Management Report 2021

About Ecopetrol S.A.

Ecopetrol S.A. (Ecopetrol, the Company) is a mixed economy company, with the Colombian State holding an 88.45% share. It is the head of Ecopetrol Group, made up of multiple companies in which it holds stakes directly or indirectly.

Three (3) types of companies can be identified within Ecopetrol Group:

Those in which Ecopetrol is the

majority shareholder

and exerts direct or indirect control.

Those in which Ecopetrol engages in the

purpose and direction,

in addition to having control thereof; that is, those that make up the Ecopetrol Business Group.

Those in which Ecopetrol

holds a share.

Ecopetrol S.A. is currently listed on the Colombian Stock Exchange (BVC) and the New York Stock Exchange (NYSE).

Strategy

As of the approval of the 2020+ strategy in February 2019, Ecopetrol Group has made satisfactory progress in its implementation. In the last three (3) years, the 2020+ strategy fulfilled its purpose of generating adaptive growth based on competitiveness and sustainability, focusing on three (3) fundamental pillars:

Reserves and production growth

Cash protection and cost efficiency

Strict capital discipline

Ecopetrol updated its strategy in a timely manner, thereby accelerating its pace towards a more flexible, resilient, agile, and dynamic Company, which adapts to the changes and expectations of the market and its stakeholders.

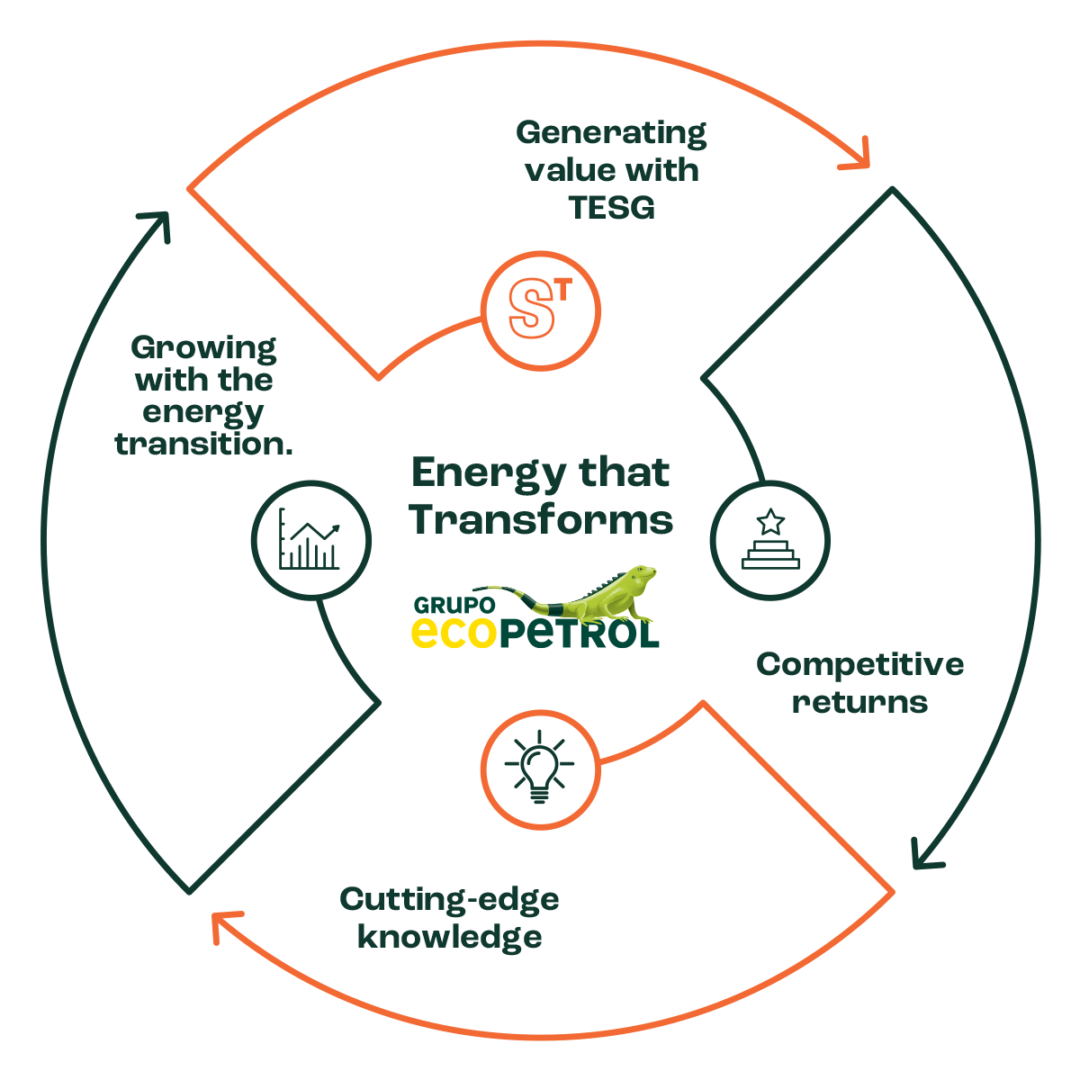

In December 2021, the Board of Directors approved Ecopetrol Group’s 2040 Strategy “Energy that Transforms,” the first time the Company defined a strategy spanning longer than 10 years. This new strategy seeks to generate growth in the energy transition by maximizing the value and competitiveness of the oil business and accelerating the diversification of the portfolio. This while generating value with TESG, ensuring operation decarbonization, and leveraging on technology, innovation, and human talent to uphold competitive returns.

4. 1) Continue strengthening the competitiveness of the oil and gas business; 2) Diversify the portfolio; 3) Accelerate and prioritize decarbonisation and, 4) Strengthen the TESG agenda.

The 2040 Strategy “Energy that Transforms”

is a turbine made up of four (4) engines:

2040 Strategy “Energy that Transforms”

Growing with the energy transition.

This sets the stage for growth and value generation in the businesses of Ecopetrol Group, competitively, and in line with the new demands of the energy transition and of the environment. The two (2) purposes of this pillar are: Maximize reserves and the production value and diversify the Group’s portfolio in energy and low-emission businesses.

Generating value with TESG.

This responds to socio-environmental challenges and the need to achieve sustainable operations while recognizing and working hand in hand with stakeholders.

Cutting-edge knowledge.

This includes all efforts to attract, develop, and retain talent, as well as the development of a comprehensive science, technology, and innovation (CT+I) strategy. In a cross-cutting way, it also adapts the organization of Ecopetrol Group by implementing digitization processes and adopting agility and innovation.

Competitive returns.

This ensures the growth and value generation of Ecopetrol Group, even in low price environments, by focusing on the hydrocarbons´ core business and sustainable businesses.

The new 2040 Strategy of Ecopetrol Group seeks to meet four (4) financial objectives:

(i) Ebitda growth.

(ii) Profitability and value generation maintaining a ROACE5 above the cost of capital.

(iii) Sustainability by maintaining a debt/ebitda ratio consistent with the investment grade.

(iv) Dividend payout between

40 %

and 60 %

(minimum 40%) in line with operating results, in three (3) planning scenarios: Stress test, Reference, and High Prices.

5. Return on Average Capital Employed

Towards an integrated energy

Group with regional presence

ISA: New Ecopetrol

Group subsidiary

For more than two (2) years, Ecopetrol evaluated, structured, and executed the acquisition of Interconexión Eléctrica S.A. ESP (ISA), the leading energy transmission group in the Western Hemisphere.

It is Ecopetrol Group’s most relevant inorganic acquisition in its 70-year history, providing resilience to Ecopetrol by incorporating material, stable, and regulated returns (between 15% and 20% of the Group’s ebitda) not associated with hydrocarbons. Furthermore, it offers scale and growth prospects in low-emission activities, thereby contributing to Ecopetrol’s decarbonization.

On August 20th, 2021, the closing conditions were fully met for the Inter-administrative Contract entered into on August 11th of the same year with the Ministry of Finance and Public Credit (MHCP) for the acquisition of

569,472,561

shares of ISA,

Equivalentes al

51.4%

of the outstanding shares of the company (the “shares”) and representing 100% ownership by the MHCP.

Closing the stake acquisition in ISA marked a milestone in the deployment of the Ecopetrol Group's strategy, turning it into a leading energy transition conglomerate in the Western Hemisphere.

The transaction was closed with:

(i)

Ecopetrol’s payment to the MHCP of the agreed price of COP 14,236,814,025,000 for all shares, at a rate of COP 25,000 per share, and

(ii)

the transfer of the shares to Ecopetrol S.A. as its new owner, with the respective entry in ISA’s shareholder ledger by Depósito Centralizado de Valores de Colombia S.A.

ISA, a new Ecopetrol subsidiary, was founded as a corporation (or PLC) in Bogotá, Colombia, in 1967. Since then, it has become a multi-Latin company in Colombia, Brazil, Peru, Chile, Bolivia, Argentina, and Central America. ISA and its 46 companies operate and maintain electricity transmission networks, including the largest high-voltage transmission network in Latin America, and also engage in toll road concessions, telecommunications, and information and communications technology (ICT) businesses.

ISA is structured as a Colombian corporation and as a mixed public services company. As of December 31, 2021, Ecopetrol owns a

51.41%

stake, while other shareholders (including Colombian pension funds, international and local institutional investors, and retail shareholders) own the remaining

48.59%

of ISA’s capital stock.

Most of its consolidated income derives from client contracts:

- from the regulated payments received by ISA and its consolidated subsidiaries operating in the Electricity Transmission Segment for making their electricity transmission assets available to the national interconnected systems in their countries of operation;

- from the income related to interconnection, dispatch, and coordination charges by the National Dispatch Center (CND) in Colombia and the administration services of the Wholesale Energy Market (MEM) in Colombia; and

- from the income recognized according to the degree of completion of the contractual activity in the electricity transmission business.

ISA’s main activity is distributed as follows:

Electricity Transmission

ISA is the largest international energy transmission company in Latin America in terms of kilometers of power grids in operation. ISA’s energy transmission companies operate and maintain a high voltage transmission network in Colombia, Brazil, Bolivia, Peru, and Chile, as well as some international interconnections operating between Colombia-Ecuador and Ecuador-Peru. In Central America, the company has a stake in Empresa Propietaria de la Red (EPR), a company incorporated under the laws of Panama and headquartered in San José, Costa Rica, which operates the Central American Electrical Interconnection System (SIEPAC).

Highway Concessions

ISA designs, builds, operates, and maintains toll road infrastructure connecting millions of people in Chile and Colombia. As of December 31, 2021, ISA was the largest interurban highway operator responsible for four (4) concessions in Chile and operating the Ruta Costera Concession in Colombia. In total, the company operated five (5) toll highway concessions, covering a total of

860 kilometers

in these two (2) countries, also with

137 kilometers

of new highways under construction. In 2021, 129.2 million vehicles transited the roads operated by ISA.

Telecommunications and ICT

As part of its telecommunications and ICT segment, InterNexa and its subsidiaries provide connectivity services, managed services, cloud services, data center and security services to clients throughout Latin America. In 2020, they added a new line of services based on analytics and the “Internet of Things” (IoT). These ISA subsidiaries also maintain a fiber optic network that totaled more than

57,000 km.

in 2021.

In addition to the existing data centers in Medellín, Bogotá, and Rio de Janeiro, ISA also incorporated two (2) new data centers in Santiago and Lima in 2020.

ISA in financial figures

*Expressed in trillions of Colombian pesos

Consolidated figures ISA

| Consolidated financial figures | 2021 | Variation % | 2020 |

|---|---|---|---|

| Operating income | 11.2 | 9.8 | 10.2 |

| Net profit | 1.7 | -19.1 | 2.1 |

| EBITDA | 7.1 | 8.4 | 6.6 |

| EBITDA margin | 63.8% | -1.2 | 64.6% |

| Assets | 61.7 | 13.8 | 54.2 |

| Liabilities | 39.6 | 16.2 | 34 |

Cifras financieras individuales

| Individual financial figures | Net profit |

|---|---|

| 2021 | 1.7 |

| Variation % | -19.6 |

| 2020 | 2.1 |

Per Business figures

| Per business figures | Income | % share | ebitda | % share | Assets | % share |

|---|---|---|---|---|---|---|

| Electric power* | 8.7 | 77.6 | 5.8 | 81.8 | 48.2 | 78.2 |

| Roads | 2.1 | 18.7 | 1.1 | 15.5 | 12.1 | 19.5 |

| Telecommunications and ICT | 0.4 | 3.7 | 0.2 | 2.7 | 1.4 | 2.3 |

| Total | 11.2 | 100 | 7.1 | 100 | 61.7 | 100 |

Programa Conexión Jaguar

Conexión Jaguar is the sustainability program developed by ISA and its companies together with its technical partners, South Pole and Panthera, to contribute to biodiversity conservation, climate change mitigation, the development of rural communities, and the connectivity of the jaguar’s natural habitat (Panthera onca) in Latin America. The Program provides technical and economic support for the best forestry initiatives, in the hands of rural communities, to issue and market certified carbon credits under the highest international standards to finance conservation.

Primeros resultados en América Latina:

Nine (9)

ongoing projects

Conservation or restoration actions deployed in more than

+ 800 thousand hectares

Potential to reduce emissions in more than

Six (6) million

tCO2e

Improvement of soil and water conditions

Support in various activities conducted with approximately

320 families

in Colombia, Peru, and Brazil

The Program seeks to contribute to the global goals of the 2030 Agenda, such as the Paris Climate Accord, the Biodiversity Convention, and the SDGs.

In its five (5) years of operation, Conexión Jaguar has achieved important national and international recognition as an innovative program and the best corporate emissions compensation program.

To extend the actions and benefits of the Program, ISA invites new partners interested in multiplying the benefits and positive impacts in Latin America to participate. The organizations that are committed to these objectives and that are willing to contribute with economic or technical resources for the expansion and strengthening of the Program are invited as Cooperators. The terms of cooperation in Conexión Jaguar were defined for the Ecopetrol Group in 2021, with the Group starting to support conservation initiatives in 2022 and this formal relationship ending in 10 years.

Thanks to its outstanding sustainability performance, ISA has been a member of the Dow Jones Sustainability Index (DJSI) for seven (7) consecutive years, a member of the Dow Jones Sustainability Index MILA Pacific Alliance for four (4) consecutive years, and it was included in S&P Global’s 2021 Sustainability Yearbook for the fifth year in a row with the bronze medal.