Results for financial year 2021

International market

environment for crude oil and

petroleum products in 2021

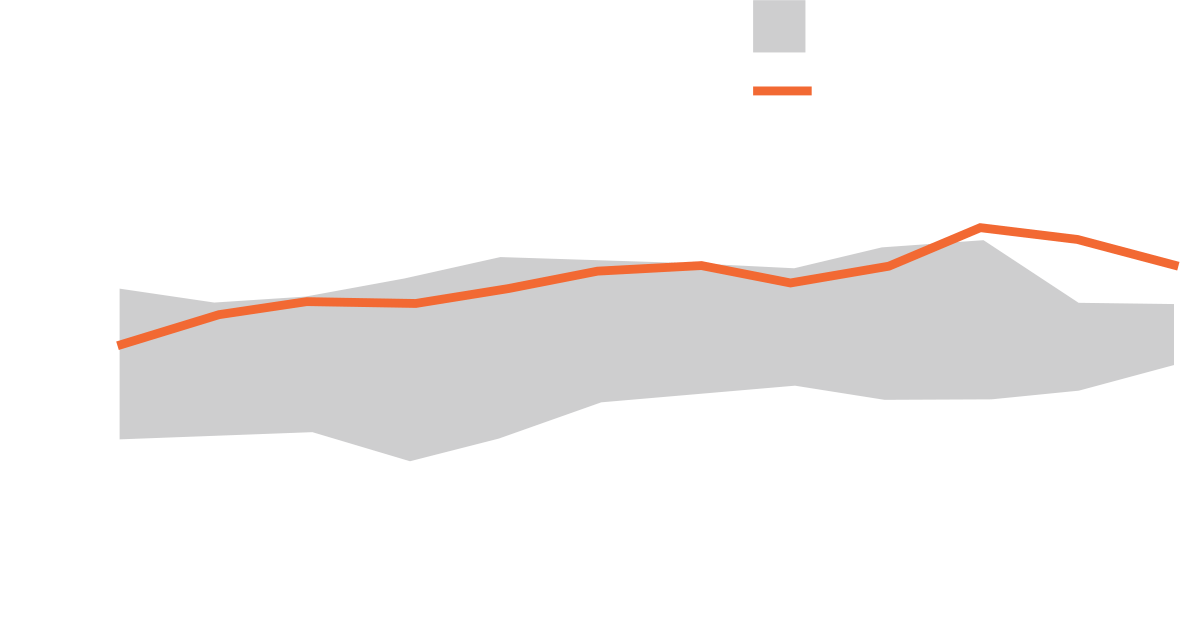

The Brent price trended upwards for much of 2021. Oil demand recorded a significant recovery, with about 4.9 million barrels per day (mmbd) more than in 2020.

Crude oil consumption benefited from the progress in coronavirus vaccinations, where the global population percentage with at least one dose grew from less than 1% to 58%. Demand was also favored by ample global liquidity (most central banks kept their interest rates to a minimum) and the strong fiscal stimulus implemented in some economies (in the US, the fiscal stimulus in 2021 was at 10% of GDP and in the Euro Zone at 6% of GDP).

Despite the rapid recovery in demand and favorable crude oil prices (the Brent price has remained above 60 USD/barrel since February), supply only grew by 1.6 mmbd between 2020 and 2021. The Organization of Petroleum Exporting Countries (OPEC) and its partners kept their production under control, favoring a continuous reduction of the inventories accumulated in 2020. OPEC only returned to the market in 2021 with 0.7 mmbd of the 4.2 mmbd it withdrew from the market in 2020. Outside OPEC, output growth was exceptionally low (strict capital discipline). Supply from the US, the world’s largest producer, remained practically stable at around 11.2 mmbd in 2021, as most companies prioritized the payment of debt and dividends over the CAPEX.

This low growth in supply allowed the crude oil market to reduce inventories globally at a rate of 2.4 mmbd (the crude oil market was in deficit throughout 2021). This reduction was very rapid, allowing companies to not only drain the inventories accumulated in 2020 (which grew at a rate of 1.8 mmbd), but also to bring the inventories of OECD (Organization for Economic Cooperation and Development) countries to levels unseen since 2014. In this context, Brent showed a rapid recovery, reaching an average of 71 USD/barrel in 2021, far exceeding the 2020 average of 43 USD/barrel.

Refineries also saw recovery in their margins. The normalization of land mobility and the favorable flow of freight transport, which continued to benefit from expenditures on goods, pushed up gasoline and diesel differentials (cracks) for gasoline and diesel (jet fuel remained somewhat weak as demand has been slow). The gasoline differential vs. Brent in the Gulf Coast stood at 15.6 USD/bbl in 2021, exceeding the 4.1 USD/bbl in 2020, while the diesel crack stood at 13.7 USD/bbl in 2021, above the 7.0 USD/bl averaged in 2020. It is worth mentioning that these cracks referenced to the American market were also supported by the higher cost of renewable fuel blends given that the regulator took longer to determine the blend percentages for 2020 and 2021, thereby increasing market uncertainty (the RVO price – renewable volume obligation- went from 2.5 to 6.8 USD/bl in these two (2) years). Refineries also benefited from a less expensive diet, given the increased supply of heavy and intermediate crudes (OPEC increasing its supply and Canada’s production reaching a record high by the end of 2021).

The global refining margin calculated by Wood Mackenzie, which is the average margin of typical refineries in the United States, Europe, and Asia, stood at 3.1 USD/bbl for all of 2021, exceeding the low margin of 1.0 USD/bbl in 2020, although still below the 2019 record of 3.2 USD/bbl (these margins discount the RVO price of the American market.

Gas and LNG market

environment in 2021

Gas experienced a significant increase, comparing the average prices of December 2020 to December 2021.

The JKM indicators for Spot LNG governing prices in Asia and the TTF in Europe grew by more than

590%.

In Asia, demand increased due to the accelerated recovery of natural gas end users and an LNG supply limited by plant maintenance activities. On the other hand, Europe experienced a strong winter and low inventories in natural gas reserves, which led to price levels close to

USD38/Mbtu,

in relation to the Henry Hub, a benchmark for the Americas, which grew by 70%, amounting to a price of

USD 3.86/Mbtu.

By observing gas supply behavior, many challenges became evident. First, the aftermath of a 2020 affected by the pandemic and low prices, delayed several liquefaction plant projects, thus preventing them from coming into operation. Low temperatures in southern US in February led to a significant decrease in supply, as gas pipelines and valves became frozen. In addition to maintenance and unexpected interruptions in Australia, Norway, Malaysia, and Algeria, which contributed to a limited LNG supply.

Given the demand for natural gas, Europe began to implement stringent requirements to replenish its low levels of natural gas inventories as of April, after a winter season with colder and longer frosts in 2020-2021, which represented higher electrical energy demands for heating, a deficit that could have been covered with imports from Russia. However, this country faced difficulties in supplying natural gas due to infrastructure improvement works and prioritization in meeting domestic demand, thereby contributing to the strengthening of natural gas prices in 2021. Moreover, China was the country that grew the most in its requirements, leveraged by its manufacturing industry.

The high LNG price trend also had an impact on consumption sectors, which triggered the search for other fuel alternatives.

Colombian economic

environment in 2021

According to the National Administrative Department of Statistics (DANE), the Colombian economy grew

10.6% in 2021,

one of the highest in the region (in 2020, the economy contracted by 7.0%).

This growth was mainly driven by a

14.6%

increase in private consumption (in 2021, more than 1.3 million jobs were recovered). Public consumption also contributed favorably to GDP, growing at a rate ofincrease in private consumption (in 2021, more than 1.3 million jobs were recovered). Public consumption also contributed favorably to GDP, growing at a rate of

12.1%.

For its part, the external sector contributed negatively to GDP growth, with imports growing much faster than exports (27.5% vs. 14.42% in 2021), thereby expanding the current account deficit and pushing up the exchange rate. The external sector was affected by an oil and gas production that fell by 5.7% in 2021.

This strong recovery in consumption has deteriorated the external accounts of the economy (the current account deficit for 2021 exceeds 5% of GDP) and has pushed up inflation (5.6% in 2021, the highest rate since 2016). This, together with the high fiscal deficit of 2020 and 2021, escalated the financing needs of the Colombian economy, leading to higher indebtedness and greater vulnerability (Colombia lost its investment grade in 2021). Banco de la República, Colombia’s Central Bank, in response to this situation, began to raise interest rates at the end of 2021 so as to moderate consumption (the main reason for the increase in the external deficit) and inflation.

Contribution of the oil sector to the Gross Domestic Product (GDP) of Colombia

The behavior of GDP in the mining sector in 2021 showed a slight increase

0.4%

compared to the previous year, due to a

-5.6%

contraction of oil and gas extraction activities and a growth in the extraction of bituminous coal and lignite (+12.1%) and metal ores (+10%), and the exploitation of other mines and quarries (+5.5%).

The contraction in oil and gas extraction is mainly due to low crude oil production, which stood at 736 kbd in 2021 compared to the 781 kbd the previous year. For its part, the gas production marketed in 2021 recorded an increase of more than

4%

compared to the previous year.

Ecopetrol’s growth and contribution to the national GDP

Ecopetrol’s contribution to the national GDP accounted for

2.5%.

Contribution of the oil sector to GDP

(billions of constant Colombian pesos in 2015)

Financial strategy

and results

(201-1) (201-4)

Ecopetrol S.A. obtained record results in 2021, with a consolidated income of COP 91.7 trillion, a net profit of COP 16.7 trillion, and an EBITDA of COP 42 trillion (45.7% EBITDA margin)

Ecopetrol Group obtained outstanding financial results in 2021, reflected in a net profit of COP 16.7 trillion, 10 times higher than in 2020, and an Ebitda of COP 42 trillion, both record-high indicators. This performance was leveraged by:

(i)

A favorable price environment and outstanding commercial management efforts to materialize better spreads for crude oil, related products, and petrochemicals.

(ii)

Higher product and gas sales volumes associated with the a higher demand thanks to the country’s economic reactivation

(iii)

A solid operating performance in all its business segments despite the public and social circumstances in the country.

(iv)

El aporte a la producción de Permian.

(v)

The acquisition of ISA.

Accumulated revenues at the end of 2021 recorded an increase compared to 2020, as a result of a higher weighted average sales price of crude oil, gas and products, higher sales volume, higher transportation revenues, and increased revenues thanks to the consolidation of ISA after its acquisition.

Cost of sales in 2021, including variable and fixed costs, also increased compared to 2020, as a result of higher purchases of crude oil, gas, and products, higher procured services, maintenance activities, operating supplies, and other operational activity costs due to the execution of more activities associated with the economic reactivation and the consolidation of ISA’s results. The foregoing was partially offset by a higher valuation and an increase in the Group’s crude oil and product inventories.

Operating expenses increased due to:

Higher provisions associated mainly with environmental aspects and the public works contribution process.

More exploration activities associated mainly with seismic in Brazil, updated costs for abandoning dry wells, and the recognition of exploration activities in unsuccessful wells.

The consolidation of ISA.

More social investment projects, especially the one undertaken for the International Mission of Wise Men for the advancement of science, technology, and innovation, convened by the National Government and the communities, among others.

Financial expenses increased mainly due to:

Higher

financial costs

arising from the new debt acquired to finance the purchase of ISA,

Lower

financial income

due to the valuation and returns on the securities portfolio, and

Higher

financial expenses

due to the incorporation of ISA’s net financial results, including interest, exchange differences, financial returns,

and others.

Investment Analysis

In 2021, Ecopetrol Group executed capital investments for a total of

USD 8.024

billion.

Including organic investments for

USD 4.351

billion

and inorganic investments (purchase of ISA)

for an equivalent of

COP 14.2

trillion

(USD 3.673 billion).

This is the Group's highest level of investment in the last six (6) years.

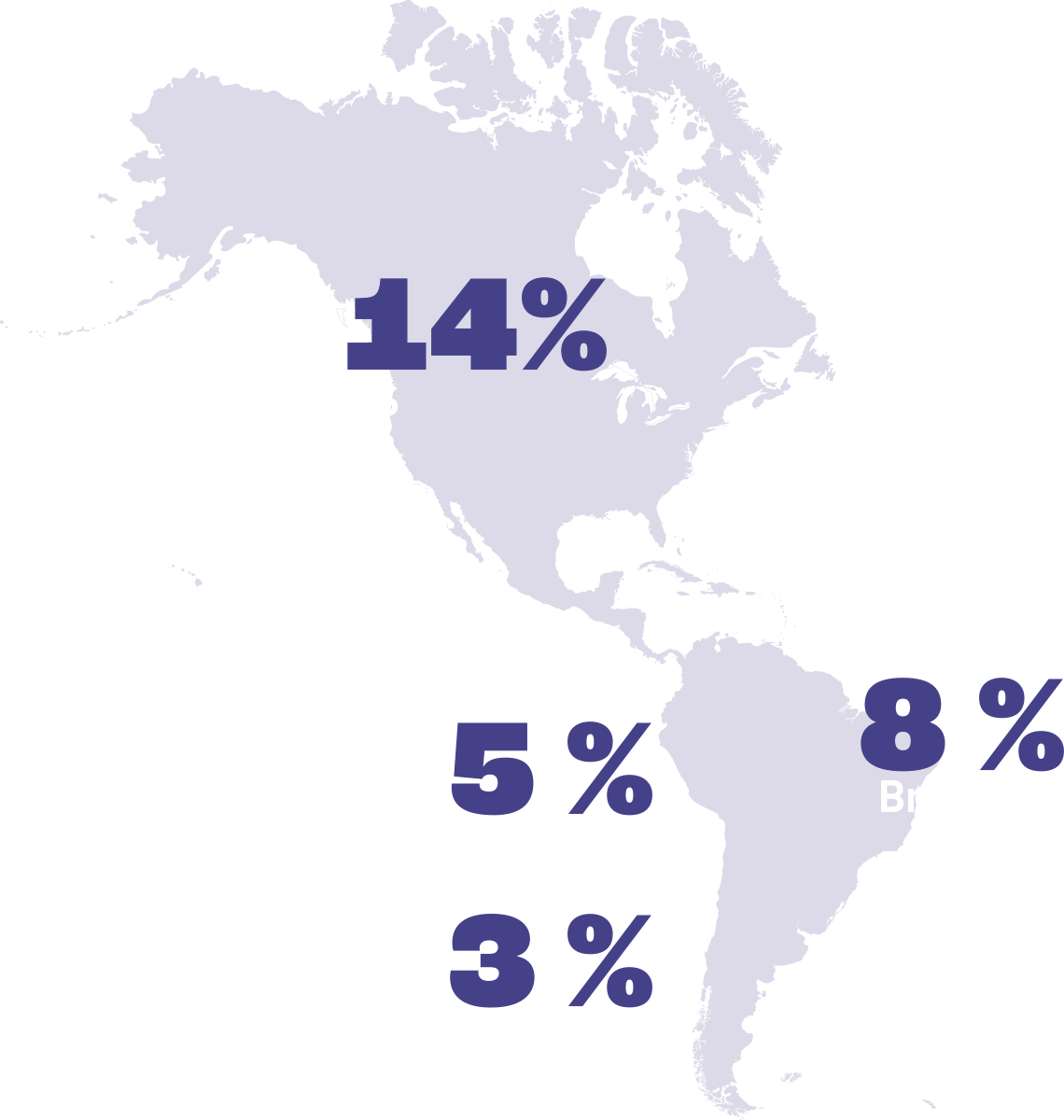

Of the total organic investments in the oil and gas business,

78%

were allocated to Colombia, and the remaining

22%

to the United States, Brazil,

and Mexico.

The factors that explain why Ecopetrol Group’s execution of organic investments is lower than initially expected include:

Efficiencies in the maturation and project execution phases, mainly in development and production projects.

Restrictions related to public order situations and the impact of COVID-19 on global supply chains, thus affecting the normal evolution of the project supply process.

Longer administrative procedures, which mainly affected the activities

in Piedemonte.

Blockades in the Rubiales, Caño Sur, La Cira, and Llanito fields.

The investments focused on expanding the gas chain represented 7% of the investments made throughout the year and were mainly impacted by the delay of activities in Piedemonte due to administrative procedures.

For its part, ISA’s investments

amounted to:

USD 1.108

billion,

in 2021, mainly concentrated in the energy transmission business with

And

2%

(USD 27 million), respectively. Brazil and Colombia accounted for

86%

(USD 955 million), while roads and telecommunications represented

49% and 18%

of total investments, respectively, and the remaining

12%

(USD 126 million)

35%

corresponded to investments

in Chile and Peru, mainly.

Investments by Segment

| Million (USD) | Ecopetrol S.A | Affilates and Subsidiaries | Total 12M 2021 | % Share |

|---|---|---|---|---|

| Production | 1,474 | 735 | 2,209 | 68.1% |

| Downstream | 228 | 198 | 426 | 131% |

| Exploration | 86 | 122 | 208 | 6.4% |

| Midstream* | 0 | 306 | 306 | 9.4% |

| Corporate** | 94 | 0 | 94 | 2.9% |

| Total excluding ISA | 1,882 | 1,361 | 3,243 | 100.0% |

| Energy Transmission | 0 | 955 | 955 | 86.2% |

| Toll Roads | 0 | 126 | 126 | 11.4% |

| Telecommunications | 0 | 27 | 27 | 2.4% |

| Total ISA | 0 | 1,108 | 1,108 | 100.0% |

| Total | 1,882 | 2,469 | 4,351 | – |

* Includes total amount of investments in each of the subsidiaries and affiliates of Ecopetrol Group (both controlling and non controlling interests)

** Includes investments in energy transition projects.

Update of the 2022-2024

Business Plan

The Ecopetrol Group updated its 2022-2024 business plan, which focuses on profitable production growth under the framework of the energy transition and ISA’s (Interconexión Eléctrica S.A.) 2030 Strategic Plan.

The plan contemplates organic investments for 2022 in the amount of

USD 4.8 to

USD 5.8 billion.

Of the total investment,

70%

% will go to projects in Colombia

and the remaining

30%

The goal of the plan is to continue growing the exploration and production business (E&P), to which

63%

of the investments will be allocated, with a focus on projects with greater contributions to production and reserves and improved recovery technologies. The economic evaluation of these projects includes the cost of greenhouse gas (GHG) emissions, calculated using the CO2 shadow pricing methodology.

20% of the plan’s investments will be allocated to the execution of ISA projects, both in Colombia and abroad, in the energy transmission, road, and telecommunications businesses.

In terms of Unconventional Oil and Gas Reservoirs, more than

USD 700 million

in investments are expected to continue expanding production activities in the Permian Basin in Texas, USA. In addition,

USD 20 million

investments will be made in the Kalé and Platero PPII Comprehensive Research Pilot Projects in Valle Medio del Magdalena in Colombia.

En línea con los objetivos de transición energética y SosTECnibilidad del Grupo, se invertirán cerca de

USD 50 million

will be invested in the decarbonization agenda in 2022, including the new competitive renewable energy and gas utilization projects that are part of the Roadmap to advance towards compliance with the goal of reducing 25% of CO2e emissions generated by the operations by 2030 and becoming a net-zero emissions company by 2050 for Scopes 1 and 2.

Furthermore, the plan includes investments of more than

USD 200 million

million in water management projects, nearly

USD 30 million

million in fuel quality improvement projects, and

USD 6 million

in the development of pilot projects and green and blue hydrogen studies for refinery and mobility applications, among others.

Some of the most relevant operational and financial goals of the 2022-2024 plan are:

Production levels between 700 and 705 thousand barrels of hydrocarbons per day in 2022 (81% oil and 19% gas), with a growth potential to reach production levels close to 733 thousand barrels of hydrocarbons per day by 2024.

Joint load of the Barrancabermeja and Cartagena refineries between 340 and 360 kbpd, amounting to 427 kbpd by 2024, in an expected scenario of recovery in demand and

refining margins.

Volumes transported in excess of one million barrels per day, in line with the country’s production expectations and the demand for refined products.

Goal of incorporating renewable energies for own consumption between 400 – 450 MVp by 2024.

The plan contemplates funds for the social investment program close to COP 1.5 trillion between 2022 and 2024, in order to close social gaps and boost the economic reactivation, development, and wellbeing of the communities, with strategic infrastructure, public services, education, sports and health, rural development, entrepreneurship, and business development projects. Furthermore, the Company will continue providing resources to address COVID-19-related needs in its areas of operation and in the communities in the areas of influence.

The organic investment plan will be financed with own resources and will not require marginal leverage under a Brent scenario of USD 63 per average barrel for the year.

The Group expects to maintain a Gross Debt/ebitda ratio of less than 2.5 times by 2022 and less than 2.2 times by 2024.