Resultados del ejercicio 2021

(201-1) (201-4)

Financial Results

Balance sheet

The Group’s assets amounted to

COP 244.2

trillion

with an increase of

COP 104.8

trillion

compared to 2020, mainly due to;

The consolidation of 100% of ISA’s assets and the recognition of the difference between the fair value and the book value of its net assets, in compliance with IFRS;

The increase in Capex and translation effect of subsidiaries using currencies other than the Colombian peso, offset by depreciation for the year;

Increased accounts receivable in the Fuel Price Stabilization Fund – FEPC;

Higher inventory stock due to sales of crude oil in transit, restrictions in TLU2, and higher prices; and

Higher current and deferred taxes thanks to better results.

The Group's

liabilities

stood at

COP 150.5

trillion,

with an

increase of

COP 66.9

trillion

Principalmente por:

The consolidation of 100% of

ISA’s liabilities;

The financing for USD 3.7 trillion for the acquisition of ISA;

Increased accounts payable and other liabilities associated with more activities being deployed and increases in oil prices; and

Mayores provisiones asociadas a actualización de Costos de Abandono y provisiones ambientales.

Equity amounted to COP 93.7 trillion, of which 71.7 trillion corresponds to equity attributable to Ecopetrol shareholders and COP 22.0 trillion to non-controlling shareholders.

Financial

indicators

The results of the financial indicators in 2021 were as follows:

Liquidity Indicators. These correspond to the resources required by Ecopetrol Group to operate in the short term, maintaining a margin to cover cash fluctuations as a result of current asset and liability operations.

Al cierre de 2021, los activos corrientes aumentaron en

126%

compared to the previous year, mainly due to:

In addition, current liabilities grew by

65%,

Indebtedness indicators. This represents the proportion of the company’s investment financed with debt, that is, with third-party resources.

Total backed liabilities with third parties with respect to the level of assets represented 62% in 2021 and 60% in 2020. Similarly, the concentration of short-term indebtedness was 20% and long-term indebtedness 80%.

Profitability indicators. The Ebitda margin for 2021 stood at 45.7% compared to 33.7% in 2020. The Ecopetrol Group’s return on assets in 2021 was

9.9%,

recording an increase compared to 2020. These increased indicators are mainly due to higher results in all operating segments in 2021 compared to a 2020 impacted by the pandemic.

Activity indicator. As a result of the above, the company’s activity index stood at 0.38 in 2021 (compared to 0.36 in 2020).

Economic value

generated and distributed

(201-1) (WEF 18) (WEF 21) (WEF 32E)

For its part, the economic value distributed includes operating costs, employee salaries and benefits, payments to capital providers, payments to the government, and social investment (see table 06).

Economic value generated and distributed – Ecopetrol Group (COP pesos)

50,026,561

2020

Income

92,147,671

2021

| Economic value | 2020 | 2021 |

|---|---|---|

| Operating costs (Cost of sales and Operating expenses) | 43,014,343 | 62,183,496 |

| Employee salaries and (expense) | 1,968,585 | 1,577,109 |

| Payments to capital providers | 2,828,361 | 6,104,841 |

| Payments to the Government | 19,389,423 | 16,771,372 |

| Investments in the community | 226,295 | 199,056* |

| Economic value distributed | 67,427,007 | 86,835,877 |

* The figure was adjusted to millions of pesos.

Financial assistance received

from the government

Current tax regulations do not contemplate tax breaks applicable to the Company. On the other hand, tax regulations contemplate tax credits that can be used by the Company to determine income tax. As of December 31, 2020, Ecopetrol has accrued COP 668 billion in tax credits, which will be used to determine income tax payable in 2021.

On the other hand, no financial assistance was received in 2021 from Export Credit Agencies (ECAs

Transfers

to the Nation

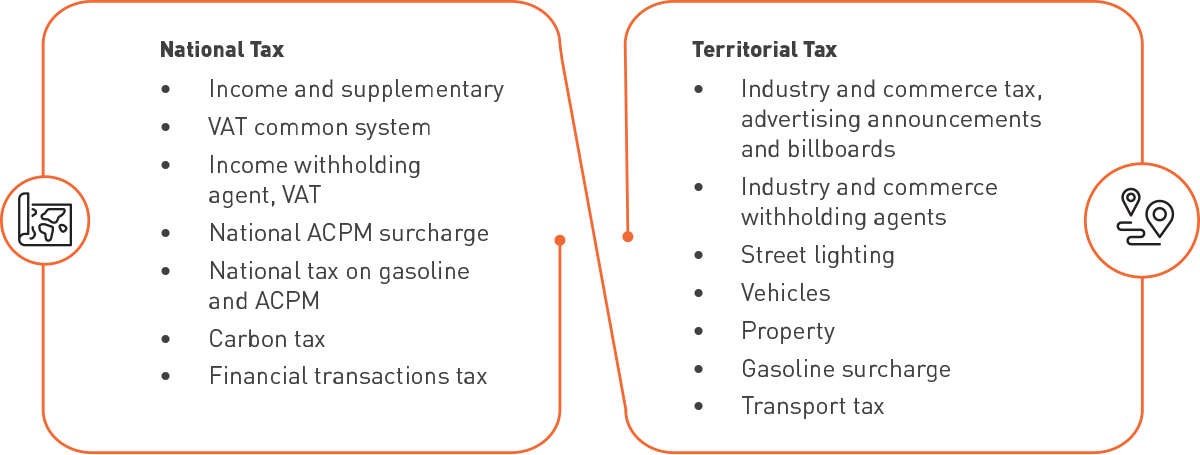

Ecopetrol is one of the largest national and territorial taxpayers in Colombia. Its tax policy is designed to comply with its legal obligations under current regulations and obtain the highest tax benefits for the Company. The taxes payable by Ecopetrol are summarized in Table 07.

Taxes payable by Ecopetrol

The value paid by Ecopetrol includes the taxes payable by the Company and the tax withholdings or collections applied to third parties and turned over to the different tax authorities in its capacity as withholding agent.

The individual and consolidated effective tax rate for Ecopetrol in 2021 was 28.8% and 38.5%, respectively.

National and territorial taxes and transfers paid (in COP millions)

by Ecopetrol S.A.

| TAX TYPE | 2017 | 2018 | 2019 | 2020 | 2021 | Purpose |

|---|---|---|---|---|---|---|

| OWN TAXES | ||||||

| Income tax | 372,438 | 272,763 | – | 446,316 | – | Nation |

| Self-withholding for equity – CREE | 75,130 | – | – | – | – | Nation |

| Income self-withholding tax | 1,407,033 | 5,094,734 | 2,172,632 | 1,728,724 | 2,795,957 | Nation |

| Equity/wealth tax (in force until 2017) | 147.168 | – | – | – | – | Nation |

| Gasoline and ACPM national tax | 2,706 | 45 | 45 | 31 | 30 | Nation |

| Carbon tax (in force as of 2017) | 556 | 619 | 1,128 | 446 | 800 | Nation |

| National ACPM surcharge | 40 | 29 | 26 | 18 | 16 | Nation |

| Sales tax | 865,288 | 765,949 | 756,350 | – | – | Nation |

| Industry and commerce tax | 136,819 | 136,012 | 167,124 | 165,289 | 149,353 | Municipalities |

| Property tax | 22,801 | 22,641 | 22,439 | 20,763 | 21,184 | Municipalities |

| Transport tax | 113,412 | 73,786 | 77,267 | 163,553 | 166,936 | Municipalities |

| Financial transactions tax | 95,579 | 137,975 | 142,312 | 128,230 | 135,793 | Nation |

| Vehicle tax | 182 | 239 | 173 | 92 | 95 | Municipalities |

| Lighting tax | 13,775 | 10,590 | 11,646 | 19,374 | 40,534 | Municipalities |

| Gasoline surcharge | 5 | 6 | 5 | 2 | 2 | Departments/ Municipalities |

| SUBTOTAL OWN TAXES | 3,252,932 | 6,515,388 | 3,351,147 | 2,672,838 | 3,310,699 | |

| THIRD PARTY COLLECTIONS | ||||||

| Gasoline and ACPM national tax | 1,181,870 | 983,425 | 1,188,018 | 954,854 | 1,303,416 | Nation |

| Income/VAT/stamp withholding tax | 639,167 | 985,174 | 1,060,373 | 1,175,564 | 1,328,934 | Nation |

| National pro-university stamp | – | – | 3,132 | 675 | 2,063 | Ministry Of Education – Nation |

| Construction contribution (in force as of 2020) | – | – | – | 688 | 14,942 | Ministry Of Interior |

| COVID-19 Solidarity tax withholdings | – | – | – | 45,216 | – | Nation |

| National ACPM surcharge | 44,278 | 49,658 | 50,870 | 31,594 | 26,690 | Nation |

| Carbon tax (in force as of 2017) | 345,762 | 224,730 | 363,930 | 235,123 | 264,210 | Nation |

| Industry and commerce withholding tax | 35,495 | 46,791 | 68,940 | 77,870 | 230,873 | Municipalities |

| Subtotal taxes collected from third parties | 2,246,572 | 2,289,778 | 2,735,263 | 2,521,583 | 3,171,128 | |

| TOTAL | 5,499,504 | 8,805,166 | 6,086,410 | 5,194,421 | 6,481,827 | |

Ecopetrol Group’s contribution to the Nation in 2021 represented transfers effectively paid in the amount of

COP 16.8

trillion,

as follows:

dividends

COP 0.6

trillion,

total taxes

COP 10.6

trillion

COP 5.6

trillion.

Evolution of company shares

In Colombia

The Colombian Stock Exchange (BVC) experienced an appreciation during 2021, in line with the improved performance of crude oil prices. The Brent increased

50%

last year, growing from

USD 52/bl

at the beginning of 2021 to

USD 78/bl

at the end of the year; however, the COLCAP index, the main reference of the Colombian Stock Exchange, had a negative appreciation of 2% during 2021.

Ecopetrol’s share price closed the year at

COP 2,690,

with a 20% appreciation.

The stock hit a 2021 high of

COP 2,960

COP 2,030

on January 29th.

Evolution of the ADR on the

New York Stock Exchange

Ecopetrol’s ADR (American Depository Receipts) closed at

USD 12.89.

Although oil and gas companies showed positive performance in 2021, the ADR recorded a negative valuation of -0.15%. The ADR reached a maximum of

USD 15.69

on October 15th and a minimum of

USD 11.38

on January 29th.

Relevant information

All relevant information disclosure obligations in Colombia and abroad were met.

Total Capitalization

Table 09 shows Ecopetrol’s market capitalization as of December 31, 2021.

Total Capitalization

41,116,694,690

Number of shares

$2,690

Share Price (December 31, 2021)

$ 110,603,908,716,100

Market Capitalization (COP pesos)

Tax issues

The main aspects that it contains are the following:

Commitment to complying with all national and international tax obligations in a timely manner and pursuant to current legislation.

Ecopetrol’s strategy is not to make aggressive or risky fiscal decisions that could question its tax returns.

The Board of Directors of Ecopetrol S.A. and of the different Group companies will be informed about the main tax implications of their operations or matters subject to their approval, particularly when they constitute a relevant factor for decision-making.

In order to optimize the tax treatment for the different operations, the rules set forth in the different agreements shall apply to avoid double taxation, if any.

Good Tax Practices

Documentation and standardization of the Group’s tax planning.

Ecopetrol employs a transfer pricing guide that ensures that the operations, agreements, and/or contracts entered into between the affiliates and subsidiaries of the Group take place under market conditions, avoiding tax base erosion.

The Company does not use structures or the interposition of instrumental companies through tax havens or territories that do not cooperate with tax authorities without a real or valid business reason.

Monitoring and Control

Update, publish, and socialize the tax planning memorandum with all Group companies every time the National Government enacts a regulation that affects its guidelines.

Hold quarterly committees with the Group companies to review the application of benefits and update tax issues.

Report relevant aspects such as the behavior of the effective tax rate, the relevant transactions that affected it, a comparative table with the immediately preceding period, the effect of the last tax reform on the Group’s rate, among others.

Main aspects of Ecopetrol’s tax planning

1

Use of tax benefits contemplated in current regulations:

Reduction of the presumptive income tax rate

VAT discount on the acquisition, construction, etc.,

of real productive fixed assets

50% discount of the industry and commerce tax (ICA) actually paid in the year

Tax benefits for the use of alternative energies

Optimize the benefit of carbon credits

Other

2

Active participation in structuring the tax definitions for the Group’s new businesses.

3

Notification of changes in the tax legislation to the different company areas and subsidiaries.

4

Work hand in hand with the MHCP, the Ministry of Mines and Energy (MME), and the National Tax and Customs Administration (DIAN).

5

Hold Ecopetrol Group’s

Tax Committee.

Tax risks

Ecopetrol has identified some tax risks that could lead to business losses, if materialized, as well as the payment of penalties and default interest to tax authorities.

The main risks are:

1

Changes in the tax legislation in the countries of operation of the Company.

2

Adopt aggressive tax positions that may trigger disputes with the tax authority.

3

Changes in the existing tax doctrine that create disputes with tax authorities.