy | Texican Oil & Gas Ltda. |

| Hocol S.A. | Nexen Petroleum Colombia Ltda. |

| Unión Temporal Ismocol – Joshi – Parko (UT IJP) | Lewis Energy |

| Parex Resources | Lagosur Petroleum Colombia Inc. Colombia Branch |

| Repsol | Petrosouth Energy Corporation |

| Perenco Oil & Gas y | Saint Aubin International |

| Perenco Colombia Limited | Nikoil Energy Corp. |

| Emerald Energy PLC Sucursal Colombia | Valle Energy (Las Quinchas Resources Corp.) |

| Petrosantander Colombia Inc. | Colombia Energy Development Co. (CEDCO) |

| Cepsa Colombia S.A. | Cinco Ranch Petroleum Colombia Inc. Colombia Branch |

| Gran Tierra Energy Colombia Ltda. |

Production Contracts in force as of December 31, 2021

| Type of contract | Total |

|---|---|

| Partnership Contract (risk only and ORRI) | 37* |

| Incremental Production Contract (Palagua, Suroriente, Neiva, and Orito) | 4 |

| JOA (CPO-09, Capachos, Aguas Blancas) | 3 |

| Business Collaboration Contract (La Cira Infantas and Teca) | 2 |

| Shared Risk Agreement (CRC 2004) | 1 |

| Business Collaboration Agreement (Arauca) | 1 |

* Includes five (5) Partnership Contracts transferred to Hocol as of July 1, 2018, where Ecopetrol has been assigned the area.

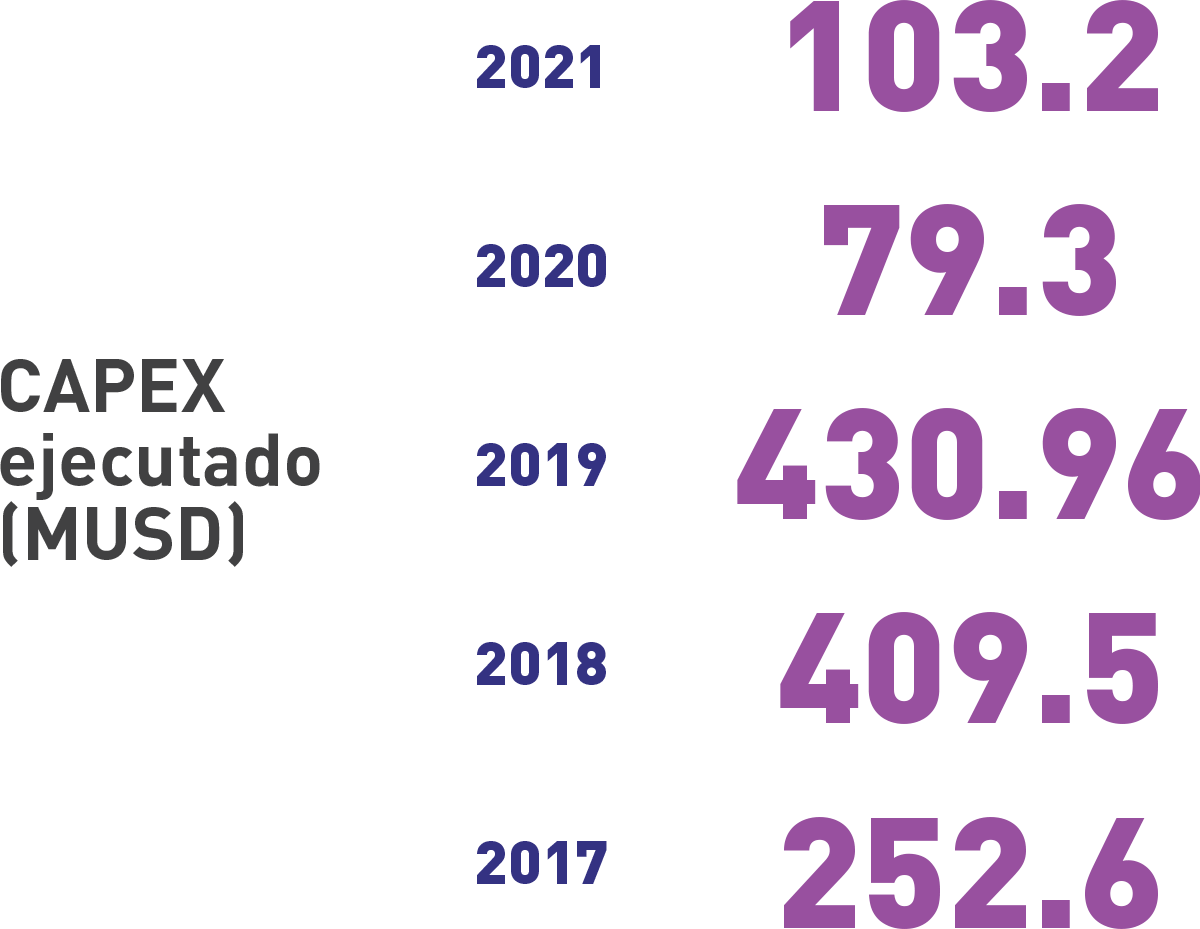

En 2021, la inversión ejecutada en los contratos de asociación en Colombia fue de USD 103.2 million.

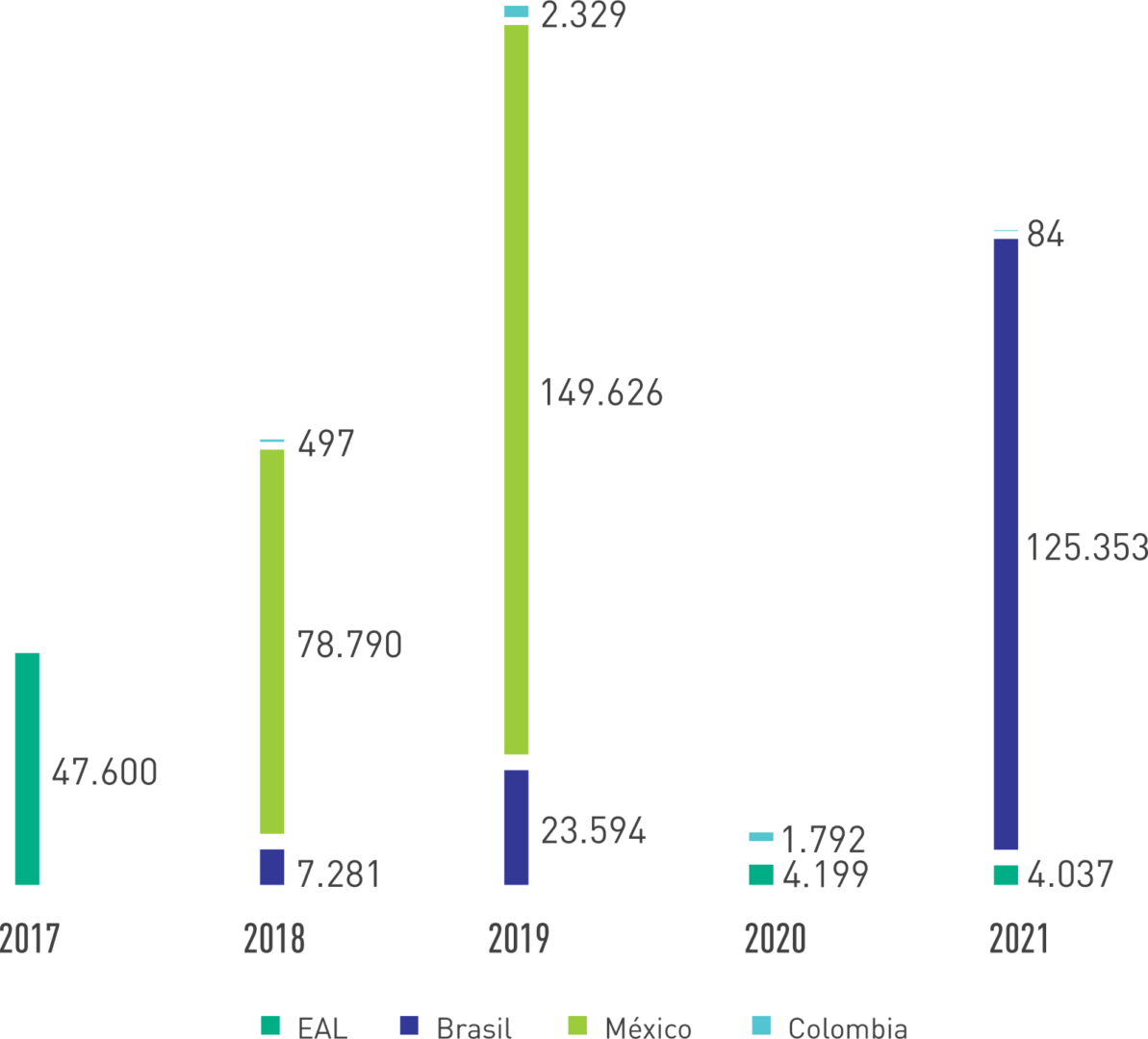

2017- 2021 Investments with Partners

Unconventional Reservoirs

(YNC, by its Spanish acronym)

The assignment of cross-shareholding stakes with ExxonMobil was approved in 2021 in the PPIIs6 in the unconventional Reservoirs of Kalé and Platero in the municipality of Puerto Wilches (Santander), leaving Ecopetrol as operator, with a

62.5 %

37.5 %

(i)

(ii)

(iii)

(iv)

Reserves Balance

At the end of 2021, Ecopetrol’s net proven reserves were

2,002 mbpe

Proven reserves Ecopetrol Group (mpbe)

Average lifespan of the reserves

Average lifespan of the reserves (years)

Time covered by the reserves under the current production rate if no new activitie s are undertaken

Gas and LPG

Hydrogen

9-11 %

1

Sustainable growth and decarbonization of own operations

2

Sustainable mobility

3

Mixture of hydrogen with gas for thermal applications

4

USD 6

millones

Industrial-scale projects will enable increased output of valuable products at the Cartagena and Barrancabermeja refineries, with a low-carbon hydrogen yield of 8,700 kt/year.

7. Hydrogen of geological origin.

Gas and LPG business performance

18 %

50 %

3 %,

~8%

approved a 30%

LPG price reduction

3.3 million

households

using this fuel throughout Colombia.

Total investments in 2021 compared

to the last four (4) years

LNG liquefaction capacity

Transport (midstream)

Total crude and refined oil transported

| Evacuation | Total |

|---|---|

| Transportation of crude oil (GSV) | 733.42 kbpd |

| Transportation of refined oil (NSV | 277.19 kbpd |

| Total | 1,010.61 kbpd |

* The volumes of crude oil transported correspond to the following systems (country evacuation): Ocensa Segment 3, ODC, Vasconia-Galán, Ayacucho-Galán, Ayacucho-Coveñas, and the Trasandino Pipeline.

Consolidated income of the segment in excess of USD 3.279 billion, and an ebitda generation exceeding USD 2.691 billion.

Cenit Recognitions and

achievements in 2021

PAR Ranking (2020 and 2021) as the company with greatest gender equality in the energy mining sector in Colombia and Latin America.

- Position number 10 in the 2021 Ranking of Inclusive Companies from the LGBT Chamber of Commerce and the National Consulting Center.

- Top 10 Companies Committed to Youth from

- the International Organization of Human

- Capital Managers.

- Fourth place in the Merco ranking of companies with best Social Responsibility and Corporate Governance in the category of oil and hydrocarbon distribution companies.

Refining and Petrochemical

Activities (Downstream)

Refining and Petrochemical Strategy

To contribute to Ecopetrol’s diversification in low-emission businesses, the configuration of the assets will be transformed to meet the demand for emerging products in the medium and long term. This includes green and blue hydrogen, reconverting part of the refineries to produce biofuels, and increasing the sale of lubricant bases. Similarly, the segment has begun developing new mechanical and chemical plastics recycling initiatives, the production of biodegradable polyethylene, the recovery of spent catalysts, among other Circular Economy initiatives, and environmental management efforts continue with specific comprehensive water management goals and a portfolio of decarbonization initiatives by 2030.

01

Adapting the facilities to the new fuel quality challenges and expanding the petrochemical and other new businesses

(2022-2030)

Commissioning of the original crude oil unit with the new refinery in Cartagena. With this project, the Cartagena refinery will reach a crude oil loading capacity of 200 KBD.

Implementation of decarbonization portfolio initiatives with a potential reduction of up to 0.57 Mt CO2e by 2030.

Refining

New demands for quality fuel have been identified, as well as greater restrictions on emissions and environmental regulations, which lead to significant changes in the supply and demand for fuels, in addition to the effects of the Covid-19 pandemic, with a sharp decrease in demand, drop in margins, reduction of loads in processing units, and the cancellation, slowdown, and/or postponement of projects.

02

Development of new businesses and consolidation to respond to the strategy, including Growing with the Energy Transition and Generating Value with TESG.

(2030-2040).

8. National Council for Economic and Social Policy, Policy to improve air quality (2018).

9. Resolution of the MME and the Ministry of the Environment and Sustainable Development establishing quality parameters and requirements for diesel fuel, biofuels, and gasoline.

Performance

353.6 kbd

y un margen bruto integrado de

10.24 USD/bl,

Investments in 2021

The Barrancabermeja

refinery

USD 220

million,

The Cartagena refinery

USD 164

million,

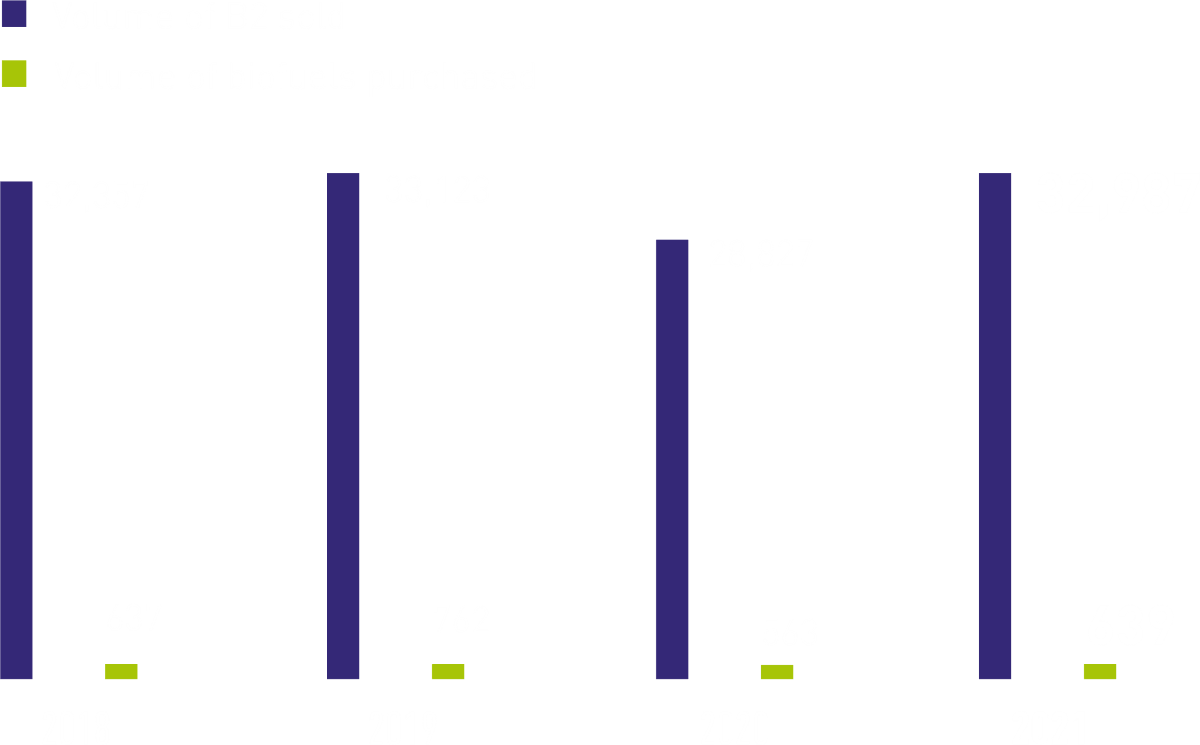

Investment’s refineries Barrancabermeja and Cartagena (USD millions)

88 % de of the Group’s verified GHG emission reductions10

between 2010 and 2019.

10. 1,498,070 tons of CO2e verified by Ruby Canyon Environmental, Inc as of May 6, 2020.

Petrochemical activities

Biofuels

Volume of biofuels

produced and purchased

Volume of biofuels11

Technical Abandonment of Wells

402

362

206

(i)

(ii)

(iii)

Dismantling

of facilities:

Environmental

recovery

Asset Divestiture

Asset divestiture

| Asset divestiture | Unit of measurement | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Quantity | # | 7,731 | 5,441 | 2,672 | 4,718 |

| Net Book Value | COP | 71,857,718,587 | 24,978,003,206 | 9,854,979,248 | 45,276,886,507 |

Products

Fuels derived

from crude oil

51.4 %

shares in ISA,

First in Latin America to

offset carbon in crude oil sales

12. Verra international certification standard.

12. Estándar de certificación internacional Verra.

2021 National and

international clients

65%

are refiners

28

national and seven

7

international,

transformers

and marketers.

Performance

Sales revenue

Sales revenue*

Sales volume (kbd)

Sales volume (kbde)*

Fuels – domestic sales

Gasoline

sales volume

109,7 kbd

33%

Gasoline sales volume (BPD)